[ad_1]

MicroStrategy ( MSRR ) has “outperformed every asset class and large tech stock” since the firm adopted a bitcoin strategy and began hoarding cryptocurrency in corporate treasury, CEO Michael Saylor said. The pro-bitcoin executive will step down as CEO of MicroStrategy and take on the role of company chairman to focus on bitcoin.

From the adoption of the Bitcoin strategy to the implementation of micro-strategy

Nasdaq-listed software company Microstrategy Inc. (Nasdaq: MSTR ) released its Q2 financial results on Tuesday. CEO Michael Saylor tweeted on Wednesday:

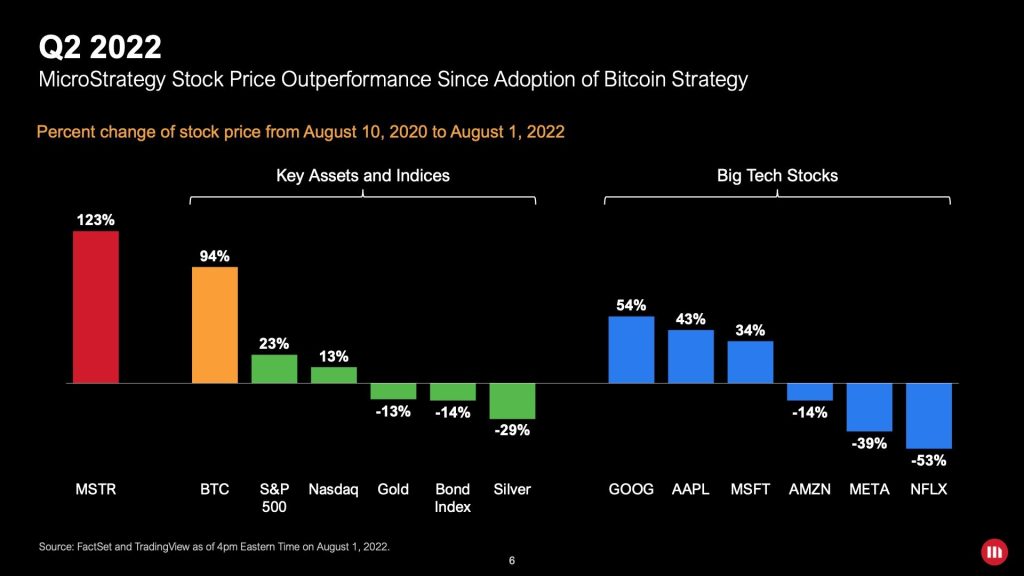

Since using the Bitcoin strategy, MSTR has outperformed almost every asset class and large tech stock.

He added that during that period, the price of bitcoin increased by 94%, the S&P500 increased by 23% and the Nasdaq increased by 13%. In contrast, gold, bonds and silver fell by 13%, 14% and 29% respectively. Microstrategy adopted a Bitcoin strategy in the third quarter of 2020.

He said in a separate tweet.

Since Microstrategy adopted the bitcoin strategy, its enterprise value increased +730% (+$5 billion) and MSTR +123%.

Comparing the microstrategy’s stock performance to large tech stocks since the bitcoin strategy was adopted, Seiler said MSTR outperformed Alphabet/Google ( GOOG ), Apple ( AAPL ), Microsoft ( MSFT ), Amazon ( AMZN ), Facebook owner Meta. (META) and Netflix (NFLX).

MicroStrategy has two corporate strategies: Business Analytics and Bitcoin. The bitcoin strategy is “long-term acquisition and holding of bitcoin; buy bitcoin using excess cash flow, and debt and equity transactions,” according to the company’s Q2 financial results presentation.

The software company currently owns 129,699 BTC at an average purchase price of $30,664 per bitcoin, net of fees and expenses, for a total cost of $4 billion, the company said. Microstrategy reported $917.8 million in bitcoin shortfall charges in the second quarter, which were non-cash charges due to BTC price volatility.

Saylor stepped down as CEO to focus on Bitcoin strategy

MicroStrategy announced Tuesday that Saylor will step down as the company’s CEO and assume the role of executive director effective Aug. 8. Fong Le, the company’s current chief financial officer, will become the new CEO.

Saylor, who has served as the company’s CEO since 1989, will continue to serve as the chairman of the board of directors and the company’s chief executive officer. He said in detail.

As Executive Chairman, I will be able to focus more on our Bitcoin acquisition strategy and related Bitcoin support initiatives.

“I believe splitting the roles of chairman and CEO will allow us to better pursue our two corporate strategies of acquiring and holding bitcoin and growing our enterprise analytics software business,” commented the outgoing CEO.

“I intend to focus more on bitcoin in my next venture,” he tweeted on Wednesday.

What do you think about micro strategy performance after using bitcoin strategy? Let us know in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons

DisclaimerThis article is for informational purposes only. It is not an offer or solicitation to buy or sell, or a recommendation or endorsement of any products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the Company nor the Author shall be liable, directly or indirectly, for any damages or losses arising out of the use of or reliance on any content, goods or services referred to in this paragraph.

[ad_2]

Source link