[ad_1]

Gary Ewell

Overview

Over the past few quarters, Tripadvisor, Inc.NASDAQ: Trip) inventory is influenced by a number of factors, including:

- Gradual recovery from the Covid-19 pandemic: This has had a significant impact on the travel and tourism industry. some Revenue shares for Tripadvisor are still below 2019 levels.

- Economists Expect Recession in 2023: Many market experts, including former Boston Fed President Eric Rosengren, are predicting at least a mild recession by 2023. The travel industry will without question face financial challenges as people travel less to save money.

- High costs are impacting profitability: Sales and marketing expenses increased by 58% in Q3 2022 compared to last year. In addition, Tripadvisor increased its headcount to handle the surge in travel following the pandemic.

- Management cuts Q4 2022 revenue guidance: The company expects a slight decline in revenue relative to Q3 2022 and Q4 2019.

All these factors cause the company’s stock price to drop significantly, and it is difficult to argue the logic. There were really no positive incentives to justify buying Tripadvisor. But, as investors, it’s important to look ahead, especially when market reactions are outsized. TripAdvisor’s enterprise value is now trading at levels not seen since March 2020, which is surprising given that it reported revenue and total bookings in Q3 2022.

Management’s focus on mobile investments and delivering high-quality products has been a key driver of higher take-up rates, new customer sign-ups and improved repeat rates last quarter. In a normal environment, I believe the company will continue to operate with a low cost structure and R&D expenses will be minimal to help improve profitability.

Based on these assumptions, my long-term price target (through 2024) for Tripadvisor is $23 per share.

- Revenue: 2 billion dollars

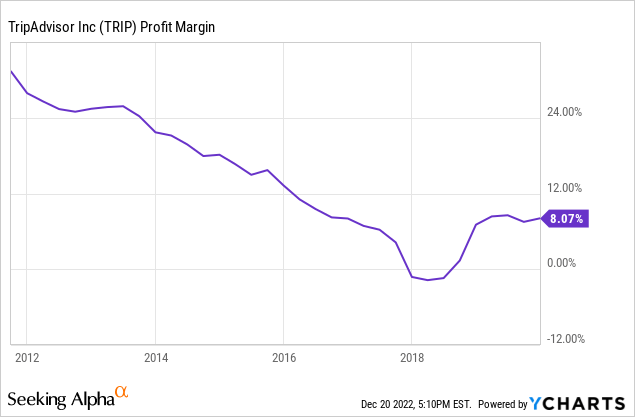

- Profit margin: 10%, based on 8% margins from 2018-2019 +2% for R&D cost reduction and lower cost structure.

- Shares outstanding: 139.3 million

- P/E multiple: 16x, based on S&P 500 historical averages.

Despite the recent negative outlook, there are a few reasons I love Tripadvisor next year:

1. Wall Street is priced out of the negative outlook.

Given the negative sentiment surrounding the company and the weak macroeconomic outlook for 2023, it’s easy to write Tripadvisor off. But that’s too easy, the markets already know. Despite a record-setting quarter, stocks fell to lows not seen since early 2020. Much of this is because the macroeconomic outlook for 2023 is very negative. Markets are typically forward-looking, which is why we’re looking at major research firms’ outlooks for the travel industry ahead of the coming year. This is not the first time that travel stocks have received valuations based on future expectations.

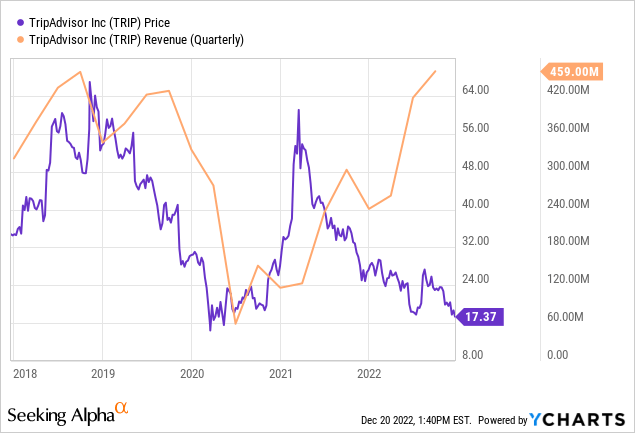

A good example of this forward-looking thinking can be seen in the chart below. Especially in the year By the end of 2020, as Tripadvisor’s share price begins to rally sharply, look for more than $50 per share after months of under $20 per share.

Note how revenues barely changed during that time frame, from Q3 2020 to Q1 2021, hovering around $120 million per quarter. look after Earnings will bounce back in the coming quarters as the economy reopens and reflects in current stock prices.

I guess we’re seeing the opposite in real time now. Earnings are at record highs, and the stock price is at a 5-year low. In the year If we expect a mild recession in 2023, when should Wall Street expect it to end? If it’s only 6-9 months, investors will quickly assess TripAdvisor’s long-term prospects. And based on historical trends, investors expect this to be reflected in the stock price Season Failure (maybe towards the end). I think getting ahead of Wall Street is key.

2. Debt is not a threat

Another headwind that I suspect is driving Tripadvisor’s stock price down is its debt. During the pandemic, TripAdvisor had to raise a significant amount of cash in the form of fixed and convertible debt. In the year There are two remarkable notes in 2025 and 2026. The 2025 debt is fixed for $500 million at 7% and the 2026 debt for $345 million is fixed at 0.25%, with a conversion price of $73.81 to equity, which is below. It is now traded.

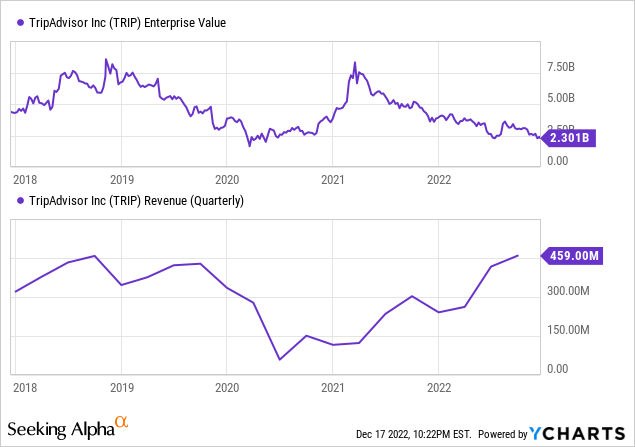

At the end of Q3 2022, TripAdvisor held more than $1 billion in cash and cash equivalents on its balance sheet. The interest cost for the previously mentioned debt is very low compared to the cash position. Interest expense on the 2026 convertible debt is negligible at 0.25%, while the 2025 debt is around $9 million per quarter. When you include this debt as part of the company’s enterprise value, Tripadvisor is still trading at 5-year lows, which is amazing in my opinion.

Enterprise value continues to decline, earnings continue to grow

Note that while TripAdvisor’s quarterly revenue grew to 2019 levels, its enterprise value is still trailing by a significant margin (~$5 billion in 2019 vs. $2.3 billion). While many are pointing to an economic slowdown in 2023, I don’t understand how much lower stocks can go. In the year It is surprising to see prices below the epidemic lows of March 2020.

3. Revenue segments are constantly growing.

During Q3 2022, Tripadvisor saw significant improvements in its small business segments compared to 2021:

| Room | Q3 2022 | Q3 2021 | Change |

| Tripadvisor Core | 284 million dollars | 212 million dollars | 34% |

| Viator | 174 million dollars | 73 million dollars | 138% |

| Fork | 35 million dollars | 30 million dollars | 17% |

TripAdvisor Core’s quarterly revenue is only 88% of 2019 levels, while Viator’s is at 179% and TheFork’s at 103%. Of particular note is the “Experiences and Dining” revenue stream (representing 16 percent of TripAdvisor Core revenue), which was 125 percent of TripAdvisor Core revenue at 2019 levels. On the latest earnings call, CEO Matt Goldberg said this was driven by improved offerings for travelers:

“We continue to build relationships with travelers who want more than just hotels. We recovered 79% and 80% of 2019 levels in our hotel B2B and media offerings, which reflect trends in hotel marketing and shifts in the advertising market.”

Management does not seem to be satisfied with the current revenue figures. They are looking to grow more, which is a great sign as an investor. Rather than simply looking to cut costs, Tripadvisor will continue to invest in ways to increase revenue through better customer experiences and new offerings.

4. Income can (and can) change quickly.

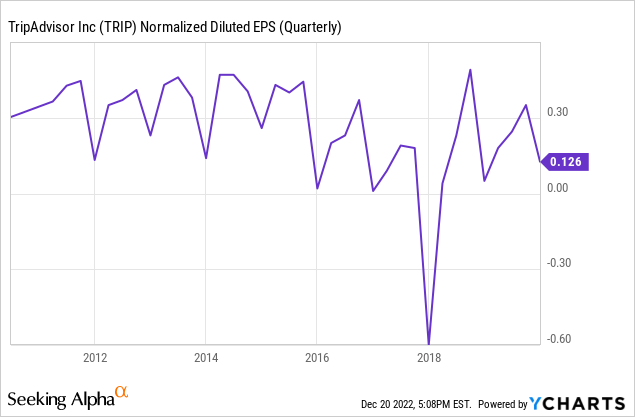

TripAdvisor’s historical earnings per share have been highly volatile. In trying to predict Tripadvisor’s future EPS, I decided to look at pre-pandemic earnings, which in my opinion represent a more common view. As you can see below, the company has historically generated between $0-0.50 in EPS each quarter, as a profit margin:

Gross profit margins have been on a downward trend, but stabilized around 8% before the outbreak. I have not received any indication from TripAdvisor management that these margins are unlikely to be regained, so I believe it is reasonable to assume that the company may eventually return to those levels.

Risks and conclusions

Overall, the future performance of Tripadvisor stock depends on a number of factors, including the continued recovery of the travel and tourism industry, the company’s ability to adapt to consumer behavior and preferences, and its ability to compete with other players online. Place of travel. It’s important for investors to consider these factors carefully and understand that travel stocks have historically been more volatile. It is a cyclical industry that is highly dependent on how the overall economy is doing. As we head into 2023, investors shouldn’t expect TripAdvisor’s revenue to grow year-over-year. Management has made it clear for now.

I’m looking further ahead to 2024 as we hope to start seeing economic growth and travel demand pick up again. If Tripadvisor can return to pre-pandemic margins in that time frame, it could mean a ton for its share price. Tripadvisor, Inc. The current enterprise value of $2.3 billion is well below what it has historically traded for, and I expect that to change as margins improve and revenues stabilize.

Editor’s note: This article is featured as part of the Search for Alpha’s Best 2023 Pick competition, which runs through December 25. This contest is open to all users and contributors. Click here Learn more and submit your article today!

[ad_2]

Source link