[ad_1]

So the first half of 2022 was definitely something. From the unprovoked Russian attack on Ukraine to the supply chain crisis to inflation to astronomical gas prices to the accelerating rate of natural disasters to the Supreme Court — you know what, I have to stop before the fifth stress ball of the year explodes. 2022 basically saw 2020 and responded with a “hold my drink” protest. And with all of these crises occurring simultaneously, the venture capital landscape has taken a hit.

But what about investing in startups? Investing in climate technology startups specifically? What will the end of our days look like?

Looking back to look forward

In the year Climate tech startups have raised around $19 billion in 500 venture deals in the first half of 2022, both Powerhouse Ventures, a leading early-stage venture capital (VC), and Climate Tech VC, an online database detailing the complexity of the Internet database. The current climate investment market. For perspective, a total of $40 billion has been invested in climate technology startups by 2021, setting $19 billion by mid-2022 to match last year’s impressive run.

However, the general market downturn has reared its ugly head in climate technology circles. Growth (late-stage) financing accounted for most of the impact, falling 39 percent from $10 billion in H1 2021 to $3.9 billion in H1 2022. But the number of seed and Series A VC funding deals and venture capital investments rose to 310. Offers, to double in number from H1 2021.

Pour one for women

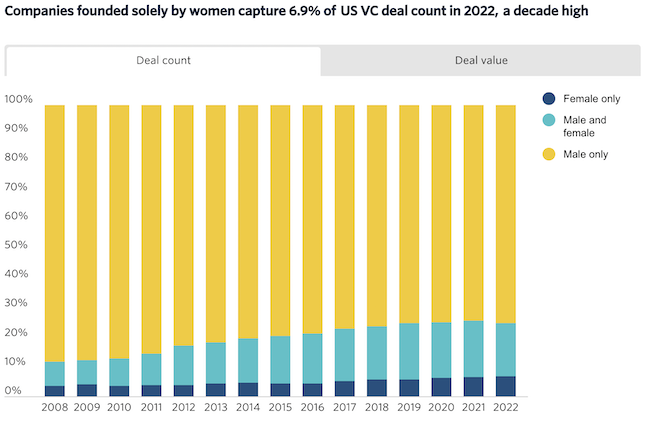

According to Pitchbook, US startups with one or more female founders raised $20.8 billion in the first half of 2022. While this number is not limited to climate technology, it is still an important fact to consider the resilience of the climate technology sector this year. While the total number of female-led funded businesses is still disproportionately, excitingly, vexingly (insert any appropriate adjective that conveys great disappointment) low, overall VC deals are higher in mid-2022 than in all of 2021. I’m going to start chanting Bob Dylan’s famous song about changing times, but there’s still a lot of 2022 to go down as a woman in the United States.

How does the rest of 2022 look?

It is safe to assume that growth funds will continue to bear the brunt of the sluggish market. When I spoke with Climate Tech VC co-founder Sophie Purdom, she explained that the days of $500 million late-stage megadeals are behind us. However, Purdom continued, based on the numbers for the first half of the year, seed and Series A investment will be steady in their upward trajectory. Shandin Cedar, partner at VC firm Powerhouse Ventures, confirmed this prediction, saying, “Investment [in early-stage ventures] The business case for climate innovation remains strong because it remains strong.

The viability of emerging sectors?

New areas of climate technology such as carbon, climate management and industry They’re out the front doors in 2022. Some of the companies showing interest in these verticals include Heirloom’s $53 million Series A funding (Carbon), Carbon Equity’s $1.8 million. Seed Fund (Climate Governance) and Helios $6 million raised by Seed Fund (Industry). Those deal-doubling numbers in seed and Series A funding I mentioned? Yes, most of the activity comes from these new sectors.

In particular, the carbon footprint has emerged as the year’s heavy hitter, closing 25 deals in the first half of this year and counting, compared to 13 in the first half of 2021. In CHC (cold hard cash, not an official acronym, but I like it) these deals will close in the first half of 2022. Half were worth a total of $397.6 million.

This trend is likely to continue. Pitchbook has identified climate technology as third place – behind fintech, and artificial intelligence (AI) and machine learning (ML) depending on their application that can be folded into the climate technology sector – which could disrupt the capital flow from investors for the emerging technology in the next five to 10 years.

And, as mentioned above, constants can overlap. Venture capital investment group Women Founders Fund (FFF) predicts that sustainable enterprise software with the ability to measure, understand and reduce carbon emissions will emerge as a popular investment opportunity. In fact, FFF is particularly optimistic that “advanced technologies such as AI/ML have the potential to help corporations generate an overall value of $1-3 trillion through cost reduction and revenue growth by 2030.” Deep VCs’ pockets.

What is dry power and why is it important?

Venture capitalists collect money like squirrels collect winter nuts and call it dry flour. According to Octavi Simonin, technical director at Powerhouse Ventures, “Everything in climate technology is dry powder. The biggest climate funds raised last year… [Powerhouse’s] The flow of his own agreement has not changed in a meaningful way to date, perhaps a little moderation in reviews.

With these funds already raised, startups can rest assured that their investment capital will remain plentiful. According to Powerhouse, a total of around $20 billion remains to be invested in climate technology dry powder.

What external factors indicate a positive or negative impact on the climate technology investment sector?

The experts wrap us up:

Semonin: “If oil and gas prices start to fall, this is likely because clean energy and mobility solutions will have a tangible impact on long-term demand expectations for fossil fuels.”

Natalie Geise, Innovation Analyst, Powerhouse Ventures: “Many major federal, regulatory, policy and fiscal initiatives, the SEC’s corporate emissions regulation and the West Virginia and EPA rulings are having a significant impact on the market and climate investing.” And it will continue in the future.”

[ad_2]

Source link