[ad_1]

U.S. stock futures edged lower on Tuesday after a series of major companies reported earnings and ahead of broadly-viewed business activity surveys.

Futures tied to the S&P 500 slipped 0.3%, capping recent gains for the broader market index. It gained 1.2% a day earlier to close at its highest level since early December. Nasdaq-100 futures retreated 0.4%.

Stocks rallied over the past two sessions as investors argued that easing inflation would allow the Federal Reserve to slow interest rates and cut rates later this year. Officials at the central bank are considering a smaller rate hike at next week’s meeting, The Wall Street Journal reported.

Earnings season is in full swing with blue chip companies like General Electric.,

Johnson and Johnson,

Danaher,

and 3M will all report before the opening bell. Microsoft is expected to post earnings after markets close.

“The big thing this week is earnings,” said John Roe, head of multi-asset funds at Legal & General Investment Management.

So far, this earnings season hasn’t seen a big drop in corporate outlooks, or consensus forecasts for the coming year, Mr. Roe said. “Everybody was worried that it might be an earnings season where we’re going to downgrade, so when you get a period where nothing happens, you get the idea that this is going to push the U.S. into recession,” he said.

US purchasing managers’ indexes, at 9:45 am ET, will be examined for another indicator of the economy’s health. Similar data on the euro zone showed the currency bloc’s economy expanded in January and beat forecasts.

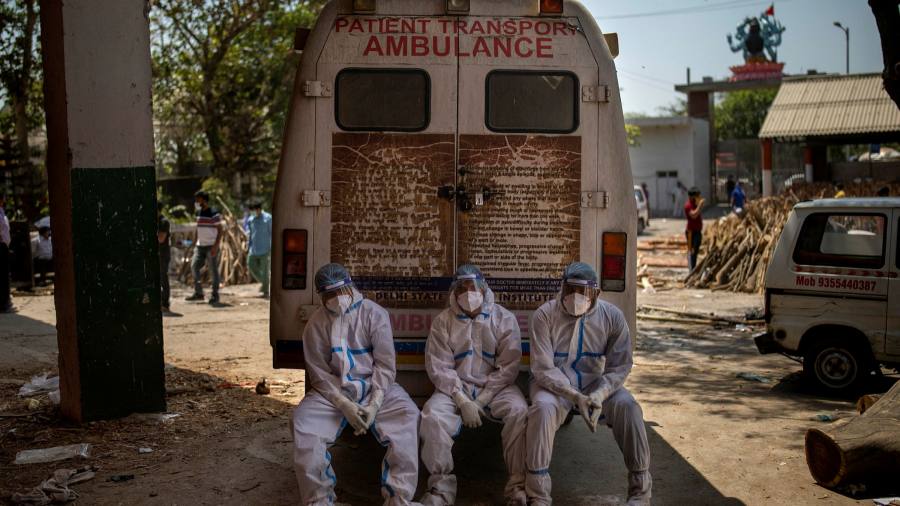

Traders working on the New York Stock Exchange earlier this month. Corporate earnings are the main focus for the market this week.

Photo:

Michael M. Santiago / Getty Images

“The market wants to make sure this rally from the beginning of the year is sustainable. Every number counts,” said Antonio Cavarero, head of investments at General Insurance Asset Management.

In bond markets, the yield on the benchmark 10-year Treasury note fell to 3.493 percent from 3.522 percent a day earlier. When bond prices rise, yields fall.

Oil prices slipped with Brent the most active trading contract, losing 0.6% to trade at $87.64 a barrel.

Overseas, the pan-continental Stoxx Europe 600 lost 0.2 percent. In Asia, markets in Hong Kong, mainland China and South Korea remained closed for Lunar New Year holidays. Japan’s Nikkei 225 rose 1.5%.

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All rights reserved. 87990cbe856818d5eddac44c7b1cdeb8

[ad_2]

Source link