[ad_1]

Throughout 2020, Asia’s success in controlling Covid-19 made it the world economy champion. While Europe and the United States were mired in deep recessions, much of Asia escaped with a deeper recession or even continued to grow.

But as Western economies prepare for one vaccine-induced rebound which is expected to resume production on its pre-pandemic scale later this year, some parts of Asia are still paralyzed by the coronavirus. As a result, although production in the region is already above its pre-pandemic level, slower growth is expected in the coming months.

When it launched its new regional perspective last week, the Asian Development Bank said the region’s economies were divergent and that more Covid-19 waves were a big risk.

“New outbreaks continue, in part due to new variants, and many Asian economies face challenges in vaccine procurement and administration,” said Yasuyuki Sawada, chief economist at the ADB.

The AfDB predicted 5.6 percent growth among developing Asian economies in 2021, led by growth in 8.1 percent in China and 11 per cent in India. But the continuing threat of coronavirus means that the risks for this outlook are downward.

“Six months or eight months ago, I would have said Asia will be ahead of the game because Asia can control Covid,” said Steve Cochrane, chief economist at Apac for Moody’s Analytics in Singapore.

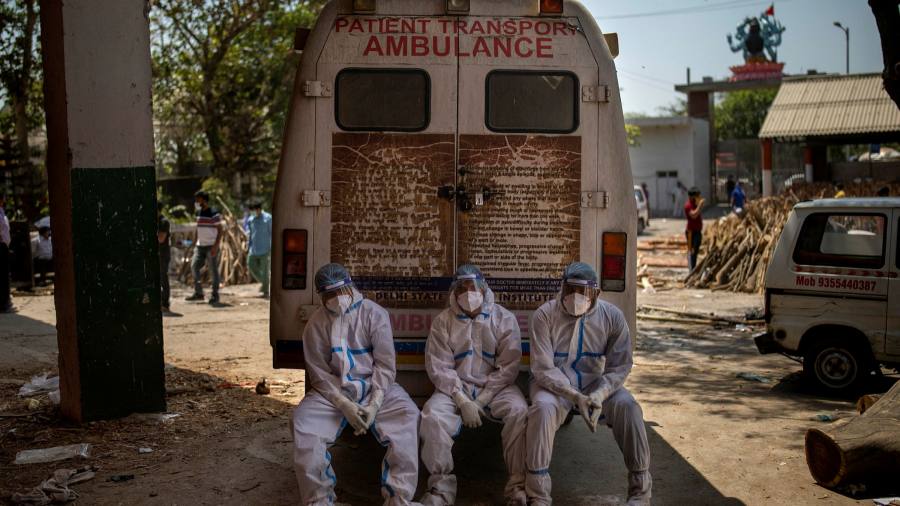

But the picture has changed, with India is suffering from a severe wave of the virus and cases still high in countries such as Indonesia, the Philippines and Thailand. Thailand cannot reopen its crucial tourism industry.

More subtly, countries like Japan only control the virus with restrictions that keep parts of the economy in hibernation. “Some countries need vaccines to control Covid,” Cochrane said. “Others need it to open up to international travel and tourism.”

The promise of more than 6% growth in the U.S. this year, as a result of President Joe Biden’s fiscal stimulus, would normally make Asian exporters lick their lips.

However, the outlook is more moderate than U.S. record growth would normally mean: Americans already bought many commodities during the pandemic, while higher interest rates would mean tighter financial conditions in Asia.

“Adding stimuli at this stage, from a commodities perspective, is a real test of whether needs are insatiable,” said Freya Beamish, Asia’s chief economist at Pantheon Macroeconomics. As the economy opens up, American consumers will likely pay for services that were denied to them during closure, such as meals and haircuts, rather than replacing television again.

Beamish will follow, although there will be some effects from the US stimulus, noting that service providers also needed equipment. “We suspect that people will find new goods to buy and that Asia will benefit.” But he added: “We suspect that China will benefit proportionately less from the recovery of services than from the recovery of manufacturing.”

Whether the extra demand for goods in the United States is large or small, it is clearly positive. In contrast, higher US interest rates and a stronger dollar would threaten many emerging Asian economies with the repetition of the 2013 “tantric tantrum”.

Rising financial integration and foreign currency indebtedness make the pain of rising US interest rates quickly felt on the other side of the Pacific.

“A stronger dollar is no longer a blessing for Asia,” said Frederic Neumann, HSBC’s co-head of Asian economics in Hong Kong. “It helps exports, but it hardens financial conditions.”

However, inflation is moderate in most of emerging Asia and the AfDB said the risk of a US-induced shock to financial conditions “remains manageable today”. He said economies like Sri Lanka and Laos would be vulnerable if such a clash occurred.

Coronavirus business update

How does coronavirus affect markets, businesses, and our daily lives and jobs? Stay informed with our coronavirus newsletter.

Some Asian economies are well placed over the next few years, especially Taiwan and South Korea, which are exposed to the semiconductor cycle. “Judging by the shortage of semiconductors, it does not seem that the electronics cycle will be broken in the next two or three quarters. That makes them go over that rough patch, ”Neumann said.

But other Asian economies will find themselves in the less familiar position of relying on domestic demand to grow. One of the main questions is China itself, where first-quarter numbers suggest the economy has lost some momentum.

“Chinese domestic demand still has a long way to go,” Cochrane said. “Our forecast is now 8% growth in China by 2021, but it depends a lot on policy makers and how quickly they withdraw from the stimulus and introduce friction in areas like construction.”

[ad_2]

Source link