[ad_1]

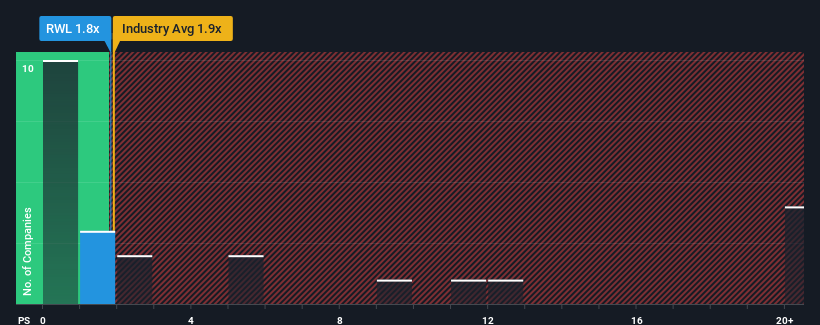

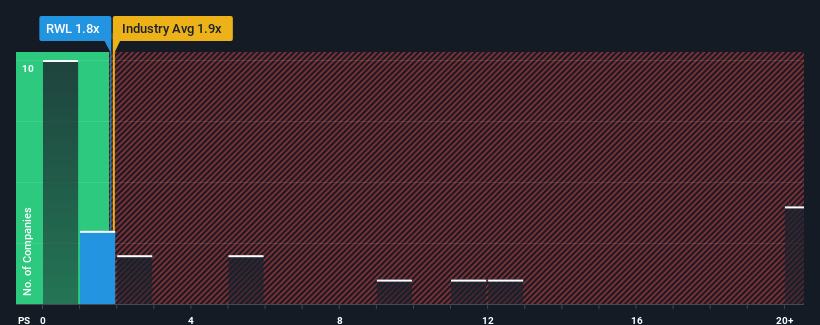

It’s not a stretch to say that. Rubicon Water Limited (ASX:RWL)’s price-to-sales (or “P/S”) ratio of 1.8x currently appears to be the “middle ground” for companies in the electronics industry in Australia. The ratio is around 1.9x. However, without a reasonable basis for P/S, investors may overlook an obvious opportunity or potential downside.

Check out our latest analysis of Rubicon Water

How does Rubicon water work?

For example, Rubicon Water’s declining earnings in the near future should be food for thought. Perhaps investors believe that recent earnings performance is good enough to match the industry, which keeps the P/S from falling. If not, existing shareholders may be a little worried about the viability of the stock.

Looking for an overview of a company’s revenues, earnings and cash flow? Then ours free The Rubicon Water report helps shed light on its historical performance.

How is Rubicon Water’s revenue growth looking?

In order to justify its P/S ratio, Rubicon Water needs to grow in line with the industry.

When we reviewed the last financial year, we were disappointed that the company’s revenue had dropped to 18 percent. This means that over the last three years, total revenue has fallen by 6.7 percent, which means that it has seen its longest revenue slide. So it is fair to say that the recent revenue growth was not desirable for the company.

Considering that medium-term earnings trajectory is set to expand by 13% from the broader industry’s one-year forecast, it shows an unappealing outlook.

With this information, we find that Rubicon Water is trading at a similar P/S relative to the industry. Clearly, many investors in the company are less bullish than they have been lately and are reluctant to give up their current holdings. There’s a good chance existing shareholders are setting themselves up for future disappointment if P/S falls further in line with recent negative growth rates.

Start button

We argue that the power of the price-to-sales ratio is not primarily used as a valuation tool, but rather as a measure of current investor sentiment and future prospects.

While the industry as a whole is expected to grow despite a medium-term decline in earnings, we find Rubicon Water’s P/S ratio to be unexpected compared to other industries. Although relative to the industry, we are not comfortable with the current P/S ratio, as this unexpected earnings performance is unlikely to support positive sentiment over the long term. Investors will find it difficult to accept a stock’s value as fair value unless the near-term conditions improve significantly.

Don’t forget that there may be other risks. For example, we have identified 2 warning signs for Rubicon water (1 doesn’t sit well with us) You should know.

If you are Not sure about Rubicon Water’s business strengthWhy not browse our interactive stock list for other companies you may have missed with solid trading fundamentals.

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality material. Simply put, Wall St has no position in any of the listed stocks.

Join a paid user research session

They receive a. $30 Amazon gift card 1 hour of your time helping us build great investment tools for individual investors like yourself. Register here

[ad_2]

Source link