[ad_1]

Ismagilov

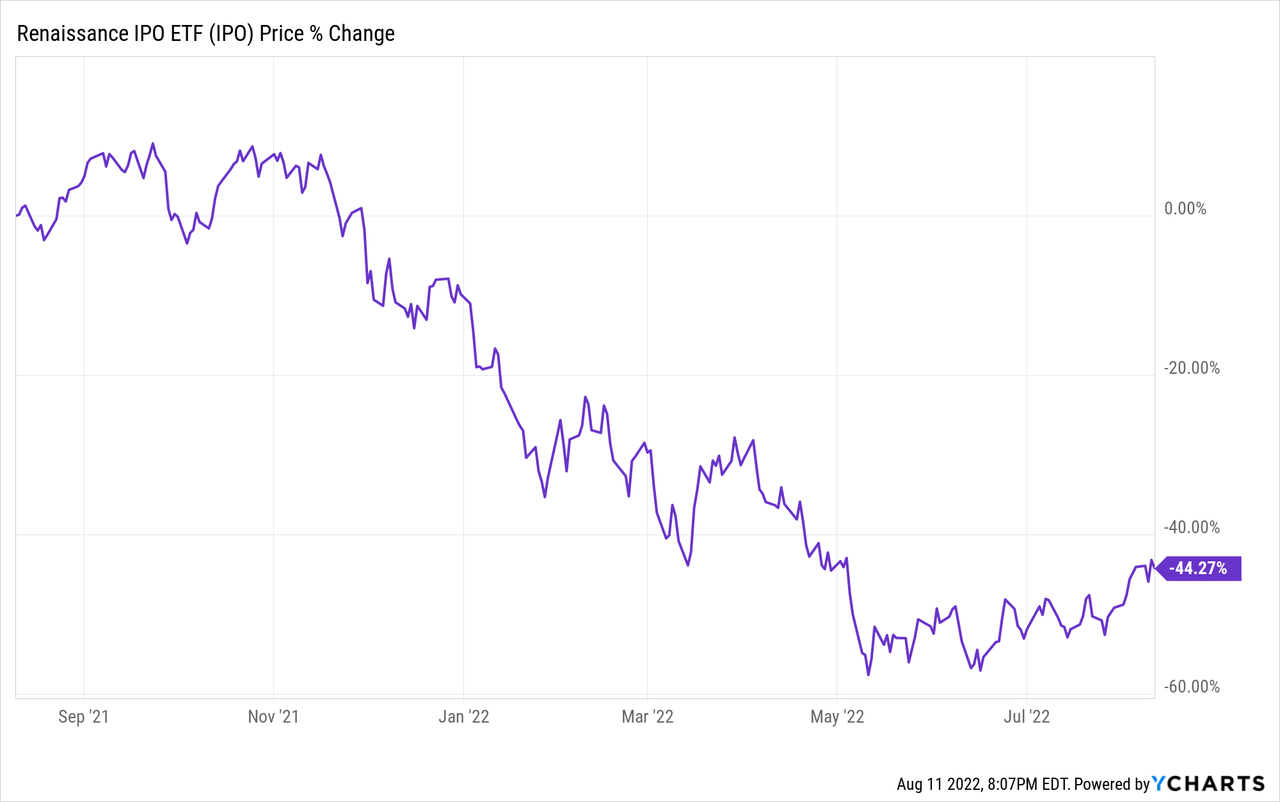

Renaissance IPO ETFNYSEARCA: IPO) is an equity index ETF that invests in recently IPOed companies. Although there are many important factors to consider when analyzing an IPO, including the growth prospects and expectations of the fund’s underlying holdings, I want to focus on A specific issue in this article: recent losses and implications. IPOs have fallen more than 40% over the past twelve months, which has important implications for shareholders.

The fundamental holdings of an IPO are to cover a significant portion of CAPEX and payroll by issuing shares, which dilutes existing shareholders. When stock prices are high, companies can issue shares at reasonable prices and terms, reducing dilution and benefiting existing shareholders. The opposite is true when stock prices are low, and issuing stocks can lead to excessive and destructive stock replenishment. The stock price has fallen 55% over the past twelve months, raising expectations of a dividend from the stock offering. Under these circumstances, I will not invest in these companies or IPOs.

IPO – quick overview

An IPO equity index ETF invests in recently IPOed US companies, defined as those that have had an IPO within the last three years. It tracks the Renaissance IPO Index, an index of these same securities. It is a market-cap weighted index intended to account for the 10% guarantee cap variance.

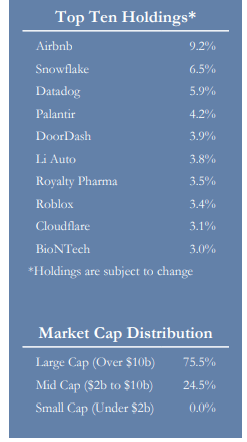

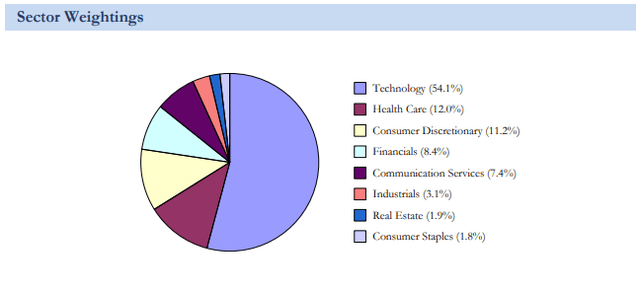

The IPO currently invests in exactly 100 companies, focusing on the tech industry. The fund’s largest holdings include well-known technology companies that have recently gone public, including Airbnb ( ABNB ), Snowflake ( SNOW ) and BioNTech ( BNTX ) IPO largest holdings and industry weights.

IPO

IPO

In my opinion and in light of the above, IPO will faithfully track the US IPO market. There are many positives and negatives to doing this, but for this article I want to focus on the impact of low stock prices on the long-term prospects of these companies. Let’s see.

IPO – Share Issue and Dilution Analysis.

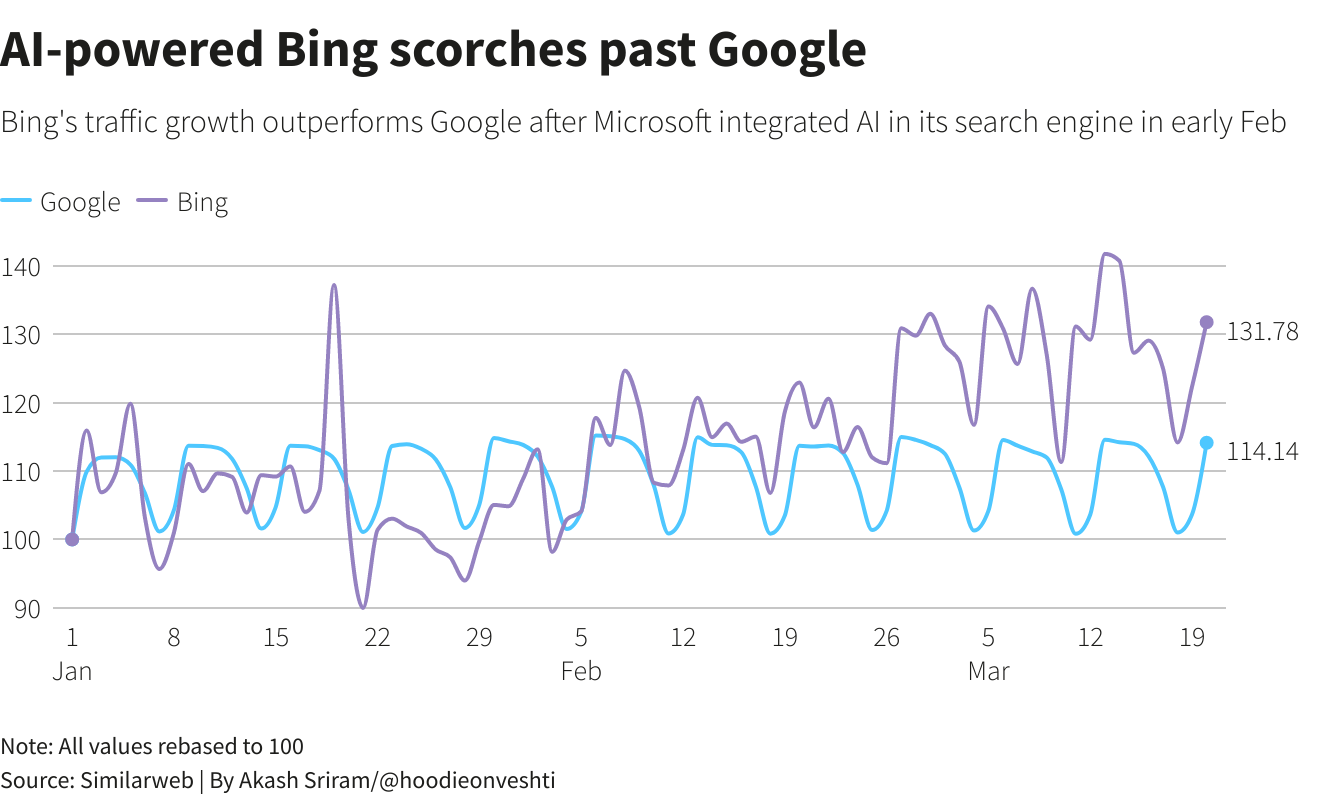

Tech has significantly underperformed in recent months, with small and high-growth tech companies seeing above-average losses. The IPO itself is down more than 40 percent in the last twelve months, which is a pretty big loss.

In most cases, a higher stock price has the opposite effect, leading to lower dividends, earnings, and free cash flow results, ultimately resulting in a lower total stock price, all else being equal. Higher stock prices mean higher valuations, which can lead to capital losses, assuming valuations are normal.

I think the above Basic A history of how stock prices and valuations affect investors. Low stock prices and cheap prices are generally good, and vice versa. However, there are other important, but sometimes overlooked, considerations. Some context first.

Companies of all lines invest in capital goods, property, plant and equipment, R&D and other CAPEX. These costs are important for growth, so especially for high-growth technology companies, including most IPO holdings. These same costs can be financed in many ways, including equity, debt, or self-financing from the company’s profits. High-growth technology companies tend to lean toward equity financing because they don’t generate enough cash flow to support their growth investments, and unproven companies in their youth have high financing costs.

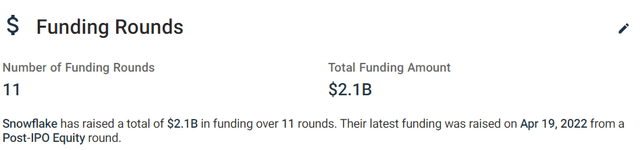

As an example, the fund’s second largest holding, Snowflake, has raised more than $2.1B in equity funding since inception. The last round was in April 2022, just four months ago, at $0.6B, so the funding needs are huge and ongoing.

Crunchbase

Equity financing means issuing shares, which means depleting existing shareholders, which is negative for them. When stock prices are high, a company may need to issue a relatively small number of shares, reducing leverage and ensuring minimal harm to existing shareholders. The opposite is true when stock prices are low, and equity financing is a big negative for existing shareholders.

As an example, let’s go back to the snowflake example above. Snowflake issued nearly $600 million in shares on April 19, 2022. At the time, Snowflake was trading at $197 a share, with 300 million shares outstanding. Assuming the shares were issued at the quoted price, the company would have had to issue about 3.0 million shares, diluting existing shareholders by around 1.0% or so. Snowflake’s stock price has fallen since April, with the company currently trading at $167. If shares are issued Today’s At cost, the company should have 3.6 million shares instead, diluting existing shareholders by around 1.4%, slightly more than before. If Snowflake’s stock price continues to decline, so will the dilution. For companies that rely on equity funds to finance CAPEX, low share prices increase equity stakes when raising money, which is negative for existing shareholders.

Although for most high-growth companies, including most IPO holdings, prices themselves are important. Inexpensive valuations tend to increase the amount of defaults on real equity-funded investments, while frame rates have the opposite effect. For a company like Petrobras (PBR) with a P/E ratio of 2.8x and a dividend yield of +20%, 20% dividend yield and 35 is definitely a scary proposition. % earnings, both are very significant figures. It is better to simply accept income and dividends as they are. It’s a much better idea to give shares to a company like Snowflake that has a P/E ratio of 1200x and no dividends. very much It generates minimal revenue, and no profit to speak of. It is better to invest to increase income.

In any case, low share prices and cheap valuations are negative when issuing shares, which is common for IPO underlying holdings. Companies have seen a decline in prices and valuations over the past few months, down more than 40% from last year, which has severely hampered their ability to raise equity financing in a cost-effective manner. In the best case, the companies can still raise money, but in the best case, the stock increase, a big negative for the existing shareholders. At worst, the companies do not at all To be able to raise equity capital at a reasonable rate, CAPEX must be cut, and growth will slow. VCs have already warned startups and startups alike that this is very likely and to prepare accordingly.

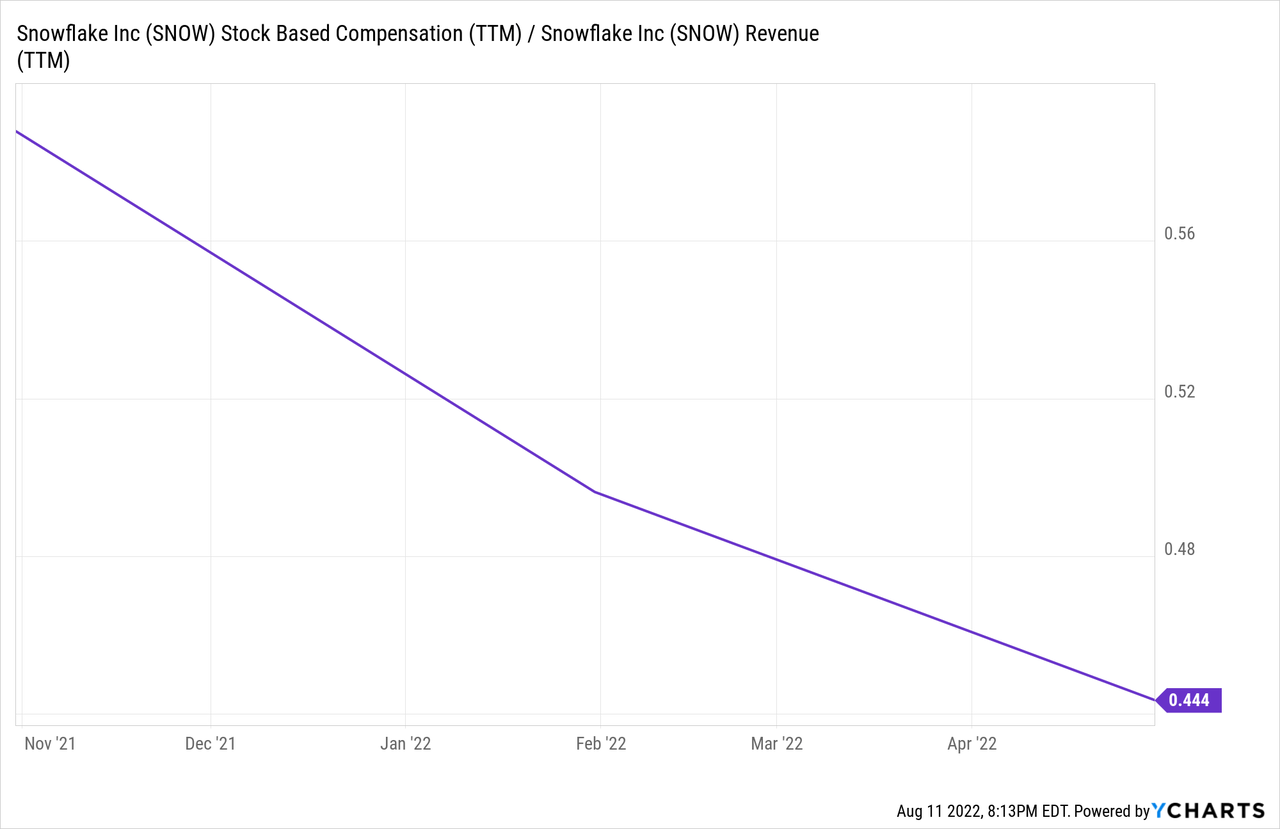

High-growth technology companies also sometimes issue shares to compensate employees (SBC). Doing so benefits the company and shareholders by saving valuable company cash and aligning employee incentives. Doing so will alienate the existing shareholders, which is negative for the same. The net effect of these policies is largely based on stock prices and rates. Stock-based compensation tends to be positive when the stock price and value are high, as stock-based compensation decreases when this is the case, and vice versa. High growth technology companies have significant SBC plans. For example, Snowflake invests more than $600 million in SBC, which equates to 45 percent of the company. revenues, A large amount.

As an aside, given the exorbitant SBC plans, it’s not clear to me that most of these companies have a clear path to profitability or cash flow generation. Snowflake looks profitable as it pays out 45 percent of their earnings by issuing shares. This is not a sustainable business with shareholders’ capital, which means it is not a sustainable business TimeAt least in my opinion.

For high-growth tech companies and shareholders, stock price declines and depreciations are both significant downsides, as these make it difficult to fund CAPEX and pay payroll without going into high stakes. These issues are already having a significant negative impact on the industry, with many tech companies cutting CAPEX and raising payroll. These are significant negative factors, but they are sometimes ignored by investors, because most companies simply do not face these problems. High-growth technology companies do, and so investors should consider these issues before investing.

In my opinion, the days of easy money, skyrocketing high-tech industry valuations, and equity-funded growth, and consecutive growth outpaces, are over, at least for now. An IPO wouldn’t do well in its current state, so I wouldn’t invest in the fund at the moment.

Conclusion – There is no reason to buy

The IPO’s underlying holdings were dependent on high share prices to cover CAPEX and payroll. Low stock prices hurt their business models, and call into question their long-term prospects, the most significant downsides. Under these circumstances, I will not invest in these holdings, or IPOs.

[ad_2]

Source link