[ad_1]

Introduction: euro on brink of parity with the dollar

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

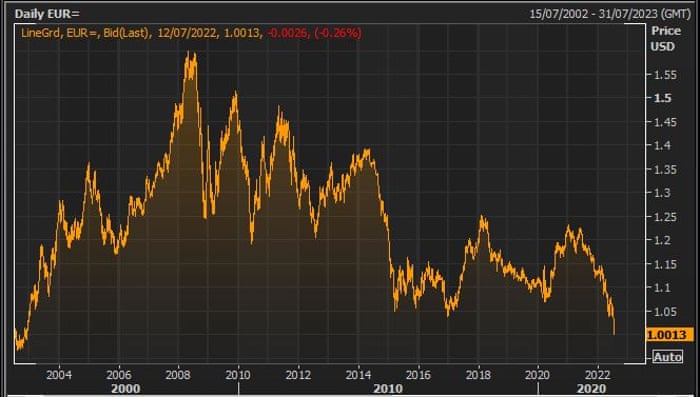

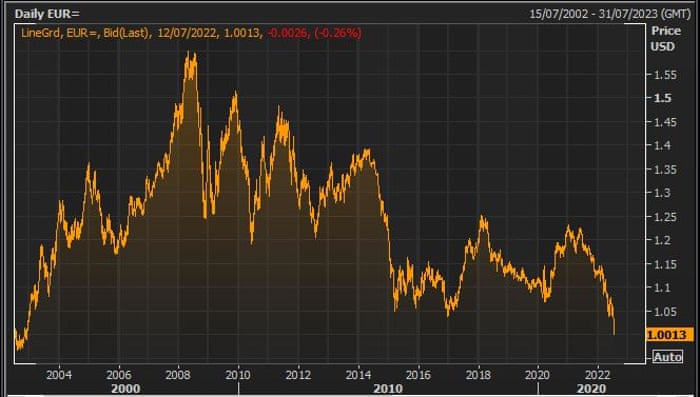

All eyes are on the euro this morning, as the single currency falls to the brink of parity with the US dollar for the first time in two decades.

Anxiety over poor European growth, and rising fears that Russia might turn off gas supplies are weakening the euro.

The euro dropped as low as $1.0006 against the dollar in early trading today, a new 20-year low, compared with above $1.13 at the start of this year.

Russia turned off the single biggest pipeline carrying gas to Germany on Monday for annual maintenance. That work is expected to last for 10 days, but governments, markets and companies are worried the Nord Stream 1 shutdown might be extended because of the war in Ukraine.

If Vladimir Putin decides to turn off gas supplies to Europe this winter, countries such as Germany could face gas rationing — potentially forcing industries to suspend work and leaving families struggling to heat their homes.

Fiona Cincotta, senior financial markets analyst, at City Index, says:

Fears are rising that Russia may not switch the gas supply back on in 10 days when the works are over. This could cause a recession in Europe.

CHART OF THE DAY: And Germany counts the days.

Nord Stream 1 pipeline has stopped shipping Russian gas into Germany (just a residual amount still flowing now). It’s annual maintenance, scheduled from July 11 to July 21.

Berlin fears the pipeline may never return into service. pic.twitter.com/HCdagmIbGs

— Javier Blas (@JavierBlas) July 11, 2022

Robert Habeck, Germany’s economy minister, warned on Saturday of the ‘nightmare scenario’ of a permanent halt to the flow of Russian gas.

“Everything is possible, everything can happen,” Habeck told the broadcaster Deutschlandfunk:

“It could be that the gas flows again, maybe more than before. It can also be the case that nothing comes.

“We need to honestly prepare for the worst-case scenario and do our best to try to deal with the situation.”

Surging energy prices and supply chain disruption due to the Ukraine war had already threatened to push Europe into a recession.

Investors are also concerned that a growing number of Chinese cities, including the commercial hub Shanghai, are bringing in new restrictions to combat outbreaks of the highly-transmissible Omicron subvariant, BA.5.

The dollar is benefitting from that uncertainty, plus concerns that US inflation could hit a new 40-year high on Wednesday.

That could prompt more aggressive interest rate rises, strengthening the US currency, especially after a better-than-expected American jobs report last Friday that calmed recession worries..

The agenda

- 9am BST: Bank of England deputy governor Jon Cunliffe: Speech on crypto market developments at the British High Commission, Singapore

- 10am BST: ZEW survey of eurozone economic confidence

- 11am BST: NFIB US Business Optimism index for June

- 6pm BST: Bank of England governor Andrew Bailey: Speech at OMFIF ‘The economic landscape’

Key events:

Filters (BETA):

The oil price is now sliding, a sign that recession fears are on the rise.

Brent crude has dropped over 4% to $102.34 per barrel, back towards the three-month lows seen last week.

US crude has dropped back below $100/barrel for the first time since Thursday, at $99.06.

Fears of gas shortages in Europe, and the latest Covid-19 lockdowns in China, have increased the risk of a downturn.

Ricardo Evangelista, senior analyst at ActivTrades, says the markets appear increasingly convinced that a global economic slowdown is coming.

With inflation remaining high and forcing central banks and fiscal authorities to withdraw stimulus, an energy crisis in Europe that appears to be about to get worse and trigger a recession, and disappointing demand in China due to continuing Covid concerns, the prospects for future oil demand are being revised to the downside.

Such expectations, that a decline in demand in the months ahead will become the dominant market driver, are keeping pressure on the price of the barrel and could lead to further drops.

Another economic warning sign — US small business confidence has dropped to the lowest level in over nine years, as firms are hit by inflation.

The National Federation of Independent Business (NFIB) said its Small Business Optimism Index fell 3.6 points last month to 89.5, the lowest level since January 2013.

Thirty-four percent of owners said that inflation was their biggest single problem in running their business, an increase of six points from May and the highest level since the fourth quarter of 1980.

But, demand for workers remained solid.

Here’s our news story on Heathrow asking airlines to stop selling tickets to fly over the next two months, as it struggles to cope with demand.

Heathrow’s two-month cap on daily passenger traffic is “a dramatic response” by the country’s busiest airport to the flight chaos that has gripped Europe for weeks, says Bloomberg:

Last month, Gatwick airport, London’s second-biggest hub said it would limit airlines to 825 flights a day in July and 850 a day in August, from a pre-pandemic peak of around 950 services to cope with the aviation industry’s staffing crisis. Amsterdam’s Schiphol hub also took similar measures, forcing Dutch flag carrier KLM to limit ticket sales.

In the UK, last-minute flight cancellations from the country almost tripled in June compared with the same month in 2019, even with fewer flights be operated by airlines, according to data from aviation analytics firm Cirium.

British Airways, whose main hub is Heathrow, has scrapped about 13% of its planned capacity this summer. That’s up from the 10% reduction it announced in May.

London’s Heathrow is imposing a two-month cap on daily passenger traffic, a dramatic response by the country’s busiest airport to the flight chaos that has gripped Europe for weeks as airlines and ground crews struggle to process a surge in demand. https://t.co/AL22EyLIj3

— Anurag Kotoky (@anuragkotoky) July 12, 2022

The news that Heathrow has told airlines to stop selling summer tickets and put a 100,000 per day cap on departing passenger numbers will be “incredibly frustrating for travellers and their families”.

So says Michael Foote, editor-in-chief of Quotegoat.com, a money saving website, who has advice for those affected:

If your flight is cancelled you should be asked whether you want a full refund or to re-book on an alternative flight. The airline should cover the cost of transport if you need to travel from a different airport to catch your replacement flight.

“You’re also entitled to financial compensation if you’re delayed two or more hours by the replacement flight offered and you were given less than two weeks’ notice. If your flight is cancelled less than seven days before departure you may be able to claim between £110 – £520 compensation depending on the distance of your flight.”

Here’s the full statement from Heathrow on its capacity cap.

To give our passengers a better, more reliable service this summer and to keep our colleagues safe – we’ll be implementing a departing passenger cap of 100k from today to 11 Sept. Read more from our CEO about why we’re doing this here: https://t.co/kf3WdJeLbe pic.twitter.com/bJSlf3L95f

— Heathrow Airport (@HeathrowAirport) July 12, 2022

Heathrow introduces capacity cap of 100,000 departing passengers per day

Newsflash: Heathrow Airport is imposing a capacity cap of 100,000 departing passengers each day until 11 September, in an attempt to limit disruption over the summer holiday season.

Heathrow says the move will provide “better, more reliable summer journeys”, following the travel chaos that has hit UK airports, and others across Europe, since travel restrictions were lifted.

But, it also admits that some trips will either be moved to another day, another airport or be cancelled.

Heathrow asking airlines to stop selling summer tickets now. But at least 1,500 passengers who have booked flights will be affected each day, on average.

Heathrow CEO John Holland-Kaye says it is a ‘difficult decision’, but necessary as the airport has been struggling since passenger numbers increased.

In an open letter, he says:

“We started recruiting back in November last year in anticipation of capacity recovering this summer, and by the end of July, we will have as many people working in security as we had pre-pandemic. We have also reopened and moved 25 airlines into Terminal 4 to provide more space for passengers and grown our passenger service team.

“New colleagues are learning fast but are not yet up to full speed. However, there are some critical functions in the airport which are still significantly under resourced, in particular ground handlers, who are contracted by airlines to provide check-in staff, load and unload bags and turnaround aircraft. They are doing the very best they can with the resources available and we are giving them as much support possible, but this is a significant constraint to the airport’s overall capacity.

“However, over the past few weeks, as departing passenger numbers have regularly exceeded 100,000 a day, we have started to see periods when service drops to a level that is not acceptable: long queue times, delays for passengers requiring assistance, bags not travelling with passengers or arriving late, low punctuality and last-minute cancellations. This is due to a combination of reduced arrivals punctuality (as a result of delays at other airports and in European airspace) and increased passenger numbers starting to exceed the combined capacity of airlines, airline ground handlers and the airport.

Our colleagues are going above and beyond to get as many passengers away as possible, but we cannot put them at risk for their own safety and wellbeing.

The UK government gave airlines until last Friday to remove flights from their schedules under a ‘slot amnesty’.

Holland-Kaye says some airlines have not gone far enough, so a 100,000/day passenger cap is needed to keep Heathrow running, and limit disruption and lost luggage.

Holland-Kaye explains:

“Our assessment is that the maximum number of daily departing passengers that airlines, airline ground handlers and the airport can collectively serve over the summer is no more than 100,000. The latest forecasts indicate that even despite the amnesty, daily departing seats over the summer will average 104,000 – giving a daily excess of 4,000 seats. On average only about 1,500 of these 4,000 daily seats have currently been sold to passengers, and so we are asking our airline partners to stop selling summer tickets to limit the impact on passengers.

And he apologises to those whose trips will be affected:

“By making this intervention now, our objective is to protect flights for the vast majority of passengers at Heathrow this summer and to give confidence that everyone who does travel through the airport will have a safe and reliable journey and arrive at their destination with their bags.

We recognise that this will mean some summer journeys will either be moved to another day, another airport or be cancelled and we apologise to those whose travel plans are affected.

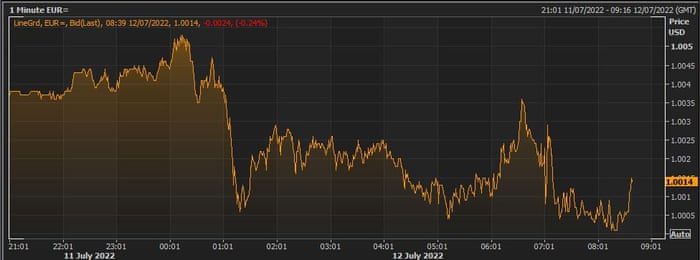

Sustained pressure has pushed the euro down to just $1.0001 now.

Euro falls even closer to parity at $1.0002

That slump in German investor confidence has driven the euro even close to parity with the US dollar.

In choppy trading, the single currency has now dropped back to just $1.0002 — a fresh 20-year low.

The weak ZEW survey is adding to fears of a recession, with traders already anxious that Russia might not turn on the Nord Stream 1 pipeline again once it has completed its summer maintenance work.

German economic sentiment takes a tumble

Ouch. Economic confidence in Germany has tumbled this month, as fears of energy disruption rise.

The ZEW Institute’s index of German investor morale has fallen to -53.8 this month, sharply down on June’s -28.

That shows that analysts are increasingly pessimism about the economic outlook, and bracing for a recession.

ZEW President Achim Wambach says analysts are more concerned about energy supplies, looming interest rate rises, and new Covid-19 lockdowns in China.

“Expectations for energy-intensive and export-oriented sectors of the economy have fallen particularly sharply.”

⚠️ ZEW below Covid ’20 levels tells us that financial market professionals think that Europe is on the brink of a GFC-like of Sovereign Debt-like crisis……

Caveat: Remember this is a survey of analysts, not businesses – so it’s as much of a positioning/sentiment gauge$EUR pic.twitter.com/WPmv3CrnPS

— Viraj Patel (@VPatelFX) July 12, 2022

ZEW’s gauge of current economic conditions also weakened, to -45.8 from-27.6.

Both readings are weaker than expected.

Russian gold miner Petropavlovsk to file for administration

In other Russia-related news, debt-laden gold miner Petropavlovsk plans to file for administration after sanctions on Gazprombank, its main lender and the sole buyer of its gold, left it struggling to repay loans.

Petropavlovsk’s London-listed shares have been suspended at its request and it said it will seek a hearing on the administration application at a London court in the coming days.

On the Moscow Exchange, Petropavlovsk shares hit a record low, falling by 39%, Reuters reports.

Back in March, Petropavlovsk has said it is unable to offload its gold or repay a loan because of the inclusion of Gazprombank on the UK’s sanctions list after the invasion of Ukraine.

In April, Gazprombank demanded immediate repayment of a $200m loan.

And today, Petropavlovsk warns that it is unable to repay the Term Loan at the present time and considers it “very unlikely that it will be able to refinance the Term Loan in the short term and has to date been unable to do”.

The weaker the euro gets, the more expensive imports such as energy will be….

Without wanting to sound too Doomsday-ish, Euro-Dollar parity is a catastrophe for the EU. Energy supply is already unaffordable and as we head into winter it’ll likely get even worse.

EU has its hands tied…

— SG Futures – Market Profile Specialists (@sg_futures) July 12, 2022

The euro isn’t giving up without a fight. It’s now pushing away from dollar parity, back up to $1.0015.

It’s still down 0.25% today, though, and trading at its lowest in 20 years due to Europe’s energy crisis and acute recession fears.

[ad_2]

Source link