[ad_1]

While investors don’t have to look far for signs of trouble on the horizon, share giant Uber Technologies (NYSE:UBER) may increase dramatically due to the travel trend of younger consumers. In particular, the Generation Z age group prioritizes experiences over many other activities. So, despite being financially strapped compared to other age brackets, Gen Z is ready to kick off the travel season. As a result, I am bullish on UBER stock.

The feeling of “revenge trip” remains strong

When Covid-19 first upended society, many people naturally took comfort in home entertainment solutions along with other digital communication platforms. However, as social creatures, people instinctively want to experience “real” relationships, not digital representations. Thus, the concept of revenge travel or the desperate desire to hit the road (and friendly skies) caught on with consumers to make up for lost time.

As jurisdictions gradually relaxed their pandemic prevention protocols, demand for travel increased. However, even after last year’s high inflation, the demand for travel is still strong. Basically, that’s great news for UBER stock because the ride ecosystem has a broader supply chain, so to speak. From retrieving and everything in between, sharing offers incredible benefits.

Additionally, as reported in January 2019 by Pew Research Center More Americans are using ride hailing services like Uber. At that time, 36 percent of American adults said they had traveled on such services, compared with 15 percent at the end of 2015. Additionally, ride-sharing platform adoption has increased across all age groups, including the 50+ demographic.

However, younger drivers have seen the biggest increase in adoption, which should bode well for UBER stock. Basically, younger consumers are likely to favor the upcoming travel season.

Youth energy could boost UBER’s stock.

As stated recently CNBC Report, which is quoted from the data Morning consultation, more than half of America’s Gen Z adults are frequent travelers. And that’s true given their youth and low income relative to an older demographic. With a consumer base willing to open its wallet, UBER stock looks like a compelling bullish proposition.

In particular, Morning Consult reveals that Gen Z doesn’t want to wait to land high-paying jobs or build a savings nest egg. Instead, they want to travel, and they want to travel right now. In fact, such behaviors are not exactly consistent with financial wisdom. However, the volatility of UBER stock should be fairly consistent.

Another element that supports ride-sharing is the platform’s universal language of Gen Z – digitization. In fact, this is the first generation that grew up entirely on the Internet and grew up with extensive mobile communication networks. Having no concept of “analog” reality, Gen Z prefers digital communication over real face-to-face communication.

Therefore, Uber benefits from organic relevance. With the platform, users don’t have to say anything to their drivers if they don’t want to. Even better, if young people want to travel abroad in non-English speaking countries, sharing will be even more valuable.

Thanks to Uber, one can enjoy mobility wherever the platform is supported. Additionally, if problems arise, users can get support through the app rather than the overseas taxi service provider.

A risky venture from a financial point of view

To be fair, while the fundamental narrative seems to favor the upside, UBER stock faces one major challenge — financial issues. In particular, the parent company faces a credibility challenge regarding its path to profitability. Year after year, Uber posts net losses, upsetting long-term stakeholders.

Furthermore, the balance sheets do not provide the greatest evidence of stability. Notably, Uber’s cash-to-debt ratio sits at 0.39, worse than its sector peers at 81.22%. Also, the Altman Z-Score (a metric of solvency) comes in at a low 0.25, indicating stress and an above-normal probability of bankruptcy.

However, the bright side is Uber’s three-year earnings per share growth of 15.7%, which is in line with 68.26% of sector players. In addition, Uber may eventually overtake its rivals as it aggressively captures domestic and international market share.

Analysts say UBER stock is a buy?

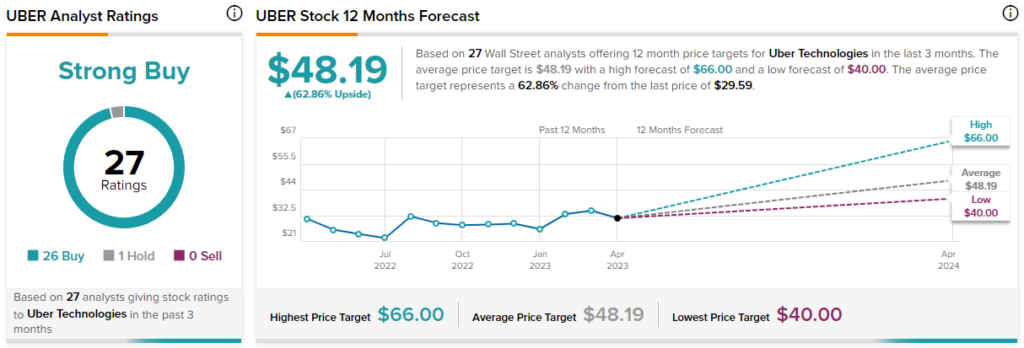

Turning to Wall Street, UBER stock has a strong Buy consensus rating based on 26 Buys, one Hold and zero Sell ratings. UBER stock has an average price of $48.19, indicating a potential upside of 62.9%.

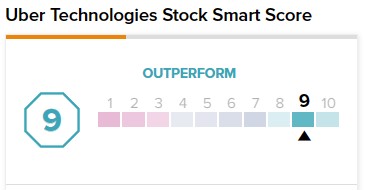

Further supporting the bullish position, at Tipranks, UBER stock has a Smart Score of 9 out of 10. This indicates that the stock has the potential to outperform the broader market.

The takeaway: Uber is well positioned for the youth travel boom

Despite the consumer economy facing significant pressures, travel sentiment is surprisingly strong. In particular, Gen Z consumers – despite their relative lack of income – desire to seek new experiences. Therefore, UBER stock is already positioned as a low wind beneficiary. Better yet, the onboarding platform speaks the language of digitalization, making its end users feel at home.

Disclosure

[ad_2]

Source link