[ad_1]

As a business owner, you need to know how well you are generating profits. This type of profit and loss report is one of three financial statements.

A pl statement is an important way to see what’s happening financially over time. This is a great way to keep track of your small business financials.

What Exactly is a Profit and Loss Statement?

This kind of financial statement looks at the overall profit by summarizing expenses, costs, and revenues. It’s a snapshot of a company’s financial health and business performance.

A pl statement is issued quarterly and annually. Businesses should know how a balance sheet works too. They are added along with a cash flow statement. Put together, all three are a popular way to show profit and loss in a business plan.

Wondering “What is a cash flow statement?” Here are some info.

Why a Profit and Loss Statement is So Important for a Small Business

This accounting concept looks at business income for a specific period. P l statements are critical for other reasons too. Following are a few of the reasons you need these statements.

For Making Good Decisions

These compare a small business ”total expenses against total revenue to make decisions based on real numbers. There’s no guesswork when you use these.

For Attracting Investors

Show off your financial strength over a specific time period. A great idea for any public company looking to attract investors.

Great for a startup looking to do the same.

For Forecasting Expenses

A good business model looks at more than just a company’s revenues. Rent, salaries, and other expenses like equipment purchases need to be considered. P l statements help forecast these on an annual basis.

For Projecting Revenue

Business finances look at top-line revenue statement numbers too. A company’s ability to generate revenue is in a profit / loss statement p l.

For Getting Taxes Ready

Updating this kind of income statement keeps you ready for tax time.

Types of Profit and Loss Statements (P&L)

Small business owners need to be aware of pl statement types. The following can show up on a final report.

Accrual Method

Accrual method accounts are for bigger businesses. They record the cash flow they are hoping to pay out or receive.

Cash Method

This is better for smaller businesses. It’s a simple pl statement. Just the cash going in and out gets recorded. This accounting method does not include anything in the future.

The cash basis is more direct. The accrual basis for the same period adds in revenue and expenses.

Main Components of a Profit and Loss Statement

This kind of financial report can be viewed by the internal revenue service. And it shows the net profit so you can make plans.

Add these components so it’s accurate. If you’re looking for more info on the subject, maybe ask “what is a balance sheet?” Here’s a good resource.

1. Operating Expenses

These are expenses not tied directly to producing goods or services. Think payroll tax expenses and sales commissions.

2. Sales or Revenue

This is the profit coming in from sales over a particular time period. A big metric to check your financial performance.

3. Net Profit

This is what’s called the bottom line. This covers the expenses incurred during producing and selling. Subtract operational expenses. What’s left is the company’s profit.

4. Gross Profit

Subtract the cost of goods sold from revenue. The gross profit is expressed as a percentage.

5. Cost of Goods Sold

These appear on an income statement analysis. The total of all the direct costs incurred in manufacturing.

6. Fixed Expenses

Private companies and public companies have these. These are small business administration costs like utilities, marketing, and leases.

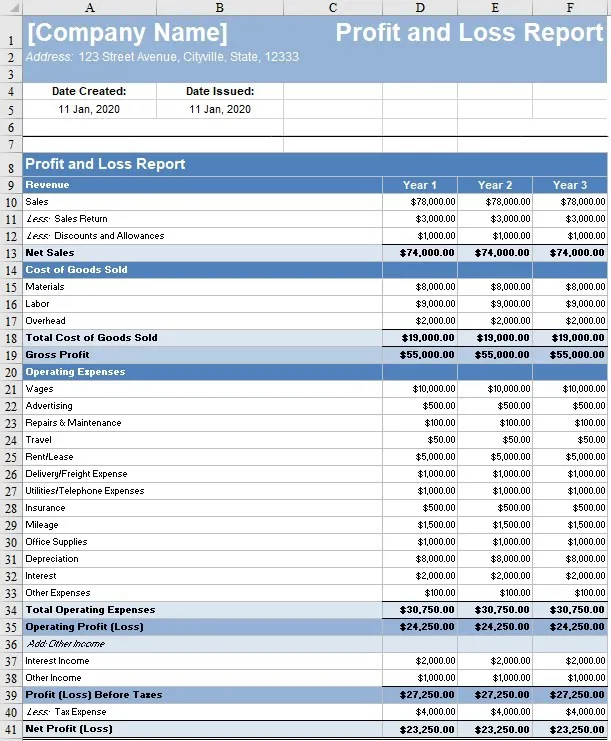

Profit and Loss Statement Example

Sorting through items like a gross profit margin and net profit margin is easier with a template.

This one is available from FreshBooks. It’s a free template to determine your net income.

A free profit and loss template can help you understand the process.

How to Create a Profit and Loss Statement

You can create one of these financial statements to find net income using these steps.

Gather The Info

An accurate profit and loss statement includes all the necessary information. Include receipts, credit card transactions, and invoices. Do not forget to include items pertaining to expenses.

List The Sales

This part of the operating statement includes sales. This is different from what a balance sheet shows.

List The COGS.

Then you subtract these from gross revenue. This provides the gross profit.

List The Expenses

Then subtract these from your gross margin in the fiscal year you are working on. Don’t forget non-operating expenses like interest payments on debt.

List Interest Expenses.

And income taxes on net income. Then subtract that from the previous total.

Finally, list amortization and depreciation and subtract that.

There’s a lot that goes into your own statement as a business person. Remember you can set the contents to expand the table feature to add rows. It’s an excellent feature when you’re putting together one of these financial reports.

Analyzing a Profit and Loss Statement

Understanding a profit and loss statement is a good start. But you need to know how to analyze one. These indicators will tell you about factors like the operating profit and the health of your business.

Net Sales

Revenue after goods that are sold are considered and they are recorded on profit / loss statements when items are bought. Not just when they are paid for.

Cost of Goods Sold

This needs to be reviewed. The loss statement pl here should indicate ways you can reduce expenses. When the cost of goods sold goes up, revenue should follow.

Gross Margin

Also called the gross profit percentage. Compare your company’s assets to the competition. Divide this profit by net sales.

Seasonality

Sales and expenses can change with the weather. Fluctuations in a loss statement template can be explained this way.

Operating Income

Subtract operating expenses from operating revenues. Learn how much your business earns from core activities.

Image: Depositphotos

[ad_2]

Source link