[ad_1]

in spite of Travel + entertainment company ((NYSE:TNL) stock is up 3.7% in the past week, and insiders who sold $439k worth of stock last year are probably better off. Selling higher than the current price at an average of US$46.66 could be a very good decision for these insiders as their investment will be worth less than when they were sold.

While insider trading isn’t the most important thing when it comes to long-term investing, we think it’s worth keeping an eye on what insiders are doing.

Check out our latest analysis for travel + entertainment

Last 12 months of internal transactions during travel + leisure

Insider Olivier Xavi made the biggest insider sale of the past 12 months. That single transaction was worth US$179k worth of stock at US$42.65. This means that an insider would have sold shares at the current price of around US$41.90. We generally don’t like to see insiders sell, but the lower the selling price, the more concerned we are. We note that this selloff took place around current prices, so while not a good sign, it’s not a huge concern.

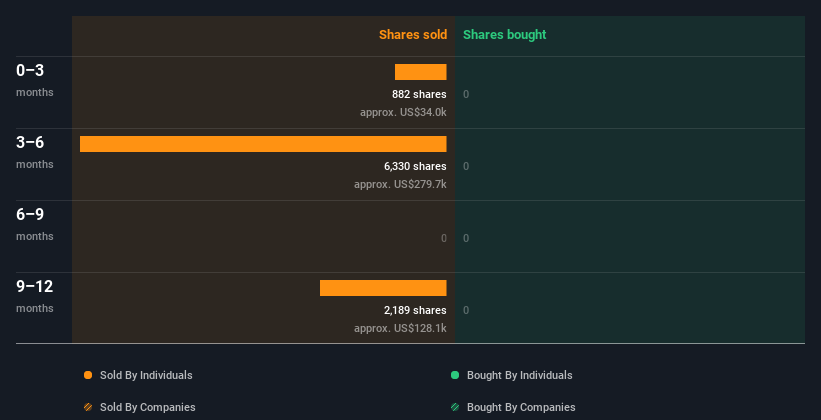

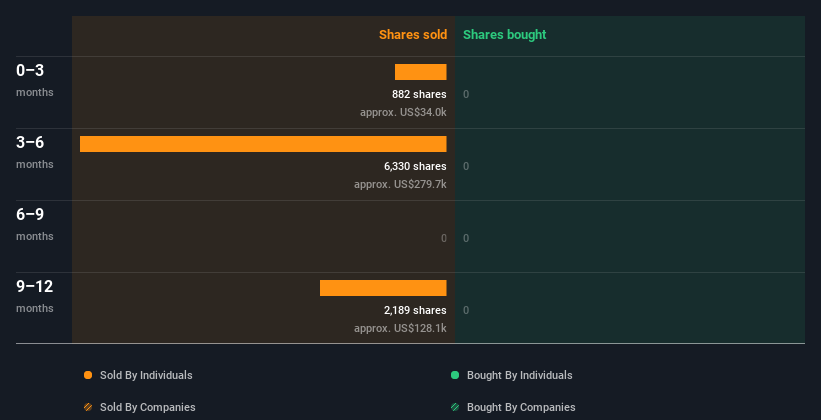

Last year, Travel + Leisure Giants did not buy any company stock. The table below shows insider transactions (by companies and individuals) over the past year. If you click on the table, you can see all individual transactions including the stock price, individual and date!

If insiders want to buy the stocks they’re buying instead of selling them, you might just like this one. free List of companies. (Hint: insiders were buying them).

Travel + Leisure insiders are selling the stock.

The past three months have seen some of the travel + leisure savvy sell out. Independent director Jorge Herrera issued US$34k worth of shares at that time. Neither the lack of buying nor the presence of selling is encouraging. But the amount sold is not enough to gain any weight.

Travel + Entertainment Insider Ownership

Looking at the total insider shares in a company can help inform your view of whether they are well aligned with common shareholders. I guess it’s a good sign if you own a large number of shares in the company. Travel + Leisure insiders appear to own 1.1% of the company, which is valued at about US$36m. Although this is not a strong but dominant level of ownership, it is sufficient to indicate some alignment between management and minority shareholders.

What can insider trading + leisure time tell us?

Our data shows a little more insider selling over the past three months, but no insider buying. However, the sale is not enough to worry us. We’re a bit worried about recent insider selling from a broader travel + leisure insider trading perspective. But it’s good to see insiders owning stock in the company. While we love to know what’s going on with insider ownership and transactions, we make sure to consider what risks are involved before making any investment decisions. Notice this Showing Travel + Entertainment. 2 warning signs in our investment analysisAnd 1 of these in a few…

If you prefer to look for another company — one with greater financial potential — then don’t miss this one free List of interesting companies with high returns on equity and low debt.

For the purpose of this article, insiders are those who report their transactions to the relevant regulatory body. We currently account for open market transactions and private views, but not derivative transactions.

What are the risks and opportunities? Travel + entertainment?

Travel + Leisure Co., together with its affiliates, provides hospitality services and products in the United States and internationally.

See full analysis

Awards

-

The fair value is trading 37.1% below our estimate

-

Revenue is predicted to grow 7.93 percent per year

-

Revenue grew by 80.8 percent last year.

Accidents

-

Debt is not well covered by cash flow.

See all risks and rewards

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality content. Simply put, Wall St has no position in any of the listed stocks.

[ad_2]

Source link