[ad_1]

Investors have raised expectations around SaaS profitability and growth since the recession began.

As a result, it’s even more important for founders to keep a close eye on the key parameters they can consider before saying “yes” or “no.”

In his latest TC+ article, Paris Heymann (Partner, Index Ventures), shares formulas for calculating Gross Dollar Retention and Net Dollar Retention, two KPIs that provide deep insight into the health of your business. It also includes GDR and NDR standards for context, enterprise and SMB.

Full TechCrunch+ articles are available to members only

Use discount code TCP PLUS ROUNDUP One or two year subscription to save 20%

Heyman writes: “Specific businesses tend to be more durable, easier to manage, and more highly valued than conventional ones.

Depending on the market, landing a new customer can be 5-25 times more expensive than retaining an existing one.

With that in mind, listing more logos on your customer page is not only good for morale, but also “instills more confidence in investing to fuel future growth.”

Thank you for reading

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

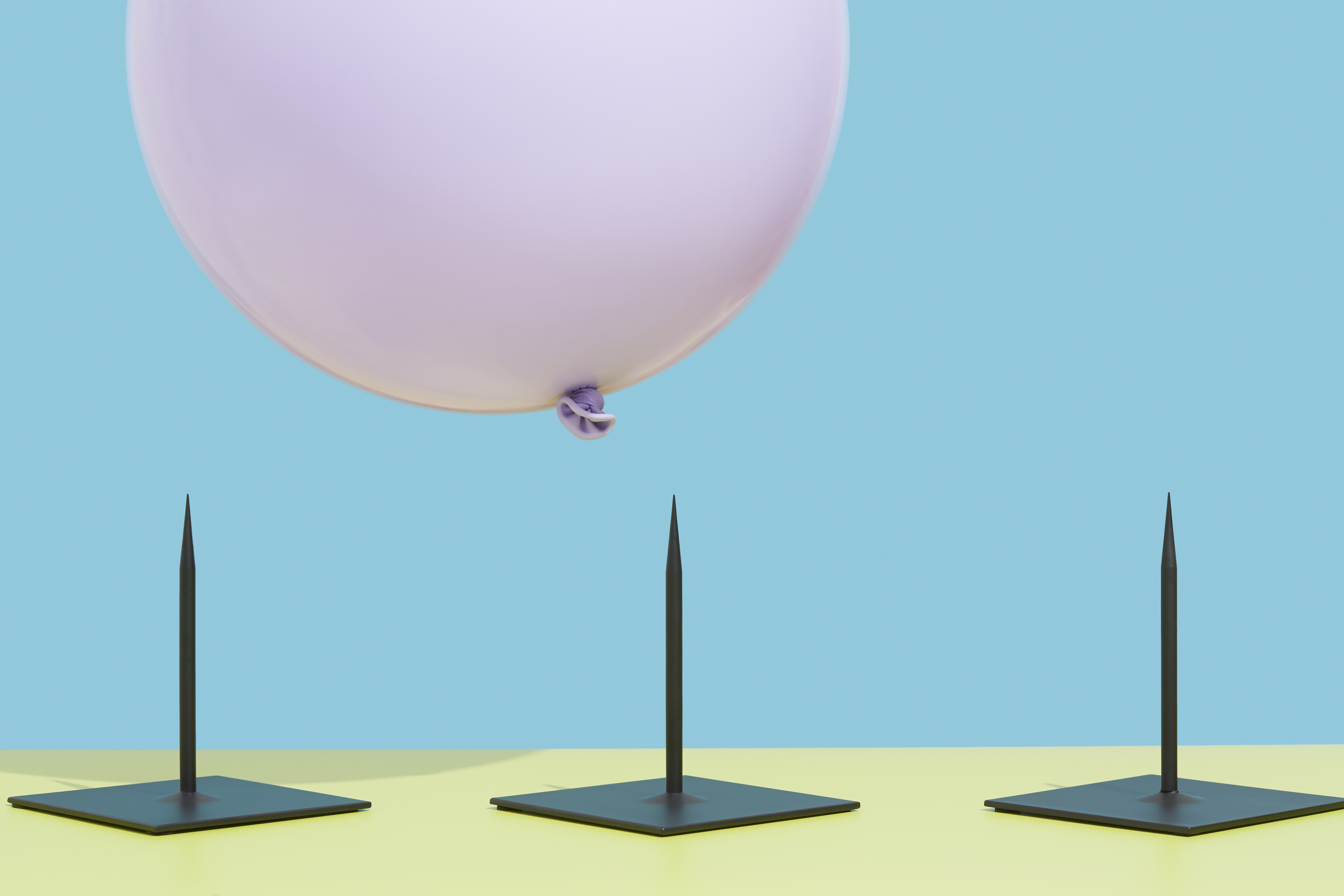

Down rounds are ‘the ticket to try again,’ says the founder, who raised 3 in a row.

Image Credits: Getty Images

Just as a rising tide lifts all boats, the ongoing drought is a humbling exercise for boat owners and kayakers.

According to Maps, “the number of downed rounds nearly quadrupled in Q1 2023 compared to the same period last year,” writes Rebecca Skutack.

As prices continue to decline, founders who receive rounds no longer have the shadow of failure, says Russ Wilcox, a partner at Pillar VC.

“When you put out a $700 million estimate, it looks like you’re somehow winning and you’re not breaking even, but the truth is, you’ve set the bar too high,” he said.

Four investors explain why AI ethics cannot be an afterthought

Image Credits: Bryce Durbin / TechCrunch

AI is inherently biased because it requires human input.

Given its potential to change the way we work and live, “it’s up to investors to ensure that some new technologies are built with ethics in mind,” writes Dominique-Madori Davies.

She interviewed four investors to get their thoughts on compassion, building fair systems, and “how to encourage founders to think more … to do the right thing.”

- Alexis Alston, Principal, Lightship Capital

- Justin Hornor, angel investor and serial founder

- Deep Nishar, Managing Director, General Catalyst

- Henri Pierre-Jacques, Co-Founder and Managing Partner, Harlem Capital

Pitch Deck Teardown: The Complete Pitch Deck

Image Credits: Suppliful/TechCrunch/Trulytell

During his last trip, Haje Jan Kamps revisited the seedbed he had covered last year at Supliful to see how it could be improved.

“Well, we didn’t get it 100% perfect,” he wrote. “There are still some issues, and in this post we’ll break them down to find out what can be improved and how we can do it.”

Slides 1-5 are facing the paywall.

- Cover

- Dragging

- Summary

- Problem

- What makes a great CPG brand

- Solution

- Product

- Case study

- Business model

- Market

- Predicting businesses

- Competitive

- Testimony

- group

- Ask

- Operating plan

- to close

Ask Sophie: If my passport expires in 5 months, will I be allowed to enter the US?

Image credits: Bryce Durbin / TechCrunch

Dear Sophie,

A few years ago I founded a startup in Zimbabwe. I plan to visit the United States for the first time next month to check out the market and apply for a visitor visa.

I’m thinking of staying in the US for a couple of months, but I just found out that my passport expires in September. I understand that I must have at least six months on my passport to travel to the United States.

Is that (still) true? Should I delay my trip?

– Hope in Harare

Have racial conventions come back to earth? It’s hard to say.

Image Credits: Getty Images

There is statistical data, and then there is empirical evidence.

According to Pitchbook and Map, median seed-level pre-money prices and contract sizes rose between Q4 2022 and Q1 2023, although it was “the slowest period for seed deals in 10 quarters,” reports Rebecca Scuttock.

At the same time, “many seed investors have seen TechCrunch+’s access to seed offers decrease and valuations soften.”

This week on fairness

Image Credits: TechCrunch

On Wednesday’s Equity Show, Natasha Mascarinhas interviewed Sam Chaudhary, founder of ClassDojo, and Chris Farmer, founder and CEO of SignalFire, which recently announced a $900 million round of funding.

Issues discussed include:

- What is the external benefit in startups?

- Why ClassDojo doesn’t see itself as an edtech company

- How Sam ended up pulling early with a difficult customer

New episodes drop every Monday, Wednesday, and Friday at 7:00 a.m. PT: Subscribe on Apple Podcasts, Overcast, or Spotify.

As power shifts back to the VCs, the down cycles are increasing.

Image Credits: Richard Drury (Opens in a new window) / Getty Images

My hot take on the rounds below: When considering the alternative, they are just as good.

Reasonable people can agree that startup valuations have been overvalued for years. I’m no economist, but this looks like a market correction rather than the start of a harsh winter.

Still, Alex Wilhelm reports that “Map accounted for nearly one-fifth of the venture capital investments it saw in the first quarter.”

“I see no reason why this trend can be reversed, let alone arrested suddenly,” he wrote.

[ad_2]

Source link