[ad_1]

Neon, a startup offering a serverless alternative to Postgres databases, announced that it has raised $30 million in a Series A-1 round led by GGV, alongside Khosla Ventures, General Catalyst, Founders Fund and angel investors. In an email interview with TechCrunch, CEO Nikita Shamgunov, who described the tract as “oversubscribed,” said he plans to grow Neon’s engineering team, launch its go-to-market team, and build developer relationships with new partnerships and mergers.

Postgres, also known as PostgreSQL, is an open source database management system launched in 1996 as a successor to a database called Ingres at UC Berkeley. Postgres has grown in popularity over the years, with more than half of developers reporting using Postgres in 2021 more than they did in 2020, according to a study by Timescale. Many developers prefer a fully managed platform. But according to Shamgunov, they often spoil, because they are in abundance Serverless PostgreSQL database platforms – platforms that abstract server management – lack key capabilities.

“I noticed how big Postgres is in the world, and my first thought for Neon was to build an open source alternative. [Amazon] Aurora and developers provide the best way to run Postgres in the cloud,” said Shamgunov. “When we started building it, we discovered how important serverless was, and now when we talk about Neon, we emphasize serverless Postgres.”

A former software engineer at Microsoft and Meta, Shamgunov founded SingleStore in 2021 before co-founding Neon at Khosla Ventures with Heikki Linakangas and Stas Kelvich. Kelvich studied physics before joining the troubled tech giant Yandex as a software engineer in the database team.

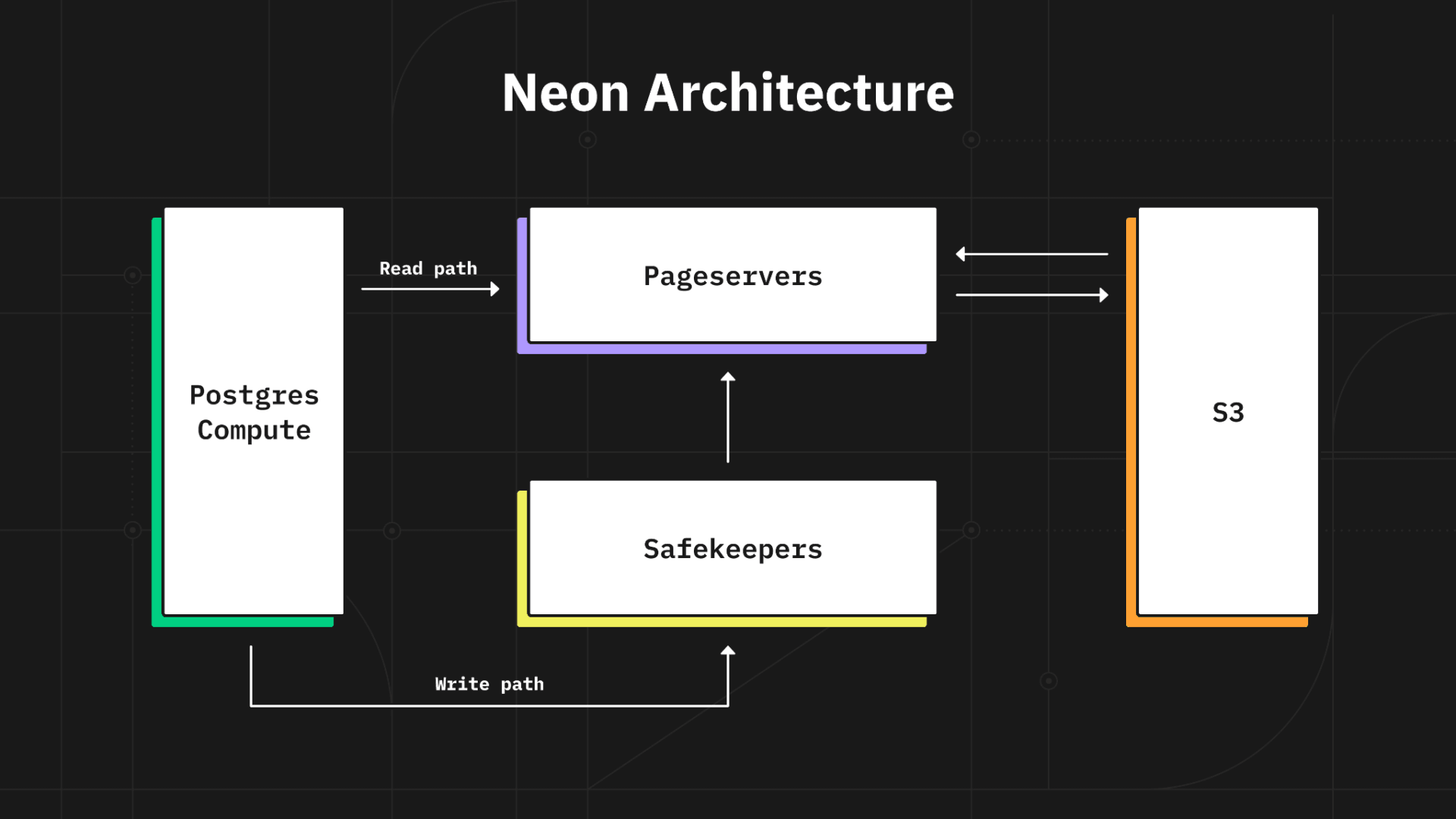

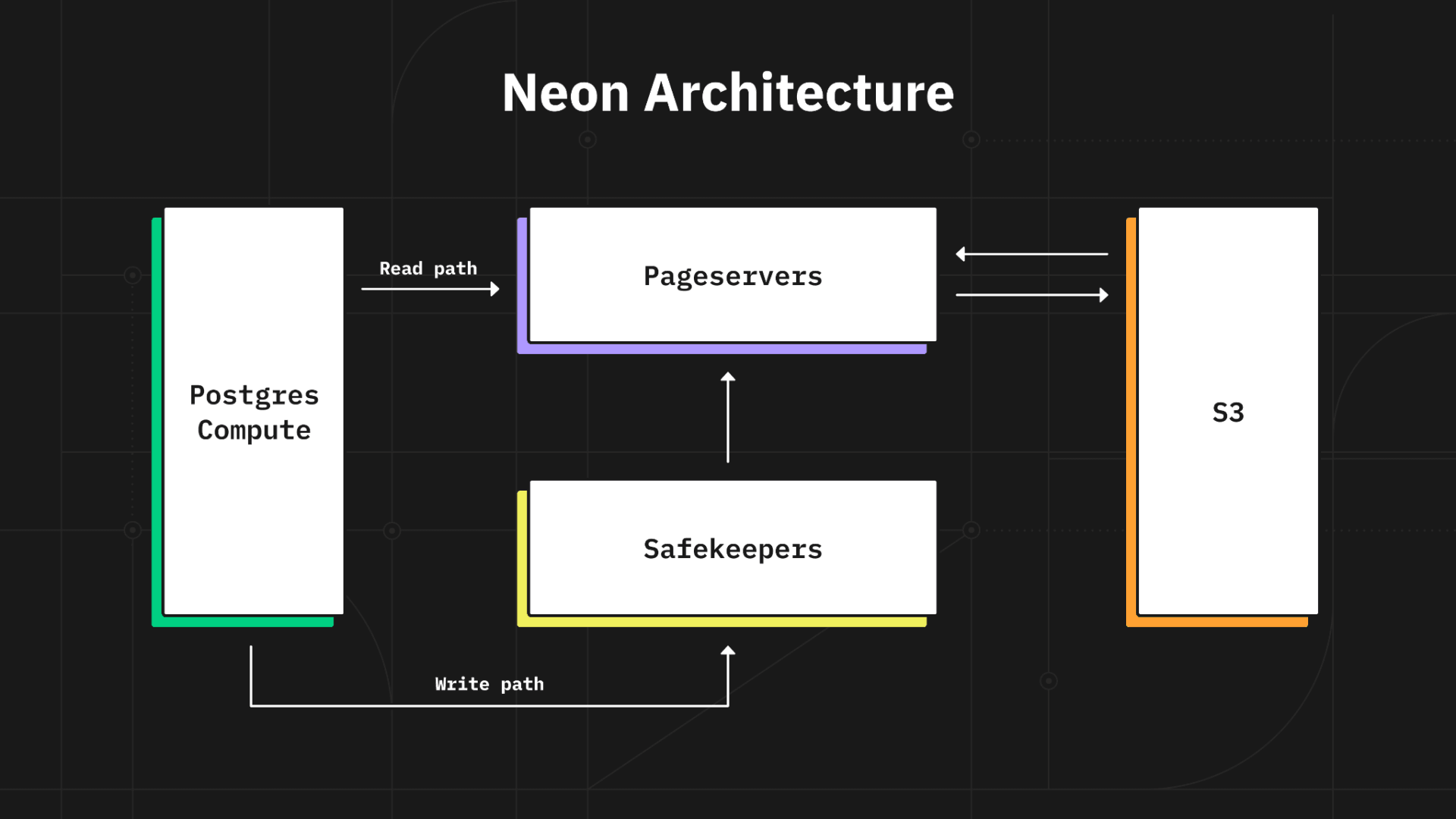

Neon offers cloud-based serverless PostgreSQL services on desktop and storage, including a free tier. Compute activates on incoming connections and shuts down when inactive, while on the storage side “cold” data (ie, less accessible data) can be offloaded to third-party services such as Amazon S3 for cost savings.

Image Credits: Neon

Neon implements Shamgunov’s “inverting” method to deliver checkpoint, branch, and “point-in-time” recovery. Using this, developers can create branches of databases for test environments whenever new code is deployed, he said.

“Most cloud database platforms charge based on availability. But you have about five hours a day of developers working on the codebase, and you only have about 22 working days in a month. Therefore, they use only 15% of the computing capabilities of the time that the database needs to work properly,” continued Shamgunov. “With Neon, the entire system is designed with costs in mind. It integrates cloud object storage to push cold data to the cheapest storage media and automatically scales to zero with inactivity.

Shamgunov sees Neon’s main competitors as database providers that are decentralized and compute-intensive but not open-source, such as Aurora and Google Cloud AlloyDB, and non-compute-storage-intensive (eg, SupaBase, PlanetScale, CochroDB, ZomboDB, Heroku Postgres, and Ugabyte). He argues that the latter are victims because it is technically challenging for them to implement features such as branching and recovery from historical points in time. Regarding the former, Shamgunov says some customers are wary of the vendor lock-in and dependency that can come with closed-source products.

The findings on the last point are mixed. In the year In 2020, according to 451 Research, only 10% of enterprises adopting infrastructure-as-a-service or platform-as-a-service public cloud products said they were “very concerned” about vendor lock-in. On the other hand, it’s true that companies have expressed a preference for differentiation when it comes to cloud – both for cost and robustness reasons. In the year A survey by Bain & Company, published in late 2020, found that a majority (65%) of CIOs in large organizations plan to use multiple cloud providers.

“Integrating functions like storage, backups and archiving into a single system would be difficult to do without Neon. Add to that open source and the cloud, and we’re seeing early adopters save costs,” Shamgunov said.[Neon’s] Multicloud and serverless storage, branching capabilities and ‘quick start’ services make it stand out.

Neon is pre-revenue, but Shamgunov says the startup’s service, which launched in beta on June 16, has 700 registered users and more than 5,000 in the waiting list. This year’s plan is to invest in building the free scale before shifting focus to monetization in 2023.

“When users pass the limit of the free tier, there is a natural way to monetize the platform… We stop burning to run for at least 28 to 30 months. Until now, we have been very frugal and run for several years,” Shamgunov said. it is. Every developer needs a database, and in many cases they’ve already made their choice – Postgres.

Neon currently has 30 employees and expects to be “in the 40s” by the end of the year, Shamgunov added. So far, the company has collected 55 million dollars.

[ad_2]

Source link