[ad_1]

If Pogo had his way, you’d be paid every time you strolled down San Francisco’s shopping street. Or check your email. Or open the app. The only catch is giving your personal data to consumer-oriented fintechs in return.

“We can almost create honey for the real world,” said Pogo’s founder and CEO. Dom WongHe is building the company with co-founders Oscar Melking and Shikhar Mohan. The startup wants to use a few technology trends to its advantage. First, as data privacy becomes more of a concern, users can choose to share their information with companies. Pogo’s argument is that if they share – why not benefit from it?

Second, Pogo is a play on the rise of e-commerce tools like Rakuten and Honey, browser extensions that earn you cash, coupons and discounts in return for your shopping history. And third, it’s using multiple APIs to plug in consumers’ location data wherever they are, from their inbox to their shopping history.

In exchange for cash, the data measurement startup raised $14.8 million in venture capital in a $12.3 million seed round led by Josh Buckley and a previously unannounced $2.5 million pre-seed round. Other investors in the startup include Slow Ventures, Village Global, Harry Stebbing’s 20VC, MrBeast’s Night Ventures, Hyper, Shrug and creators The Chainsmokers, Sofia Amoruso, Ryan Tedder and Lenny Rachitsky. Plus the startup has money from frontline founders, rent a runway and, well, honey.

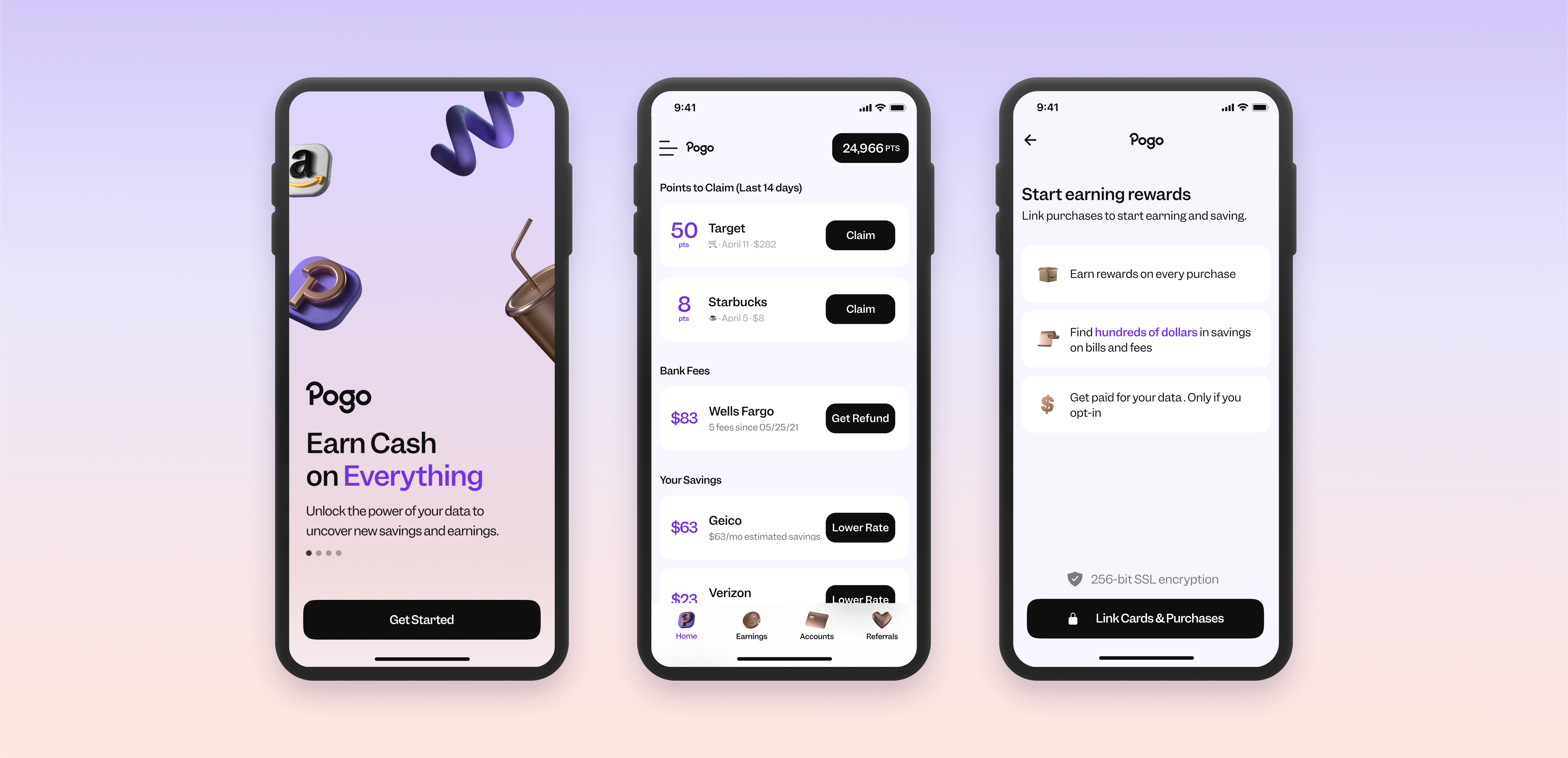

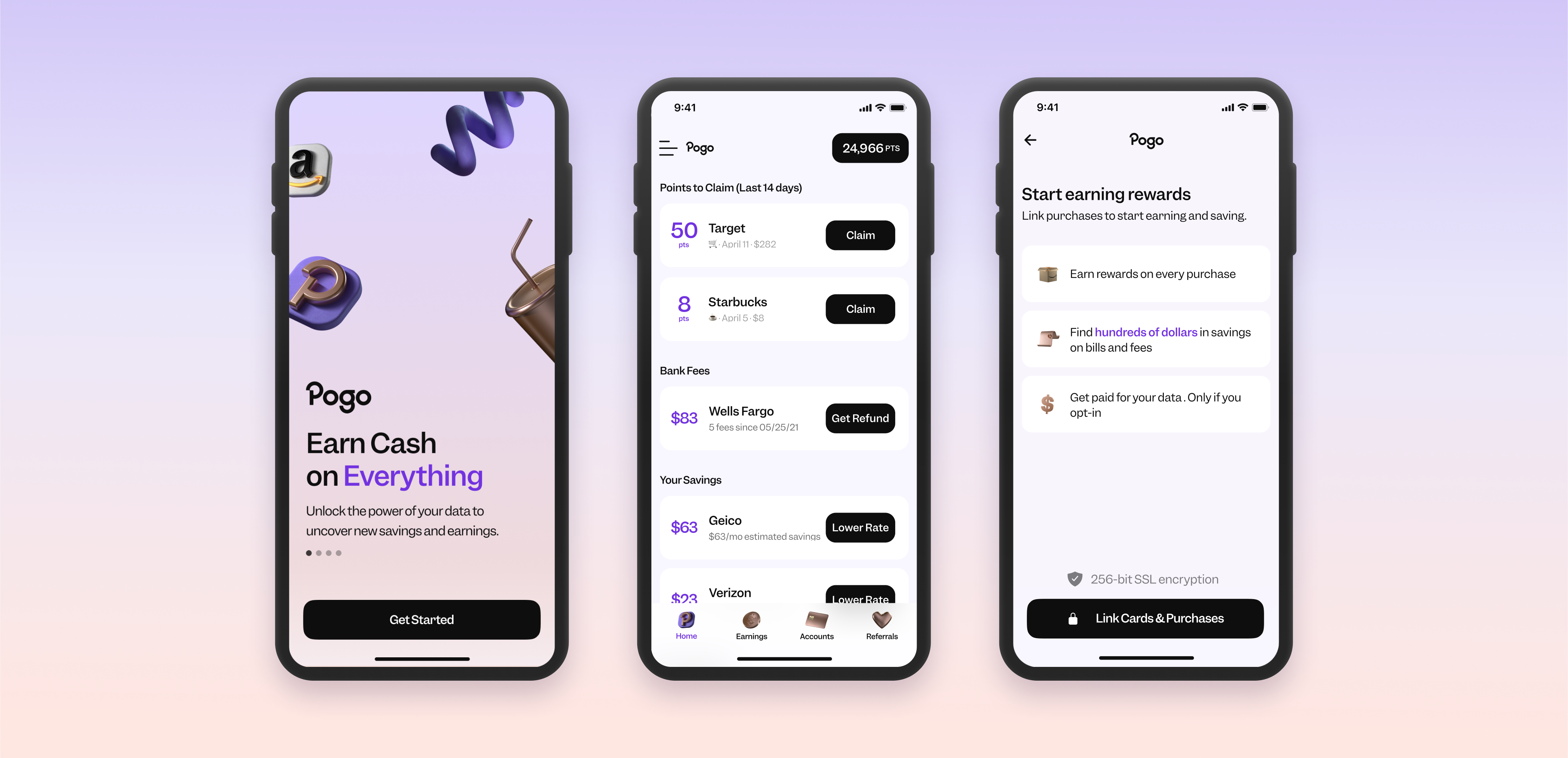

Here’s how it works: When the user joins the app, they’re invited to send their data to the company. Once Pogo connects to various data sources, it can start showing you rewards or recommendations for purchases to save you money.

Part of the app is to help opt-ins get paid for their data: “Pogo makes it easy to consolidate your data in one place, giving you the controls to pay for the use cases that suit you. Whether that’s anonymous market research or personal shopping from trusted brands. The other part of the app is similar to Honey, which acts as a financial agent that monitors your spending and makes suggestions, both for better deals or promotions that you might not otherwise be aware of.

This is not completely unheard of. Dosh, for example, is a venture-backed startup that makes deals with retailers, brands and payment providers and then gives money back to users after they buy a product linked to the connected providers. According to a report by TechCrunch, the startup was valued at $400 million in 2019. In addition, Nigeria’s ThankUCash, which received $5.3 million from PayPal to build its cashback infrastructure, launched a new credit card offering 3% cash back on all PayPal purchases.

Image Credits: Pogo

It makes sense to have activity here. As advertising dollars move away from Facebook and Google, retailers and brands are looking for ways to turn customers into potential customers. I think of it this way: while you’re browsing Twitter, you can shop for your new piece of exercise equipment or pick it up in the locker room at your local squat gym. The latter consumer gets it when it comes to fitness and style, while the former bets that someone might be in the mood for a new collection while checking out tech news.

Pogo doesn’t have exclusive partnerships with local businesses to get some sense of cashback in lieu of lead generation, the way some neobanks have failed. Instead, the startup brings all existing deals together in one place — and what Wong thinks is its biggest competitive advantage is the interoperability between different data sources.

Pogo’s real difference is the invisible layer it provides to users around the world that turns notifications into money. Most Pogo users connect location data to earn rewards while in the real world. “You’re walking into Wendy’s and if you shopped on the app, you get a notification for a free breakfast sandwich. All you have to do is look at it, and then it’s paid for and we’ll pay.”

Currently, the company is mostly paid through affiliate fees and data exchange:

- Opt-in for the suggested insurance plan.

- Click on Location Based Discount.

- Answers market research or campaign measurement questions.

- Scan your Pogo card for a discount when you purchase a prescription.

In the next iteration, Wong says, Pogo will encourage users to switch to fee-free banking options, and Pogo will be able to make money through affiliate fees.

“We’re also thinking about how we can help you take advantage of the offers that are available at the palm of your hand today without formal partnerships. That could mean delivering publicly available content or future personalized promotions to your inbox in a private and secure way,” he wrote in an email. Imagine a 40% off storewide coupon sitting unopened in your inbox when you walk in.”

Although Pogo considers itself an incentive to align with customers, in order to make money, it must prove personal data as a commodity to other companies. Pogo has an intimate window into someone’s life, from where they live to their favorite coffee shop to how many subscriptions they have. It’s similar to what a bank might see, but a venture-backed startup wants you to believe.

The Electronic Frontier Foundation, a nonprofit that has protected civil liberties in the digital world since 1990, describes the idea of exchanging data for money as “data sharing.” In an essay, the organization urges consumers to rethink whether getting paid for their data really redresses the imbalance between consumers and corporations. EFF asks a series of questions, such as what determines the value of certain data and what makes your data valuable to companies. Also, what does the average person gain from data sharing and what do they lose for that extra money?

“EFF strongly opposes data sharing and policies that lead people to think of the financial value of their data as a fundamental right rather than a basic right,” the organization wrote in a post. “You don’t value your freedom of speech. We should not keep one in privacy.”

In an email, Wong said there are existing market rates for shared data fees, but the startup is working on a pricing strategy based on “a lot of greenfield territory, which is not possible today.”

“For example, being able to serve location-based offers or ads that take into account your past purchases allows us to command more orders than your typical ad placement,” he continued. “Another example is the ability for brands to get real-time consumer feedback based on verified purchases. The ability to do this today is incredibly slow, and it’s not unusual for brands to pay hundreds of dollars per response at the rates set by multibillion-dollar-a-year behemoths.”

Wong isn’t worried about losing user trust just yet. So far, the app has been used by “hundreds of thousands of families” and the startup says it’s generated millions of dollars in savings and revenue.

[ad_2]

Source link