[ad_1]

When he called a young law student Leo Melamed arrived at 110 North Franklin, Chicago, for a job interview in what he believed was a law firm in 1952, the chaotic scene he witnessed made him explode.

Merrill Lynch, Pierce, Fenner, and Beane were actually a brokerage, and the job was for a “broker” to send messages around the Chicago Mercantile Exchange’s trading pit where financial contracts were contracted mostly from onions to a ous.

The whirlwind of people in colorful jackets screaming and stitching, marking deals on huge blackboards and recording end-of-day results with Polaroid cameras hooked young people Melamed. After graduating from law school and quickly aborting a period as a lawyer, he returned to “The Merc” and took over the presidency in 1969.

“We were a bunch of guys who didn’t know the difference between turkey or Treasury bills, or Swiss francs and cattle,” he said. “I instantly fell in love with everyone and everything.”

Covid-19 has killed some of the last bastions of “open cry”Negotiation. Traders who prefer to negotiate face-to-face deals got a rare victory this week when the London Metal Exchange reversed an earlier plan to close permanently. “the ring”: The last important commercial well in Europe.

But last month Melamed’s alma mater, now called CME Group, announced it would permanently close commercial plants which were first closed by the pandemic a year ago, with the sole exception of the Eurodollar options well. For many in the Chicago business community, it marked the end of an era.

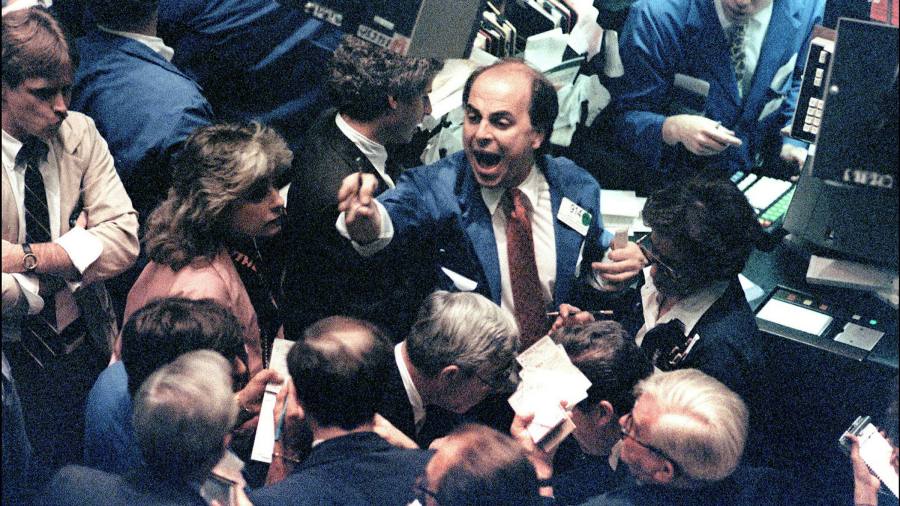

He trade pits where Melamed and many other finance titans learned their trade and were immortalized in popular culture by the film The places of trade – had been slowly dying even before the pandemic. Over the last few decades, trade has been overwhelmingly transformed in the world of algorithms. Today, even the New York Stock Exchange is largely a television studio, with most of the trading done in the New Jersey data center.

Others have survived, including the NYSE’s Ark options floor in San Francisco and the Chicago Box Options Exchange. Leading the trend, CBOE Global Markets, where the Vix volatility index is listed, is building a new, larger trading platform to accommodate hundreds of traders and will be installed there in 2022.

By keeping the ring open, the LME it tries to appease both the traditional members, who preferred the open outcry, and the larger trader and financial participants, who supported the move towards e-commerce.

Wall Street traders in 1929 when the New York Stock Exchange crashed causing a run in banks © AFP / Getty

Traders work at NYSE’s quietest trading floor in 2021 as US stocks rose to record highs © Courtney Crow / NYSE / AP

Matthew Chamberlain, chief executive of the LME, said he hoped a hybrid approach would extend its longevity. “I love the ring, I think all members of the LME love the ring: it’s a big part of the culture, an important part for which many of us joined the organization. We love the ring. From a personal point of view, I hope it will be here in 10-20 years’ time. “

Waylaid Ni, head of euro-dollar options at DRW, a large Chicago-based trading company, said having someone in the CME euro-dollar options well was still valuable and predicted his floor to clamor open that would survive will remain open for many years.

“Many of the strategies marketed in this product are complicated,” he said. “It’s much more effective to run this kind of complex negotiation when all parties talk to each other in real time and don’t see flashes on the screen.”

The pandemic offered live proof of what would happen if trade-dependent markets were solidly closed. The results were not encouraging for open shouting, argues Thomas Fitch, founder and CEO of RV Assets, a British company that provides trading algorithms for market makers and proprietary traders.

Although the euro-dollar options market went from 60% on the chest traded entirely electronically overnight, volumes and the difference in prices that people will buy or sell was not fully affected. , according to Fitch.

But since the pit was reopened and hybrid trade resumed, the difference has widened by about 0.15 cents per contract. In a market that trades 1.5 million contracts a day, that means $ 1.35 million in additional costs for the end user, Fitch said. “Why has it gone backwards? It adapts to people running operations, brokers and market makers. “

View of the Tokyo Stock Exchange in 1937 © James A Mills / AP

Tokyo Stock Exchange traders scatter confetti at a closing ceremony that marked the end of the flat trading in 1998 © Alamy / Reuters

Many veterans are increasingly resigned to the fact that open-pit graves will soon die. “The open-ended trade took much longer to die [than people expected], and it’s not completely dead yet, but it will be dried up as e-commerce takes up more and more of the volume, ”said John Lothian, who began work before writing a widely read industry newsletter.

After the death of an old friend who traded in pits in 2011, he began an oral history project to collect the memories of veterans of the open clam era, vaguely modeled on the Veterans History Project of the Library of Congress. “Every day we lose so many open outcry traders and I thought it was important to capture the functioning of the markets for so long during our history,” Lothian said. “It was face-to-face trading, where you could bid for millions of dollars with just a manual signal exchange.”

The change has been emotionally charged for many merchants who remain tied to the era, and the camaraderie and creativity it generated. Melamed recalls how some CME runners took him as “Darth Vader” for accepting e-commerce, but admits his “sadness” at seeing the final closure of most of his open protest sites. “The floor was a crucible of ideas,” he said. “That’s what you lose.”

But they have been losing a battle that began in the early 1980s when pioneers like Thomas Peterffy it connected its data feeds to basic computer programs that performed the same functions that traders performed: analyzing the market for quotes at an incorrect price. At that time, humans were still performing trades.

Peterffy still remembers his first day in a trading pit, the silver options floor of the New York Comex in 1967 (the commodity exchange where climax of The places of trade later filmed), which left an indelible imprint. “It was serious money and very exciting,” Peterffy said. “The numbers on the computer can also be exciting, but not as much as the people who call.”

Eventually, he saved enough money to buy a seat on the American Stock Exchange in 1977, the wacky little brother of the NYSE that initially began as an open-air market on Broad Street in lower Manhattan. But being slightly constructive and with a strong Hungarian accent, other flat traders struggled to hear and understand Peterffy in the vortex of Amex’s flat, which showed the momentum of his efforts to bring the trade to it was computer science.

Like many other veterans of the era of open cries, Peterffy is nostalgic, but tempers him with realism. “It was a fantastic experience, but things are changing. It was also exciting to drive a horse and a carriage. ”

The slow decline in bargaining

Oil traders work on the floor of the New York Mercantile Exchange on May 11, 2012 in New York City © Justin Sullivan / Getty

1998

The “battle of the Bund” caused the German stock exchange Eurex to seize the country’s long-term debt futures market with London rival Liffe. Contracts had been negotiated for “open outcry” in the UK, but traders preferred the electronic version because it could be changed more easily and remotely.

2001

Intercontinental Exchange, then a small start-up, made waves buying the International Petroleum Exchange (IPE) in London, where most of the volume was traded on land. Taking the lead in the battle of the Bund, ICE built a modern electronic platform.

2005

ICE announced the closure of IPE pits, converting energy futures contracts such as Brent crude into fully electronic form. Weeks later, IPE’s then-biggest rival, the New York Mercantile Exchange (Nymex), unveiled plans for an open pit in London.

2006

Nymex abandoned its plan to reintroduce land trade into oil contracts after sparking little interest from traders.

2012

The Intercontinental Exchange puts an end to 142 years of history closing the soft commodity trade pits in New York as volumes declined, in favor of e-commerce.

2015

After 167 years, CME closed most of its commercial areas in Chicago and New York. Open-ended trading had fallen to 1% of total futures volume. The decision included Nymex’s future open-ended screams, which CME had bought in a $ 8.9 billion deal seven years earlier. Only the breasts connected to some options remained open.

2020

The coronavirus forced CME and Cboe Global Markets to close their commercial plants in Chicago, but reopened many during the summer. Among the precautions, traders had to undergo sanitary checks and carry facial shields in the pit.

2021

The London Metal Exchange reversed an earlier proposal to permanently close its open-ended shouting ring after trading was temporarily halted by the pandemic.

[ad_2]

Source link