[ad_1]

Shares of major U.S. technology companies have rallied sharply in recent weeks as investors hope the sector can weather a global recession.

Tech industry titans Apple, Microsoft, Alphabet, Amazon and Tesla have added a combined $1.3tn to their combined market value since the start of July, gains that have helped the Nasdaq Composite gain 14.8% since the start of July.

But as the Federal Reserve maintains its aggressive monetary policy stance to curb inflation, some tech analysts warn that the summer tech rally could be short-lived.

A temporary monthly rebound of 10 percent or more was a “common sight” during the Nasdaq’s 2000-03 bear market, said Andrew Lapthorne, quantitative strategist at Societe Generale.

Instead, investors should prepare for higher returns this year and next, he said.

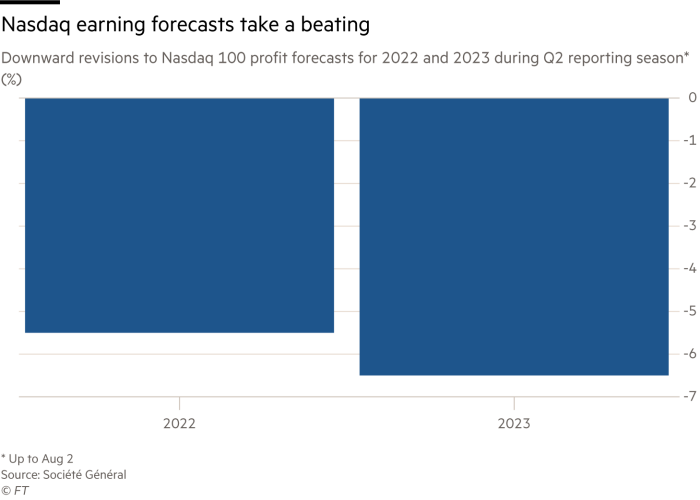

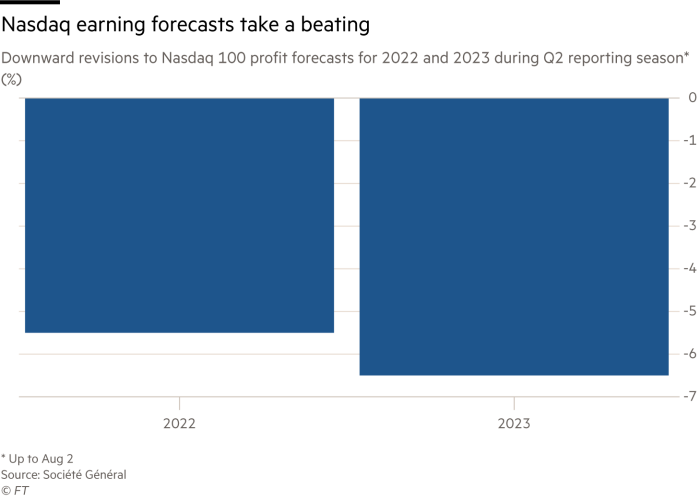

“Earnings reports for the second quarter so far have led to significant revisions to earnings forecasts for the Nasdaq 100, including a 5.5 percent decline in 2022 estimates and a 6.5 percent forecast for 2023, which will wipe out billions in revenue for U.S. tech companies,” Lapthorne added.

But John Guinness, co-manager of the £776m Fidelity International Americas fund, said a sell-off in tech stocks in the first half showed many investors were already reducing their positions in anticipation of a sharp decline in earnings in the sector.

“The narrative has changed,” he said. Investors now expect inflation to fall and are now worried about the threat of a recession, so economic issues such as consumer discretionary stocks have underperformed.

Fidelity expects global spending on technology to remain healthy this year, even if companies delay or cancel some projects.

“There were good reasons for the excitement in the sector before the sale,” Guinness said. “A fifth of all new cars manufactured in Europe now have electric computers on wheels. Cloud computing is a real substance development embraced by many companies. Tectonic shifts in driving technology adoption remain.”

Retail investors have also become more bullish on the sector since mid-July, according to Morgan Stanley, which analyzes publicly available trading data on constituents of the Russell 3000 index.

“Retail investor participation tends to be higher in sectors like tech and communications services where there are companies they know and love,” said Boris Lerner, a quantitative strategist at Morgan Stanley in New York.

But a closely-watched sentiment barometer for exchange-traded funds shows broader investors’ appetite for more exposure has been subdued.

The $173.7bn Invesco ETF, known as QQQ, which tracks the Nasdaq 100 index, has collected net inflows of $99mn since early July. But ETFs tracking the broader S&P information technology sector posted net outflows of $112mn last month, according to State Street, while the Cathy Wood Arch Innovation ETF saw net outflows of $385mn.

But some analysts see the long-term case for buying tech stocks as strong, despite near-term hurdles.

London-based Polar Capital warns that profit margins could come under pressure due to inflation, rising wage costs, supply chain challenges and the strength of the US dollar. However, it expects IT spending to increase between 2 and 4 percent globally this year.

Ben Rogoff, head of Polar Capital’s technology group, said some of the recent gains were likely driven by “bottom fishing and short covering” characteristic of temporary bear market rallies. But the risk-reward balance for investors has now improved significantly. Technology spending is absolutely essential for companies worldwide, he said.

There was further speculation last week when US private equity manager Thomas Bravo agreed to pay $2.8bn in cash to buy cyber security specialist Ping Identity for 63% of the value.

“Private equity managers can be more buying, and it’s surprising that we don’t see more strategic buyers. [mature technology companies] Entering into negotiations,” Rogoff said.

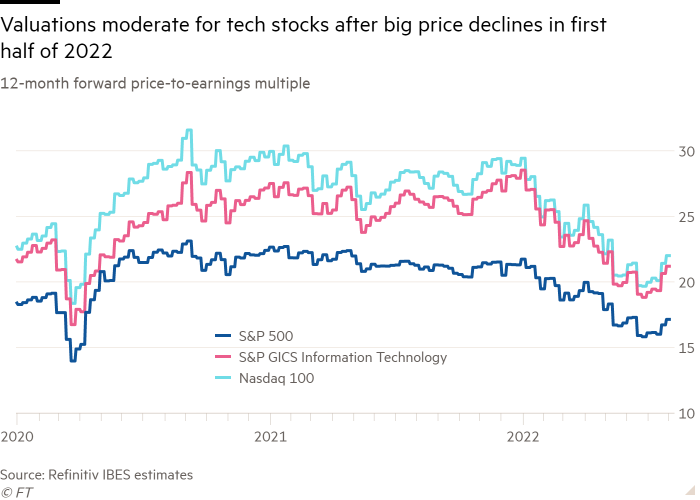

Moreover, the first half’s decline only strengthened the tech sector’s attractiveness, say optimists. The S&P’s technology sector was trading at 28 times forward earnings in early January but fell to 19.2 by the end of June, according to Refinitiv estimates. Even at its most recent earnings, it is trading at just 21.2 times earnings.

Jonathan Curtis, co-manager of Franklin Templeton’s $7.4 billion technology fund, said the technology sector was still trading at a premium to the US equity market, but that was underpinned by better fundamentals.

“The technology sector’s current valuation premium is not excessive,” he said. “Over the past 12 years, it reflects the sector’s increasing profit margins, increasing recurring revenue levels and strong global growth trends.”

[ad_2]

Source link