[ad_1]

FreedomWorks Chief Economist Steve Moore on Declining Inflation Raises Dollar Value and Future Economic Risks on ‘Kudlow’

Skyrocketing housing costs are likely to continue to push up inflation this year, exacerbating a political crisis for President Biden and creating new challenges for the Federal Reserve as it tries to cool prices without tipping the economy into recession.

The Labor Department reported last week that the consumer price index, a broad measure of prices for everyday items including gasoline, groceries and rent, rose 9.1% in June from a year earlier, a faster-than-expected acceleration. It makes a sign Very fast inflation From December 1981

In a more alarming development, accommodation costs – which account for a third of the CPI – rose again at a pace of 0.6 per cent in June, matching an 18-year high set in May. Annual housing costs rose 5.6%, the fastest since February 1991. Rental costs rose in June, jumping 0.8% on the month, the biggest monthly increase since April 1986.

Rising rents will see growth because higher housing costs have a direct and significant impact on household budgets. Another data point, which measures how much homeowners would pay in affordable rent if they didn’t buy their home, rose 0.7 percent in June from the previous month.

Housing begins in June and reaches its lowest level in 9 months

Homes in the Harris Ranch community in Boise, Idaho, US, Friday, July 1, 2022. The housing market slowdown is taking a toll on the industry and mortgage lenders are predicting a downturn in business. (Jeremy Erickson/Bloomberg via Getty Images/Getty Images)

The housing market exploded in the early days of the Covid-19 pandemic, buoyed by low interest rates at the same time American homebuyers — flush with cash and eager for more space — began flocking to the suburbs. According to data from the S&P CoreLogic Case-Shiller National Home Price Index, home prices rose 20% in April from a year earlier. In comparison, pre-pandemic levels hovered around 4%.

Economists at the Federal Reserve Bank of San Francisco forecast that peak housing costs could increase by as much as 1.1 percentage points in 2022 and 2023.

Experts say housing costs may continue to rise in the coming months, largely because the Labor Department’s way of recording rental data is outdated. Mark Fleming, chief economist at First American, told FOX Business that the 5.6% annual increase in occupancy recorded in the June data reading may have reflected inflation from six to 12 months ago because leases are typically annualized.

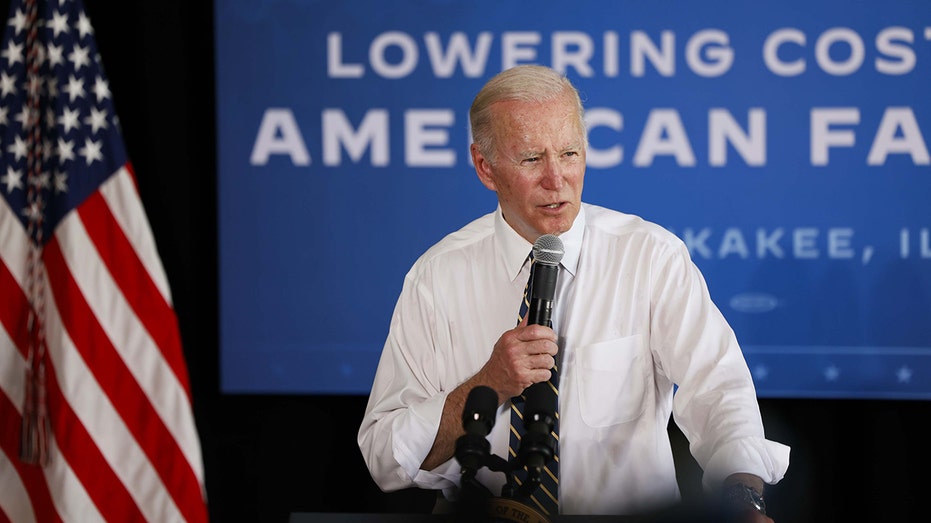

U.S. President Joe Biden speaks as he visits a family farm in Kankakee, Illinois, U.S., Wednesday, May 11, 2022. (Photographer: Taylor Glasscock/Bloomberg via Getty Images/Getty Images)

“And as you know, rents have gone up dramatically, home prices have gone up dramatically,” Fleming said. Eventually it will change because the actions of the Federation are cold things. But that will take some time to show.”

Rising housing costs could create more headaches for the Biden administration because, unlike food and gas costs — which are largely driven by unexpected but temporary events like Russia’s war in Ukraine — housing is the cause. Inflation is a severe shortage of supply.

Mortgage giant Freddie Mac estimates the country is short about 3.8 million homes. The crisis has worsened over the years: A recent analysis by the nonprofit advocacy group Housing for Growth found that the deficit doubled from 2012 to 2019. During that time, the crisis worsened in 47 states.

While the Federal Reserve is trying to tame consumer demand by raising interest rates at the fastest rate in three decades, there is little the U.S. central bank can do to increase the housing supply.

“[Fed policymakers] “That’s what makes the challenge so difficult, because you know exactly the impact of your actions,” Fleming said. Today there is a danger of overdoing it for a while.”

A sell signal Tuesday, Oct. 6, 2020, in Westwood, U.S. Long-term mortgage rates were little changed this week, after a near-year decline in recent weeks, a sell signal stalled amid economic worries. Economic collapse in T (AP Photo/Steven Sene) / AP Newsroom)

The White House is also limited in its options for addressing the problem, because building new homes is largely a local issue. There’s a push from communities fighting development — a movement dubbed “NIMBY” or “Not In My Backyard” — as well as the general issue of finding and building places Americans are willing to buy.

Get FOX BUSINESS on the go by clicking here

“We need to have a broader, deeper national conversation around local zoning ordinances and the ‘not in my backyard’ movement,” RSM Chief Economist Joe Brusuelas told FOX Business. “We simply need to build many more affordable homes.

[ad_2]

Source link