[ad_1]

This Indian Fintech and Moral Credit product is for women only.

Among the underprivileged and banking people, the number of women taking out loans is very low. Unfortunately, women in India are not very active in the formal credit system and have found comfort in the brutal hands of an unorganized credit economy. It is well known that unorganized methods of borrowing are expensive and costly.

According to a study by Individu Technologies, the number of MSMEs led by women in India has increased from 2.15 lakh to 1.23 crore in ten years. However, they face a $ 158 billion financial gap and are largely dependent on informal sources.

Read more

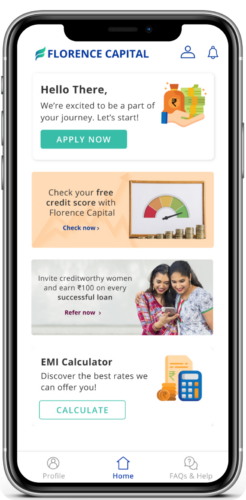

Florence Capital is an Indian Fintech and ethical loan product designed exclusively for women. Fintech shows the future of all Indian women financially independent, empowered and ready to accept the world in their terms.

Tech Panda In India, the debt gap between men and women is a sign of serious illness, said Pashak Agrawal, CEO and founder of Florence Capital.

Pashak left

Women are typically excluded from financial decisions. Our goal is to encourage financial knowledge and independence with the right frameworks and information.

“Female borrowers are growing faster than male borrowers,” he says.

According to CIBIL dataThe number of female borrowers will increase by 19% CAGR in five years, and by 14% for men. Florence Capital wants to overcome the inefficiency of the traditional banking system. Only 27% of India are financially educated, of which 20% are for women and 30% for men.

”The big vision is to make credit accessible to the lower classes in India. These units are often ‘new-for credit’ (NCC) or have a much lower credit history and are therefore considered ‘risky’. Innovation in technology not only reduces these risks but also provides appropriate products for these sectors, ”he added.

“Traditional banking systems are not efficient enough to meet these fast-growing segments because credit assessment procedures are outdated or conservative, the process is difficult, there are too many payments and too long repayments,” he explains. More.

What do they do

Florence Capital’s vision is simple – it frees Indian women financially. The app-based Fintech Tech offers Indian women access to loans at low interest rates (up to 1.5 percent lower) and promises greater transparency.

Fintech makes sure that women in India have the resources needed to achieve their entrepreneurial dreams. To add to this, their collection agents are all women. They are working on such a women-centered initiative to improve women’s access to capital. The company is working hard to reduce the loan confirmation period.

The Fintech application aims to work on the vision of building a fair and equitable credit system for women who are in need of loans.

Women experience a significant decline compared to their male counterparts. Although they may be able to get a loan, they often end up being harassed by corrupt practices. This leaves a huge gap in access to fair and transparent loans.

Florence Capital has focused on awareness and accountability for access to credit and financial decisions, so that women do not get into trouble after taking out loans. Agrawal emphasized that there is a problem with women’s ethics and access to transparent loans; Only 25 of the 100 loans go to women. There is also discrimination.

“Women face a huge decline compared to their male counterparts. Although they can get a loan, they often fall victim to corrupt practices. This leaves a huge gap in getting a fair and transparent loan. This gap is an opportunity, but it is also used in the market. There is a need for moral credit. ” He explains.

Features

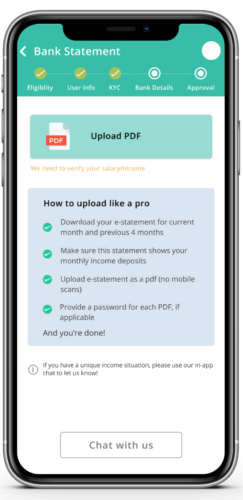

Female users can use the 100% digital process loan on the Florence Capital mobile app.

“The process is very simple and can be done easily from the comfort of your own home. Our loans are machine-driven and we will show the user credit experience,” he said.

Reasons for our creative credit writing system on women’s specific pain points

After registering, the user must upload her photo, PAN card and other important details. After the loan is approved, she will be asked to choose a method of repayment to the AMEs, and the loan amount will be paid into the specified bank account. It does not take more than 10 minutes to complete a loan application.

“Our Customer Satisfaction and Loyalty team is always ready to help, and you can find it even when the user feels stuck to a certain point in the process. “

The following features are:

- Fast personal loans up to INR 5 lakhs

- Ethical loan

- Fast money transfer to bank accounts

- Flexible payment options range from 90 to 730 days

- There are no prepaid fees

- Women’s Collection Agents

- All women customer service team

- There is no harassment or humiliation.

- Low operating fee

- 50% loan is fast.

- There are no hidden fees and deposit fees

Society and Influence

Fintech’s First Class Women’s Credit Collection Team and Customer Service Team rely on the lender’s convenience (as female borrowers only interact with other women) and clear, fair and transparent lending terms. They also provide credit awareness or counseling programs to help borrowers understand the impact of non-repayment on their credit score.

Our community is about bringing our debtors and women together. It is a safe place for Indian women who want to live a productive, dignified and prosperous life with the necessary financial resources provided by us.

”Our community is about bringing our debtors and women together. It is a safe place for Indian women who want to live a productive, dignified and prosperous life with the necessary resources we have provided, ”he said.

Their main functions include:

Learn Florence

Their small educational content, disrupts financial concepts, makes it easier to understand finances, and equips women to apply these concepts to overcome their daily challenges and achieve their goals.

Free Value-Added Services (VAS)

Borrowers also offer free VAS negotiation. They are currently offering one-on-one professional advice to borrowers, professional development workshops and webinars for soft skills and business practices.

“Women are traditionally excluded from financial decisions. Our goal is to encourage financial knowledge and freedom with the right frameworks and information. We are building a women’s community of opportunities to learn together and open up to each other.”

Home

Florence Capital was founded in 2021 by Agrawal and Rachel Subramania. Agrawal, a graduate of Princeton University in Economics and Finance, founded Athena Education, the first company in India to become well-known. During his time at Princeton, he worked for Fortress Investment Group as one of the two summer analysts.

He remembers early in life that he realized that education was not only good for himself but also for opening up bigger and better opportunities and making a difference.

“Entrepreneurship is a way for endless creativity to solve the problem one wants to solve,” he says.

If we start designing things for women, they will appreciate it and it will help them to use their amazing potential

He accepted Princeton’s motto, “In the service of the nation and the service of all nations.”

He adds: “This is something to do, to increase my enthusiasm for solving problems, to make the world a better place.

When he begins to realize that society and things are mostly designed by men and men, he remembers that the time has come.

“Women are traditionally backward. They are either confined to the home or in a world dominated by men. If we start designing things for women, they will appreciate it and it will help them use their amazing potential.

He remembers one example when he saw a women’s section of the metro.

“The importance of the women’s section is raised because women in India do not have a safe place. This is a big problem and extends beyond the limits of travel – in almost every aspect of women’s lives, including finances. Women are reluctant to take out loans and often feel excluded from the overall financial process.

“There are a lot of strong and hardworking women in India who are struggling every day to improve their quality of life but they do not have the financial means and resources to pursue their dreams and lead the life they want. to live. That’s what Florence Capital gave birth to – a moral loan app, designed just to serve women. Give women ways to provide a safe haven where they are always denied and to give them a better life beyond debt. ”

History of development

Florence capital in the country is growing. It is currently actively repaying loans to Level 1 cities such as Mumbai, Bengalru, NCR, Ahmedabad, Pune, Chennai, etc. and some Level 2 cities such as Mysore and Coimbatore. According to the pilot, he lent loans in Jaipur, Ajmer, Bohopal, Udaypur and Indor.

“Over time, we plan to expand our operations to Level 2 and Level 3 cities,” he said.

Fintech has lent 1,500 loans between January 2021 and February 2022. The default rate is about 2%, with more than half of their loans coming from the mouth. Their credit history shows between 50-50 new credit / thin credit profile and thick credit profile. About 15% of borrowers are first-time borrowers. Traditionally, women borrow money for medical expenses, family expenses, education, and higher education.

Read more

According to their future plans, women in India plan to provide ethical and transparent loans to build the largest women’s community in India.

“Every woman is financially supported. As such, we want to increase the amount of Florence Learning and Free VAS for our borrowers.

Post views

1,704

[ad_2]

Source link