[ad_1]

European stocks fell on Wednesday as investors were cautious over U.S. employment data that could put pressure on the Federal Reserve to regain its pandemic-era monetary stimulus.

The Stoxx Europe 600 fell 0.4%, although it remained on track to gain a gain of approximately 1.5% in June. Futures markets indicated that the Wall Street S&P 500 and technology-focused Nasdaq Composite indices would be pegged to New York’s opening bell.

The European equity gauge has not had a month low since January and has traded around record highs throughout June, along with Wall Street stock markets. But analysts said the Fed’s upcoming moves could be more significant than upcoming quarterly earnings reports.

Analysts have improved their 2021 earnings per share forecast for global companies by 15% since January, according to a Citi survey. Those following US and European companies that have economic cycle-related fortunes, such as industrial groups and materials producers, have increased their earnings forecasts further, Citi found.

But the prices of corporate equity and debt instruments had already been so high by this optimism that “everywhere you look there is nothing left in terms of value,” said Tatjana Greil Castro, co-director of public procurement at Muzinich & Co.

“So now it’s all about the Fed and the amount of liquidity that will continue to pump into the markets,” he added.

The Fed has bought $ 120 billion a month in bonds since last March under a monetary stimulus program that raised government debt prices and lowered interest rates. This has made the shares relatively more attractive and small real interest rates, allowing companies to borrow money cheaper.

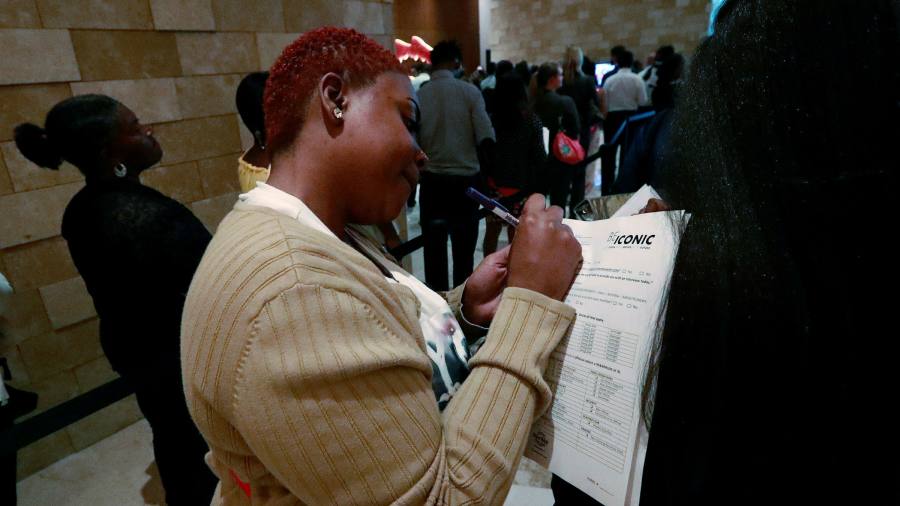

Friday’s non-farm payroll report is expected to show that the country’s employers added about 700,000 jobs in June, up from 559,000 the previous month.

The US central bank has pledged, in general, to keep monetary policy accommodative until the labor market recovers from last year’s economic shocks, although some of its political leaders have indicated that they believe ‘is approaching.

On Tuesday, Fed Governor Christopher Waller told Bloomberg TV that “we are now at a different stage in economic policy, so it’s a good idea to start thinking about removing some of the stimulus.”

On Wednesday, caution was also introduced in the markets over the intensification of the spread of the Covid-19 Delta variant in Europe. The Spanish Ibex 35 index fell 0.8%, as investors limited their exposure to tourism-dependent companies in the nation, while the Italian FTSE MIB lost 0.7%.

The dollar index, which measures the greenback against major currencies, has remained around the high since early April. The euro, which has lost more than 2% against the dollar this month, fell 0.1% to $ 1,188.

The prices of other paradise assets were also confirmed. U.S. Treasury bond yields at the 10-year benchmark fell 0.02 percentage points, to 1.459 percent. The profitability of the Bund equivalent in Germany fell 0.02 percentage points to minus 0.190%.

Barclays European equity strategists wrote in a research note that while the Delta variant was “a concern,” the “main risk of the queue” for stock investors was that bond yields would rise if the bonds solid employment data raised expectations of Fed rate hikes.

“The risk is. . . investors fear the Fed is behind the curve and start setting prices on a tighter policy, ”they wrote.

Brent crude, the international benchmark for oil, rose 0.9 percent to $ 75.40 a barrel.

[ad_2]

Source link