[ad_1]

A concept of a modern high-capacity battery energy storage system in a container in the middle of a green field with a forest in the background. 3D rendering (stock image not ESS Tech specific). Petmal

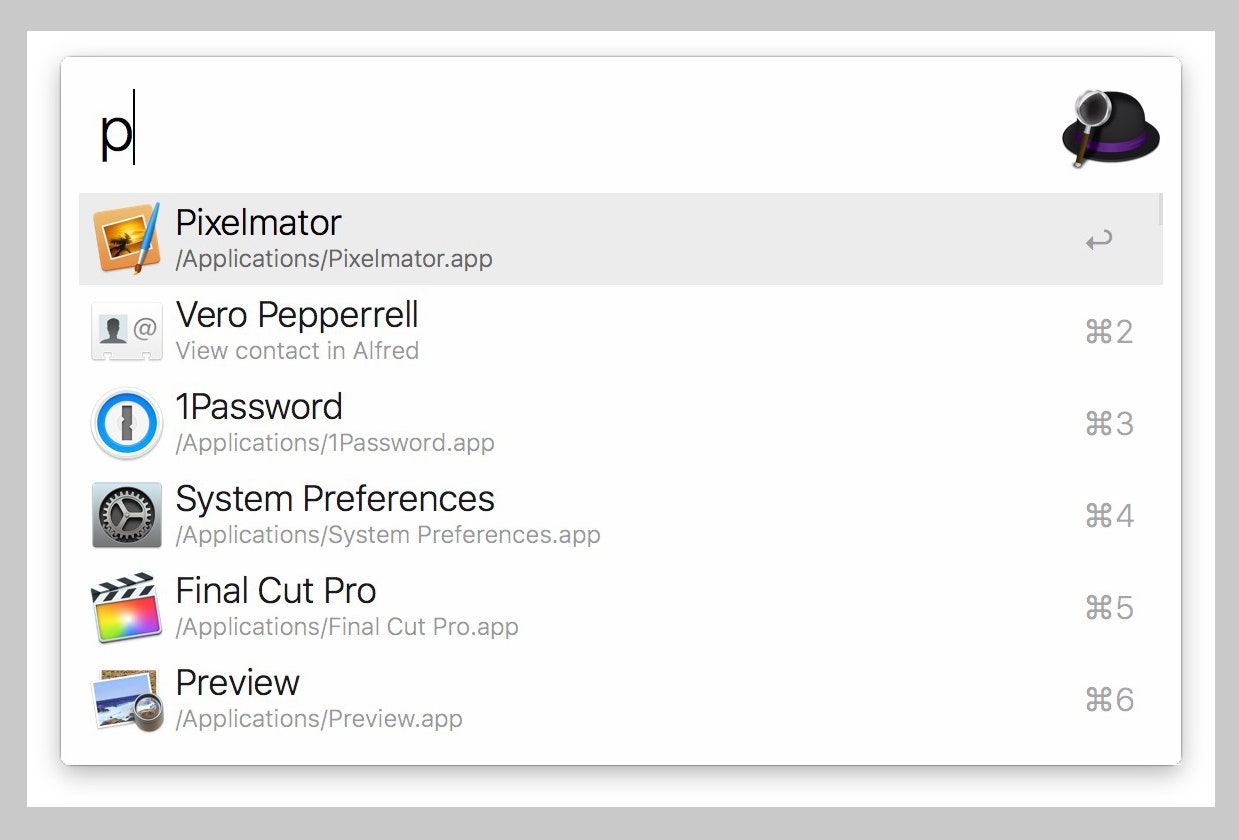

I believe ESS Tech (NYSE: GWH) is useful if it is less clear what is required to identify the energy storage tanks (ESS terminology for a containerized iron flow battery) that you sent. Here is my chart on the segments where revenue is recognized and an estimate of what is recognized:

Energy storage estimates (Summary of the authors of the company announcements)

Notes:

1-3) Revenue call for transcript 11/2/22. Answer to Joseph Osha’s question

4) “Project Nexus is expected to be completed by 2024.” The release date of the company is 2/14/2023

5) The company’s release of 1/23/23

6) “Expected ..Operation End 2023” Released 4/12/23

7) Transcript of incoming callsRev rec date not specified Except for “23”. 3/1/23 Transcript of Call.

8) Transcript of incoming calls, in response to Joseph O’Shaw’s question, 6 parts w/rev unknown, dates not specified. 11/2/22

Most of the quarterly dates for individual line items are the author’s opinion from the company’s press releases.

Recall that the most recent unit that recognized revenue was a unit for Terrasol Energy in 3Q 2022, with revenue of $189,000. Management commented on the value of this unit:

So it’s not a mile away, but it might be on the lower side of what we expect going forward.

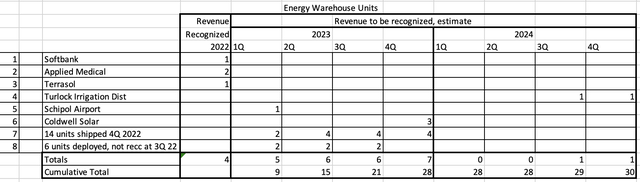

By digging through the unit ads with pick and shovel work, income estimations are provided. As with the previous experiment, this can only be guesswork as management resists giving instructions:

| Electric Phred | |||

| common sense | Estimate | ||

| 4Q | 1 Q | ||

| Income | 15 | 945,000 | |

| R&D | 22,879,000 | 16,000,000 | |

| Sales Exp | 1,721,000 | 1,750,000 | |

| G&A | 6,902,000 | 7,000,000 | |

| Refined | (25,075,000) | (24,505,000) | |

| eps | USD (0.16) | US Dollar (0.16) | |

| Price reduction | 695,000 | 700,000 | |

| cap ex | 2,994,000 | 2,000,000 | |

| Cash and short term | 141,027,000 | 115,222,000 | |

| EW #Rev recognized | 5 | ||

| Price per EW | 189,000 | ||

| He shares | 152,676,155 | 152,800,000 | |

(Cash + Short Term = Cash + Restricted Cash + Short Term Investments)

The main numbers I’m looking at here, from which I don’t expect anything greater than revenue and EPS, are cash and R&D expenses. I assume R&D will be less, with most of the one-time cost related to auto line installation and rearview mirror startup. I expect and hope that the number will decrease significantly. Cash in the neighborhood, I imagine, represents a significant runway to get us to affordable incomes.

To transparency map

As stated above, I believe the company could benefit greatly from transparency. Most of the less obvious elements of management are well known to some constituencies (suppliers, customers and competitors but not, alas, eg shareholders). Many of the more obscure things will be revealed in the following statements, so why not face them head on? And yes, I’m fine with some transparency on items that might secure some competitive advantage.

Here is a list of some suggestions on how management can improve communication

Auditor

On April 14, the company announced that E&Y would no longer be external auditors. You probably haven’t heard this news since it was buried on Friday afternoon – usually when bad news is released. But the decision to seek a new auditor was made a month ago, according to the release. Why not announce the creation of an RFP for a new auditor on March 9th even though there were no accounting discrepancies?

Income recognition

I believe there should be a clear statement of what the company needs to recognize revenue on energy storage. Here’s a quote from the 4Q earnings transcript: “Four criteria for revenue recognition under GAAP were not met because the customer did not have full control of the units, which occurs when the units are transferred through the shipping method.” Here are the 4 criteria and what we expect to meet for each of the units already shipped.

It would be nice if the parts were collected in buckets, for example: “3 parts did not arrive at the installation site, 2 were on site waiting for our commissioning, 1 grid was not connected to each other, 2 did not meet the minimum contract performance, etc.”

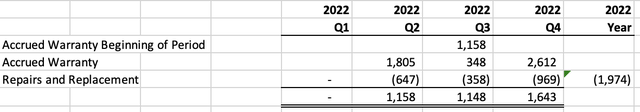

Warranty cost

I found the company’s warranty costs incredibly high. In the year Revenue of $894,000 was reported in 2022, while replacement costs for the year were more than twice that at $1,974,000. Here is a table from footnote 8 to the financials in the 10-Q’s and 10-K:

Warranty cost (Footnote 8 to 10K and 10K)

Which part of the technology is failing? What is the “repair and replace” trend based on lessons learned from previous failures?

And what about Australia??

Readers of my previous articles have seen a lot of attention on the company partner ESI Asia. Some of the comments said that I paid too much attention to this partner. But this is one repeat customer we have and partnering with external partners has been identified as a key part of the company’s proposed growth plan. Unfortunately, drone pictures and satellite images show zero progress on the parcel, which ESI apparently has a contract with its owner, the Fraser Coast Regional Council.

All ESI and ESS blown development operations are under Fraser’s control and remain on land. The access roads and drains constructed to date are leading to the proposed ECI site. I have provided documents relating to the proposed acquisition under Queensland’s Freedom of Information Act, which Fraser has acknowledged, as part of our Freedom of Information Act. The clock is ticking on your appointment.

Conclusions

I took another tax loss on ESS stock bought and sold at a loss. Now that I’m out of the wash selling rule, I can buy again after the earnings announcement on May 9th, especially on any weakness. Since the warrants have several years of life and the technology works and I can get a lottery ticket type return if the management is a little clearer, I will continue to hold a large warranty position.

I haven’t given up hope that the company’s technology will work, but given the long development runway, they’ve shown more growing pains than I expected. I don’t believe SMUD will be a client or Munich Re will guarantee performance if there are significant outstanding claims.

But the management should be more transparent and ask for some transparency from their partner ESI Asia. Hopefully we’ll see some on May 9th.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]

Source link