[ad_1]

Cloud security startup Wiz was launched two years ago. It released its first product 18 months ago. In December, the company announced a $550 million Series A at a $6 billion valuation. That’s a lot of money for a startup, and it puts a lot of pressure on the founders to live up to such obscene numbers.

If their company’s latest ARR figures are any indication, it looks like they haven’t had much of a problem. Wiz says it’s the fastest company ever to go from $100 million to $100 million in ARR over 18 months, from around February 2021 to July 2022.

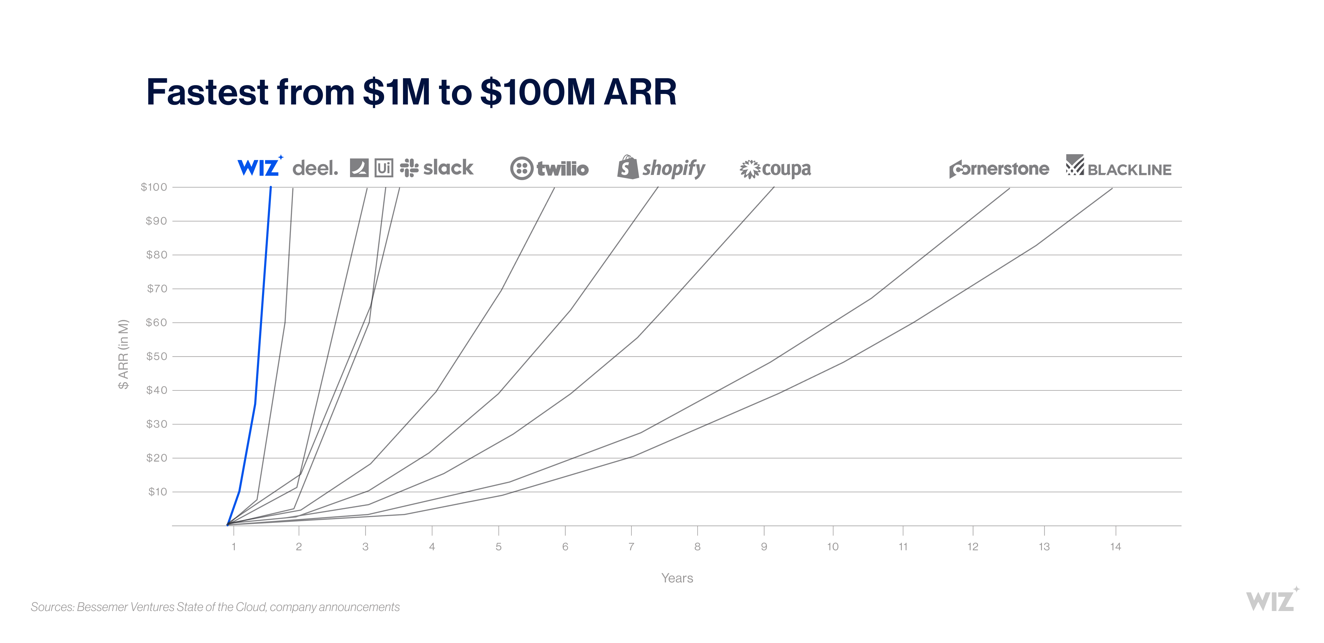

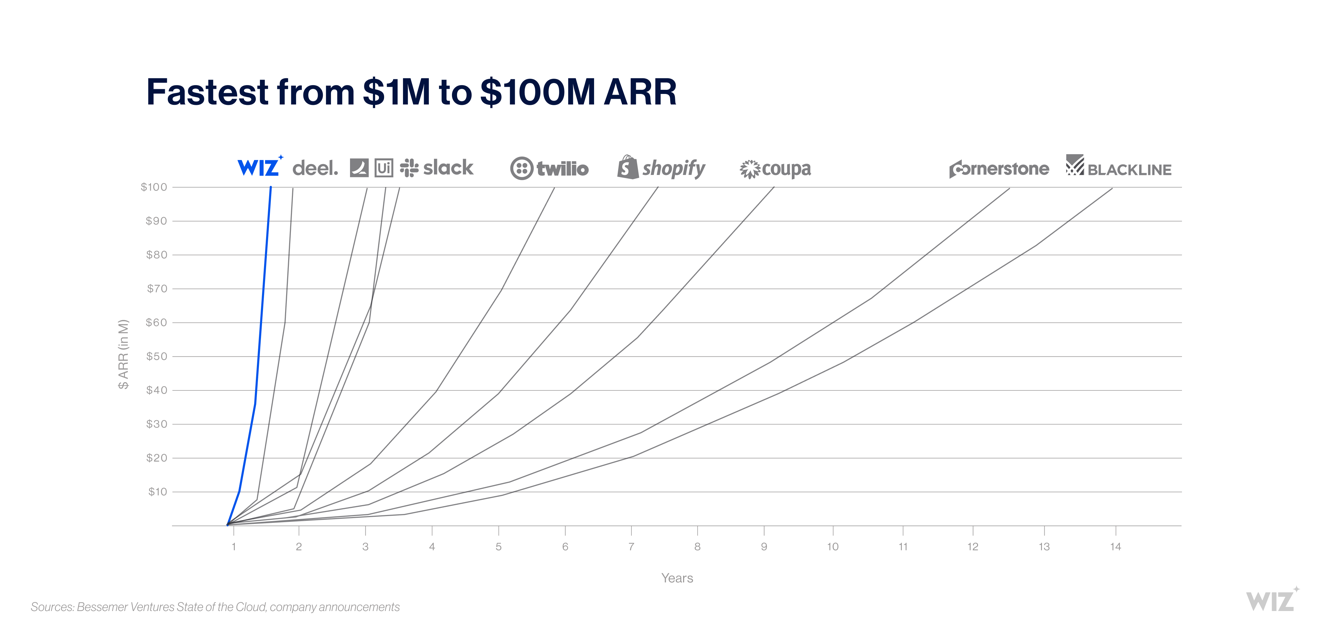

The chart below shows the data used to determine how fast they are based on Bessemer Ventures’ State of the Cloud report.

Image Credits: Wise, Bessemer Ventures

Achieving such a large ARR figure so quickly is an impressive feat, a number that sometimes takes companies years to reach. Company founder and CEO Assaf Rappaport is proud of its success, but is trying to put it in perspective.

“First of all, it’s not a goal to be the fastest company with a $100 million ARR. [we had]. And by the way, it is not a guarantee of future success. It is an important phase. It’s a small milestone in a long journey for us,” Rappaport told TechCrunch.

The way to achieve this kind of revenue number is to focus on the customers and their company has been targeting high value customers since the beginning. “One thing that was important to us from the start was that it was all about the customer, and from day one we were focused on being the thought leaders in the security world and cloud security,” he said. .

He sees that being split into two groups: First are the non-tech corporations — first, like BMW, Blackstone and Costco. The second group is software companies like Salesforce, Snowflake, and Slack (which Salesforce acquired in late 2020).

Doug Lyons, until recently a global managing partner at Sequoia Capital, but still a board member at Wise, said he was not hesitant when it came to investing big money in the company.

“We believe [being a] A quality company will increase the price, and the only difference is time. And so a quality company will excel for a long time. And [regardless of what you pay], quality is how we have learned over the years to generate great returns. And so the question is really is this a quality company, and the first indicators in the first 18 months suggest that it is very much, and that tells us that we will reward it in the long term,” he said.

Shardul Shah, a partner at investor Index Ventures, says the company is solving a common problem with cloud security, which is why it resonates with customers, and why his firm got involved. “That’s why we’ve invested as much money as possible, with a lot of confidence that this could be one of the most valuable companies we’ve seen in terms of cloud security,” Shah said.

The company has not stopped since it was launched in December, but it continues to invest deeply in the product by creating new services, which shows that it will be a platform game, which is usually a sign that it wants to live for a long time. Instead of the company selling to be part of the platform company. This includes support for all major clouds, including the big three – AWS, Microsoft and Google – along with Oracle and Alibaba Cloud.

At the core of Wiz’s solution is a security graph that not only helps identify issues that could lead to problems, but connects all data across the different environments a company is trying to protect, whether it’s the network or identity. secrets or work pressures. By demonstrating these connections, the company believes it will help plug security holes and find issues faster than competing solutions. When you combine that with a solution that installs and delivers real-time information about your location, it’s the fastest-growing startup the company has seen since it walked out of the door with its first product 18 months ago.

It’s worth noting that the company had fewer than 200 employees when I spoke with Rappaport in December. Today it is closing at 500 and expects to reach 700 to 800 by the end of the year as they continue to hire heavily.

As Rappaport said, the $100 million ARR number is a blip in the scheme of things. The company still needs to serve and serve customers, but for a barely two-year-old company with hundreds of customers — they won’t share the exact number — it’s as good a start as any startup. Investors hope so.

[ad_2]

Source link