[ad_1]

Earnings from Chinese companies have shown resilience amid heavy lockdowns, but traders are tapping into pockets of desperation and dumping stocks, with analysts slashing forecasts for the future.

A number of market-weighted stocks have seen declines after good earnings, as investors chose to focus on shares or simply took profits as an opportunity to take profits. One striking example was battery giant Contemporary Amperex Technology Co., whose shares fell nearly 6 percent early last week, despite beating earnings estimates by 82 percent.

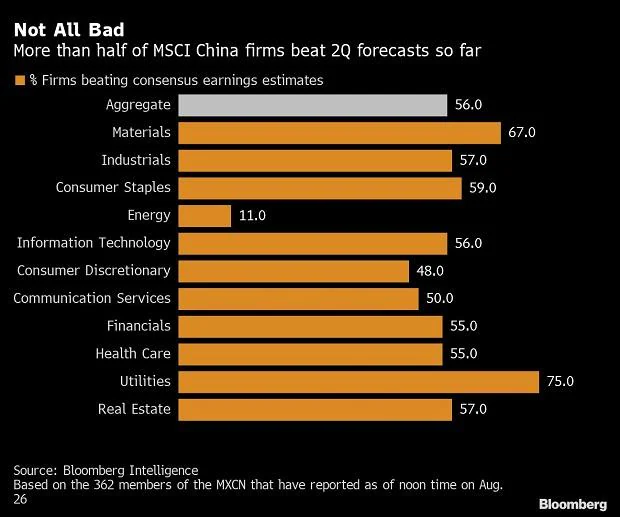

Total earnings per share for more than half of the 715 members of the MSCI China Index that reported second-quarter results were up a surprising 9.4 percent, according to Bloomberg Intelligence calculations. While that may have encouraged traders to brace for a worse crisis since the quarter when the economy barely grew, China’s benchmark fell more than 3 percent last month, while the Asian benchmark rose about 1 percent.

That underscores the broader investment pessimism as factors from the asset crisis to energy shortages and the ongoing Covid-19 pandemic cloud China’s equity outlook. Even policy rate cuts and fiscal stimulus measures failed to lift sentiment.

“These are very difficult times, and with the earnings season ending next week and some companies waiting until the last minute to spread the bad news, it’s easy to find any excuse to profit,” said executive director Wang Mingli. “For some, there don’t seem to be enough reasons to buy,” said Shanghai Yupu Investment Co.

MSCI China’s benchmark trailing-twelve-month earnings estimates are set to decline for a third straight quarter. After falling 9 percent in the previous three months, they have fallen 1.3 percent since the end of June, according to data compiled by Bloomberg.

Market response

CATL, China’s third-largest by market value, posted its biggest weekly decline since early July as a year-over-year decline in battery margins disappointed investors.

Gaming giant NetEase Inc. In Hong Kong, it fell more than 6 percent on Aug. 19, although Citigroup analysts called the results a “hard blow” to WuXi Apptec Co. – A 73 percent jump in profits over expectations.

Similarly, electric vehicle makers Lee Auto Inc. and Xpeng Inc. Inc. slipped as traders adjusted for conservative supply guidance for the third quarter, despite posting strong revenue growth.

Thanks to such responses, there wasn’t much of a stock difference between winners and losers. Overall, the companies that beat consensus saw their shares outperform the MSCI China benchmark by an average of one percentage point, Bloomberg Intelligence reported. This compares with 1.5 percentage points in the first quarter.

‘Broad-oriented Miss’

While MSCI China’s earnings have so far held up well, with a heavy increase in technology weighting, a Morgan Stanley report shows that the number of offshore listed companies is on track to be the largest since 2018.

About 28 percent of A-share companies that have reported earnings so far have missed consensus, with strategists including Frank Che saying in a report last week that “downward revisions see more room for consensus earnings.”

This “broad-based loss” clearly indicates macro weakness, they wrote.

For offshore companies, the decline in share prices has been pronounced. The benchmark CSI 300 index is down 1.5 percent so far in August, the worst among national benchmarks in Asia.

All this comes against the backdrop of a deteriorating outlook for China’s economy. Economists polled by Bloomberg expect growth of 3.7 percent this year, down from the official 5.5 percent and 4 percent at the end of July.

Zhao Yuanyuan, a fund manager at the Shenzhen Qianhai Jianhong Times Asset Management Company, said the weakness in equities “may be due to the limited impact of stimulus measures so far.” Consistent improvement in third quarter earnings.

Dear reader!

Dear reader!

Business Standard always strives to provide you with up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering has strengthened our commitment and dedication to these ideas. Even in these difficult times caused by Covid-19, we are committed to keeping you informed and up-to-date with credible news, authoritative views and thought-provoking commentary on relevant current affairs.

But we have a question.

As we battle the economic impact of the pandemic, we need your support even more so that we can continue to deliver more quality content. Our subscription model has seen an encouraging response from many of you who subscribe to our online content. Additional subscriptions to our online content may only help us achieve our goals of providing you with more and more relevant content. We believe in free, fair and credible journalism. Your support through multiple subscriptions helps us practice the journalism we’ve been entrusted with.

Support quality journalism and Sign up for Business Standard.

Digital editor

[ad_2]

Source link