[ad_1]

Businesses have a lot to worry about this year, with high inflation, rising interest rates, the ongoing war in Ukraine and rising tensions between the US and China. In fact, a A recent survey by EY-Parthenon It shows that CEOs are training their eyes on multiple risk factors, almost all of equal importance.

About a third of the CEOs surveyed cited uncertain monetary policy and the continuation or return of pandemic-related disruptions as the biggest threats to business growth. But almost an equal number face inflation, restrictive regulatory environments in key markets, geopolitical tensions or cyber security risks as their company’s biggest liability.

With so many competing concerns, captaining a company can be overwhelming, so here are five charts that can sharpen your focus on the macroeconomic climate for the year ahead, all based on research from strategists EY-Parthenon.

Hyperinflation will not go away.

Although inflation has started to come down for consumers, it hasn’t for corporate UK. Consumer inflation tends to hog the headlines, but producer price inflation (PPI), which measures the price of goods bought and sold by UK manufacturers, is more worrying for companies and is particularly more volatile.

While CPI rose 11.1% in October 2022, PPI rose 24.6% in June last year. The EY-Parthenon forecast predicts it will remain high at between 10% and 13% by the end of 2023. This means that between 2020 and 2023, PPI inflation will increase by about 50%. This is a big step away from what is considered “normal”; Between 2016 and 2019, PPI grew by 7 percent.

There are a few factors that increase inflation. China’s reopening has led to increased demand for a variety of commodities. Meanwhile, geopolitical shocks are driving up gas, commodity and food prices. These macroeconomic forces will reverberate for the foreseeable future, and businesses will need to find more cost-effective ways to survive.

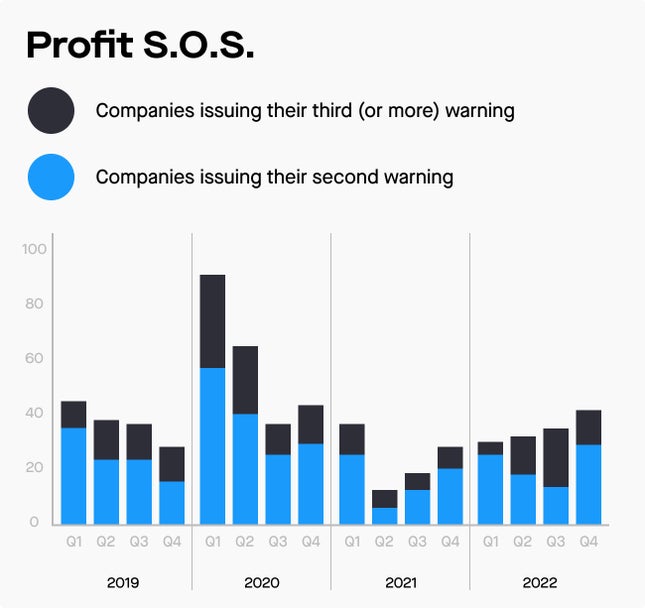

Many companies are getting into financial stress

Signs of financial distress are mushrooming, with more and more companies issuing multiple profit warnings. While retailers continue to lead on profit warnings, stress from continued cost pressures, tight credit and declining consumer confidence has spread to other sectors. In the year By the end of 2022, it was clear that almost no industry was immune as profit warnings appeared in the economy.

Financial stress is currently more concentrated among smaller suppliers and contractors in the UK. 72% of warnings came from companies with revenues of less than £200m in the fourth quarter. Past failures have shown that this stress can quickly spread up the value chain, especially when access to capital is squeezed. To avoid further profit warnings, executives must act quickly to adjust to this new, more volatile macro outlook.

Leaders should expect to see more labor unrest

Inflation can have a huge psychological impact. Rising inflation combined with a hot labor market is fueling demand for wage increases. In the UK, private sector pay growth is expected to increase by 7.2% between March and May 2022, while the public sector will see a 1.5% pay rise. But in both camps, pay has fallen in real terms.

With many unions now demanding pay rises of up to 30%, EY-Parthenon calculates that the UK is on course for the most days lost on strike since 1990.

The EU is on track to see inflation-related labor unrest. Around 120 million EU workers have collective bargaining protections and high inflation could trigger mass bargaining.

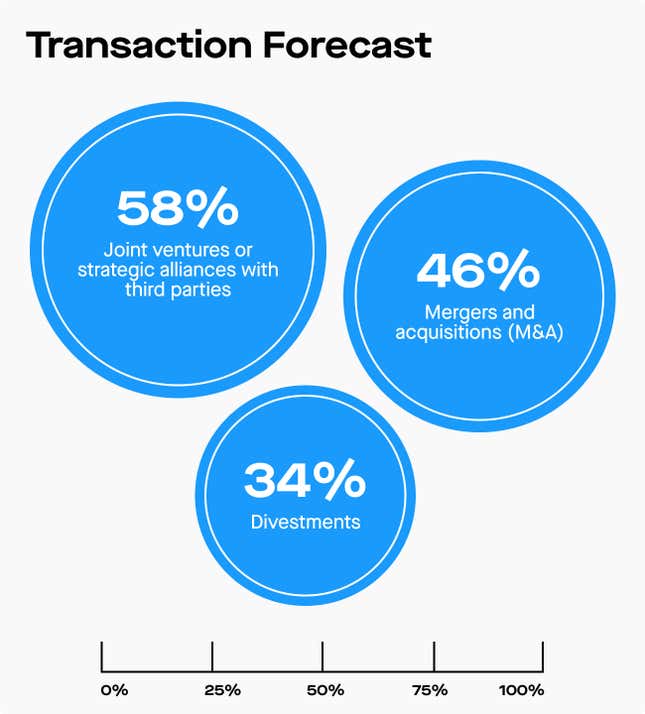

The M&A market remains active, even in a downturn

with More than 90% of executives expect to handle some kind of transaction this year, the M&A market will be more active than usual during the slow season. Half of the leaders surveyed by EY-Parthenon say they are looking to buy properties, while a third want to leave. More than half are looking to enter into some form of joint venture or alliance.

Interestingly, labor trends play a significant role in driving M&A. Access to new talent is a key driver for many CEOs. Another notable feature: geopolitical eruptions that reshape global ambitions.

Nearly four out of five CEOs surveyed said they are looking to conduct M&A in countries with geopolitical and economic ties to their home countries. In contrast, fewer than 1 in 10 CEOs said they would consider buying a non-aligned market.

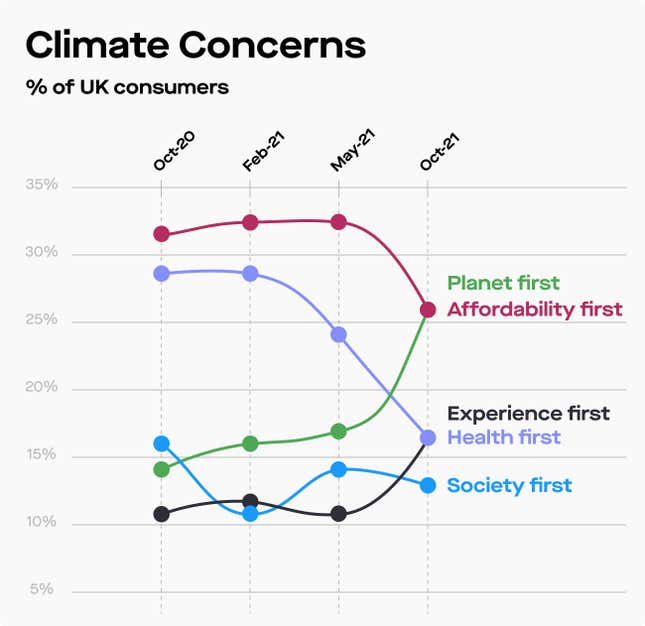

Expanded consumption is declining.

The epidemic had a profound effect on values and ideas. Vaccines and incentives have allowed a return to “normal”, but consumers have moved away from expanded spending to embrace more cautious consumption. According to the EY-Parthenon study, concern for the planet figures right now the ability to buy decisions – at least for UK consumers. Cost is still important, but not the primary concern.

This shift in thinking marks a shift away from the throwaway culture that has characterized consumer behavior for decades. UK consumers expect to buy better quality products that last, and some are willing to pay a premium for them.

About half of consumers surveyed said they are more likely to repair things than replace them, and more than half said a company’s character is as important as what it sells.

The past three years have been chaotic, and looking at the data, it’s clear that more chaos is on the horizon. More than ever, company leaders need to stay abreast of global economic trends that can make or break an individual business.

This content is produced by Quartz Creative on behalf of EY-Parthenon and not by the Quartz editorial organization. Sources are provided for information and reference purposes only. They are not an endorsement of EY-Parthenon or EY-Parthenon products or services. This publication contains information in summary form and is intended for general guidance only. It is not intended to be a substitute for detailed research or professional judgment. EY-Parthenon is the brand under which many EY member firms around the world provide strategy consulting services.. Member firms of the global EY firm cannot accept responsibility for the loss of any person who relies on this clause.

[ad_2]

Source link