[ad_1]

Following July’s impressive rally, the US SPX,

Over the past two weeks, investors have been caught in tight trading territory as they struggle to make sense of some of the most confusing economic data in recent years.

But when the S&P 500 index held above the key 4,000 level, such as Meta Platforms META and Amazon.com Inc. Reviving battered megacap tech stocks like AMZN, analysts at BlackRock, the world’s largest asset manager, believe investors would be better served by less-exciting, defensively positioned “low volatility” stocks and bonds.

This view of the “Fed pivot” hope, because the Federal Reserve has left the plan to increase interest rates, is very wrong, corporate performance indicators are declining, and inflation is the service sector. Being much stickier than investors now expect.

According to Blackrock For Gargi Chaudhuri, head of investment strategy at US iShares, the asset management giant’s domestic metrics are throwing up conflicting signals about the state of the US consumer and corporate sectors.

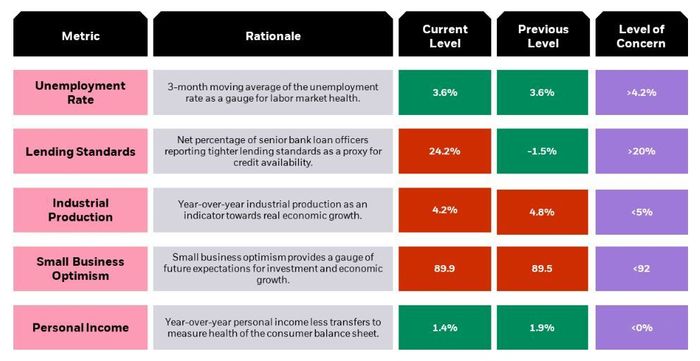

BlackRock’s in-house model says the US economy is flashing warning signs for corporate performance, while the consumer remains strong. Source: Blackrock

But once the market wakes up and the Fed pivot is still a long way off, stocks could be at risk of reversing some or all of the growth-led rally that saw the Nasdaq Composite COMP.

And Russell 1000 Growth Index outperforms RLG;

The Dow Jones Industrial Average DJIA;

and the S&P 500 last month. While rising energy and other commodity prices have gotten most of the attention this year, Choudhury said services inflation, like rising housing prices, will be more sticky than investors and economists expect.

If this continues, investors may be better off focusing their portfolios on “defensive” plays, high-rated corporate bonds and low-volatility stocks. Defensive portfolios fared better in the first six months of 2022, even as both stocks and bonds sold flat, marking one of the worst first halves for markets in decades.

watch out Goldman Sachs said it is too soon for markets to trade a ‘full Fed pivot’

Some ETFs recommended by Chaudhuri include: iShares MSCI USA Min Vol Factor ETF USMV;

iShares iBoxx $ Investment Grade Corporate Bond ETF LQD;

iShares US Healthcare Providers ETF IHF;

and iShares 1-5 Year Investment Grade Corporate Bond ETF IGSB;

BlaRock’s worries were likely on Tuesday, as the technology-heavy Nasdaq Composite led markets as semiconductor stocks such as Nvidia NVDA fell.

and Micron Technology Inc. MU,

The Nasdaq was down 1.4%, while the S&P 500 was down just 0.6% by comparison.

[ad_2]

Source link