[ad_1]

At this time last year, Chinese stocks began a slide that saw some of the country’s largest companies lose more than half their value.

Now most of these stocks have seen big reversals. While the worst may be over, more positive news may be needed for stocks to meaningfully extend their run.

The second quarter marked a turnaround in fortunes for many Chinese stocks compared to last year’s brutality. It was a time when China stocked up, including famous names like the Alibaba Group. (Baba) And don’t (START), experienced a large stock price decline. Online education companies, which have been particularly hard hit, have lost much of their stock value over the past year and into early 2022.

The triggers were the coronavirus and regulatory measures. Last year, Chinese regulators enacted several new rules on internet and e-commerce companies and education providers, sending stocks into bear market territory. Then came a row with US regulators, who threatened to delist some companies from US exchanges. As if that wasn’t enough, severe Covid-19 lockdowns have hit China’s economy.

Over the past six months, however, Beijing has sent signals to support domestic companies and boost policy support for the economy following economic data weighed down by the lockdown.

As a result, in the second quarter of 2022, there were four top-performing Chinese ADRs in Morningstar’s stock coverage.

While the market may be preparing for a rally, some investors want to see more evidence of fundamentals supporting Chinese stocks.

Wenchang Ma, a portfolio manager at Hong Kong-based mutual fund firm Ninety One, is looking for a “tipping point” where corporate earnings swing upward again. “Market sentiment alone will not be enough to sustain a stock rally,” she says. “Signals must come from strong real economic improvements, which can transmit support to corporate earnings. We’re not quite there yet, but there are early signs that earnings reports are on the downswing.

Chinese regulators are softening their tone

To bolster the recent rally, China’s State Council in June announced 33 measures to restart the economy after months of delays in parts of the country. Later in June, in a sign that government regulators are loosening their grip, trucking provider Full Truck Alliance (ymm) and online recruitment platform Kanzhun (BZ)Both are under data security scrutiny, and have received green lights from the country’s cybersecurity watchdog to continue signing up new users to the platforms. Officials continue to approve mobile game titles after a nine-month freeze.

One of the biggest positive news for the group are reports that China’s central bank has accepted a financial holding company license application from Alibaba’s fintech arm Ant Group, which could pave the way for Link 1012474 to revive its aborted initial public offering. It is set to be the largest IPO of all time, raising over $30 billion.

It remains to be seen whether the policy easing will lead to a continued stock market recovery in the wake of the new coronavirus outbreak, which in turn has led to lockdowns in key hubs like Shanghai and Shenzhen.

Despite this, the policymakers’ dovish tone was heard in the stock market. In the year

Which Chinese stocks rose the most?

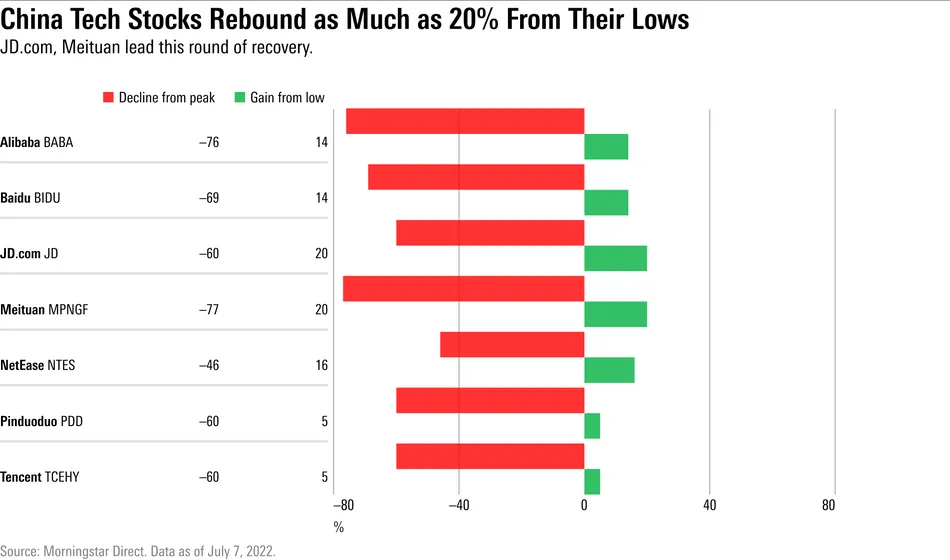

For individual names, the profits are different. Tencent (TCEHY) Late in the storm, while JD.com (JD)Meituan (MPNGF)and Pinduoduo (PDD) It’s already up 20% from their respective lows.

Is the market primed for another Chinese bull run?

After the wake, many market watchers say the worst of the regulatory reset is over, but risks with long-term fundamental implications remain.

“The gradual recovery in stock prices largely reflects the easing of regulatory impacts, but macro headwinds remain,” said Evan Su, senior equity analyst at Morningstar. For example, when Shanghai ended its lockdown in June, the country has yet to reverse its zero-tolerance approach to Covid-19.

As China records the first cases of the new Omicron variant, there is “uncertainty about how the government will handle (the new variant),” says Su. “Restricting people’s movement will seriously damage consumer confidence and the operations of some companies.”

For example, lockdowns in Shanghai have forced e-commerce platform JD’s to close warehouses, while ad-driven internet companies such as Tencent have also come under pressure due to blocked consumer sales.

In his view, the prelude to a rebound in Chinese stocks would be more positive news from government regulators.

A more aggressive rollback will come when authorities confirm reports, such as completing a cyber security review on DD or licensing Ant Financial. But it is very difficult to estimate the timetable,” says Su.

A weak return from this may be inevitable.

Although Ninety-One Ma is cautious, she believes there is nothing wrong with investing in China long-term.

For starters, officials are calling for better coordination in policy announcements and implementation of support for local businesses, and are reiterating their support for market confidence. Therefore, he believes that the healthy growth and development of Internet companies, including the platform economy, is still something that authorities should encourage.

Anh Lu, T Row Price New Asia Portfolio Manager (PRASX) (with a Morningstar Analyst of Silver rating), she still finds value in China, but the competitive landscape in e-commerce and social media is holding her back. She began reducing exposure to space in the first quarter of 2021.

“We didn’t have great foresight as to how much the policy would change, but the regulatory cycle coincided with a time when we felt the competitive environment was very tough. I don’t think this means that these are companies that one cannot invest in. Lu, who is “more cautious” about the direction of earnings in the technology sector, says that all these companies are undergoing an adjustment process.

“We try not to be too imaginative to focus on what’s going to happen today, but see how things will look next year. It goes back to focusing on businesses that we think have as many idiosyncratic qualities as possible so that we don’t hold strong views on policy or geopolitics, or that GDP will be 3% or 5% next quarter. “

For high-penetration segments such as e-commerce, gaming and social media platforms, companies have strong business models and management execution skills that enable them to generate revenue at a faster rate, or enter new markets if they have them.

There is still room for growth in categories where penetration is not high, such as online recruitment or delivery services. “Once this recession all settles down, we expect competition to slow down, especially in supply,” she said.

One of the consequences of the regulatory reset is that tech companies will have to adjust their business strategies. But that will not be the only thing that needs to be adjusted: investors will also have to temper their expectations about the sector’s earnings.

Schroders’ Asia Equity Group believes that lower returns on invested capital may be a result of the new regulations. Technology companies should prioritize investment in key sectors in a “dual circulation” strategy. Also, operations expect higher costs from paying higher wages to employees and supporting physical retailers with e-commerce players. Despite the changing ROIC profile, Schroders’ Asia Equity team believes that companies with good business models and good cash flow are likely to stand out, saying the valuation level is “very reasonable.” According to Morningstar Direct, Schroders Asia Equity Group oversees strategies such as the Gold-rated ISF China Opportunities Fund and the Silver-rated ISF Emerging Asia Fund, both managed by Louisa Lo.

Chinese tech stocks are trading at attractive valuations.

As pressure on the sector has yet to dissipate, tech stocks are very attractively priced for long-term investors. Morningstar Equity Research has two top picks: JD and Tencent. Both stocks trade at less than a 5-star rating and offer high ratings on valuation and economics. A 5-star rating, previously referred to as a “consider buy,” is the rating at which Morningstar analysts consider the stock to be significantly undervalued.

Su explains the fair value assumptions: “While we cannot predict the next policy move, we strongly believe that Tencent will be able to navigate these headwinds over time with the investments they are making today.

“In 2021, we have already adjusted to reflect the potential regulatory impact on our models, which we believe is minimal. For example, Tencent is prohibited from monetizing underage players, an area we think has relatively little financial material,” Su says.

Our analysts believe JD is the best-rated e-commerce company and prefer it to Alibaba. JD provided better clarity on long-term profit growth. The company enjoys a reputation for readily available genuine merchandise and efficient and fast proprietary logistics services that are highly reliable and help retain high-end consumers.

[ad_2]

Source link