[ad_1]

Big Tech is favorable to capital markets. This week marks the third partnership between Microsoft and the London Stock Exchange Group in more than a year.

In the year In November 2021, Google spent $1 billion and signed a 10-year cloud computing deal with Chicago-based CME. Amazon Web Services and New York’s Nasdaq agreed to a similar deal later that month, and last week Nasdaq completed moving one of its US options exchanges to AWS.

The changes, the benefits are clear. “We’re building products together, we’re going to market together,” said LSEG CEO David Schwimmer. “This is about our data and analytics capabilities.”

The American software group will help LSEG move its infrastructure to the Microsoft Cloud, which will give it more processing power and allow the company to move data faster and more flexibly.

“Moving to the cloud is critical for next-generation computing as they need to be self-sufficient,” said Nguse Beatty, CEO of consulting market structure partners. Without that, she added, “it will be difficult to move forward quickly.”

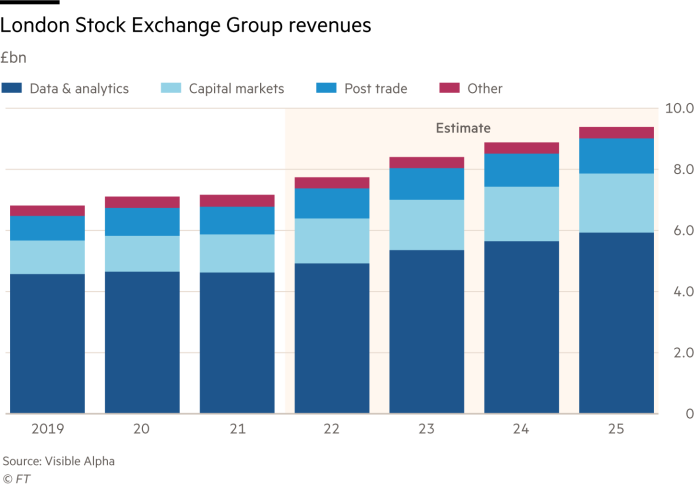

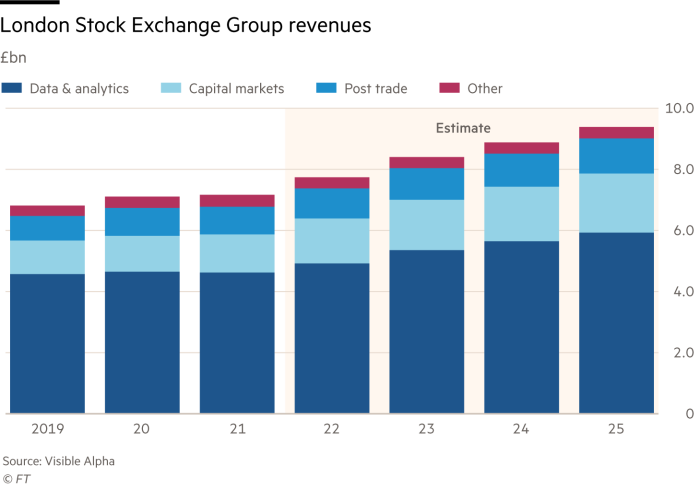

LSEG’s data and analytics business is the company’s linchpin, generating revenues of £2.4bn in the first half of 2022. The clients, fund managers and analysts share the data with traders and investment banks, who use the data to make their decisions. LSEG claims to have 99 percent of the world’s market capitalization of companies, as well as price and economic data from 165 countries.

“Microsoft has whizzy AI and algorithms, they have unique data, and they have the infrastructure to manage and create products there. It’s reasonable to expect revenue growth,” said one top 20 LSEG investor.

Could the partnership develop a “Bloomberg killer”? 40 years after Michael Bloomberg founded his data business, the eponymous terminal is ubiquitous on business floors. LSEG’s $27 billion acquisition of Refinitiv is at the forefront of rival product Econ.

One popular feature of Bloomberg Terminal is the messaging app. Microsoft and LSEG envisioned combining Microsoft’s Teams messaging system with Exchange Analytics to create a new, unified conversational and data platform.

“Primarily, people use Bloomberg for the chat functionality and creating that community ecosystem. . . This is a vital part of the institutional financial markets,” said Ben Quinlan, CEO of Advisors Quinlan & Associates. But he added that Bloomberg clients are stuck eating into the market for a long time.

One person close to LSEG said it would be a mistake to think of this as the next chapter in the final battle. “Obviously Microsoft will make Econ’s user interface better, but that’s not a big prize. The battle will never be won,” he said, adding that Econ’s roughly $1 billion in Refinitive revenue generates relatively little.

Instead, this person said that the view at LSEG is that terminal sales will decrease because there are fewer human traders. The battle of the future was a “data pipeline” through the cloud, feeding data into computerized programs that do the transaction – and feeding data into the familiar systems that banks build for themselves.

Here, Microsoft has the advantage of another product that has been around since the early 1980s: the Excel spreadsheet application. By integrating LSEG’s financial data with Excel, the companies intend to use algorithms to help analysts create financial models, charts and presentations all in one place in Microsoft Office.

Ian White, an analyst at Autonomy Research, said: “It’s a very big set of proposals,” adding, “A more competitive, better integrated technology offering will address some of the inefficiencies.”

So what’s in it for tech teams? There is a financial aspect. Microsoft expects to generate $5 billion in revenue through the 10-year partnership, with LSEG’s minimum cost of $2.8 billion guaranteed. Microsoft is buying a 4 percent stake in LSEG and taking a board seat.

Cloud providers will also see a boost in sales to securing business with financial companies. For example, Nasdaq has many infrastructure customers that rely on it for trading, clearing, and settlement, which means they also rely on AWS.

“We will have opportunities to establish new relationships,” said Scott Mullins, managing director of global financial services at AWS. “There are some markets where we don’t have the infrastructure yet and we will have the opportunity to expand,” he added.

“Cloud providers certainly want to learn more about financial markets and the quid pro quo is that they can set lower costs on their platforms, guaranteeing future revenue,” said Beatty of MSP. Perhaps it was crucial that Microsoft got such a deal when their competitors had something in the bag.

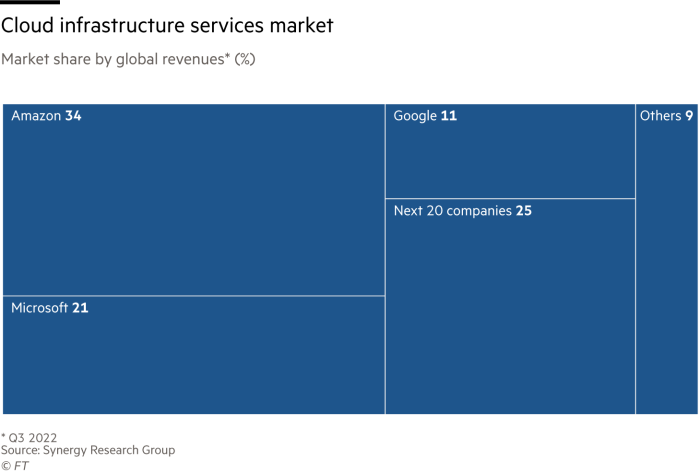

The partnerships aren’t exclusive — analysts say they should avoid getting caught in the crossfire by regulators. Lawmakers are expected to closely monitor Big Tech’s interest in global capital markets, especially since a small number of cloud computing companies dominate the market. Amazon, Microsoft and Google’s cloud computing services accounted for 66 percent of the global market share in the current third quarter, according to Synergy Research Group.

The Bank for International Settlements warned in July that growing reliance among financial institutions on cloud computing software by a few big tech companies could have “systemic implications for the financial system.”

“The cloud has changed the idea of what is strategic. [supplier] It is,” said Forrester Research analyst Lee Sustar. “When the cloud is the vehicle for all of your IT, that’s a qualitatively different challenge.”

UK companies that provide their data to cloud providers must comply with Financial Conduct Authority rules, including planning in the event of cloud computing disruption.

Some worry that US tech companies’ growing presence in the infrastructure of global financial markets could turn into a bigger challenge, becoming exchanges themselves.

At the moment, they are looking to make money by selling cloud infrastructure “so they don’t want to compete with their customers, but they want to use the knowledge for a long time” and so it can be expanded, BT.

In October, the UK’s Financial Conduct Authority began seeking views on Big Tech’s role in finance.

Sheldon Mills, director general of consumer and competition at the FCA, is assessing competition concerns and said: “This is particularly important when we consider the role of big tech companies in providing key technology infrastructure such as cloud services.”

Here’s a look at what Big Tech will eventually look like to leverage this newfound interest in exchanges and their data. “At the moment they want each other, but in the long run the friendly supplier can be a very big threat,” Beatty said.

[ad_2]

Source link