[ad_1]

If your world revolves around the fate of Joel, Ellie, and the Fireflies, it probably means one of two things: or you’re addicted to post-apocalyptic TV series. the last of us Or you are a financial analyst with a “buy” rating on Sony.

Either way, the coming weeks should be nail-biting, especially when finance chief Hiroki Totoki takes over as president this spring.

Long time Sony patrons, the last of us It marks the culmination of a decade of metamorphosis. This organizational transformation has been carried out by two successive CEOs and entrusted to a third, and Hiroki’s promotion is seen as the last step before he finally inherits the top job.

The process, which veteran Sony analyst David Gibson at MST Financial described as “phenomenal,” has transformed one of Japan’s best-known consumer electronics brands into a lesser-known specialist hardware maker and global media giant.

“It’s more about being good at a few things than trying to be average at a lot of things,” Gibson said.

Focused on the media business, analysts say, it defines the new Sony, a company that has built significant positions globally in a variety of entertainment genres as the battle between tight wallets and rival streaming services intensifies.

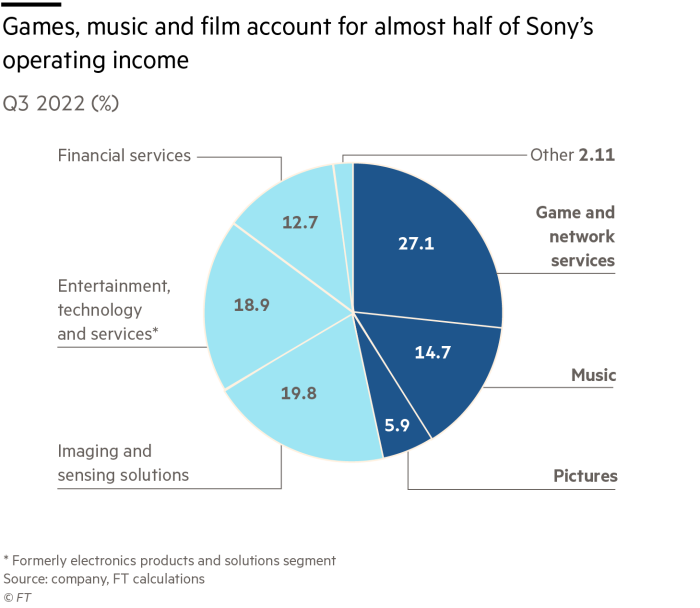

In the first nine months of its financial year, which ends next month, 48 per cent of the group’s operating profit came from games, music, film and television. Analysts expect this ratio to grow to over 56 percent in the financial year ending March 2024.

These same analysts, traditionally obsessed with Sony’s television sales and seasonal volatility in mobile phones, now have to comb media news for valuations. Spider-Man Movies, trailers for TV shows based on Sony games, and a record-breaking performance of Mariah Carey’s hit song “All I Want for Christmas Is You.”

Among Sony’s strongest new outfits is its global dominance in Japanese anime cartoon distribution — a business that has been greatly expanded both financially and geographically by the advent of streaming services.

In the year Bolstered by the $1.2 billion acquisition of AT&T’s anime streaming service Crunchyroll in late 2020, the group, which now has 10 million paid subscribers, has built what is widely regarded as the world’s largest anime portfolio.

As a result, Sony has adopted a “weaponized distributor” strategy – distributing titles on multiple competing streaming platforms to maximize profits.

“When it comes to IP and animation distribution, Sony owns the majority,” said Jefferies analyst Atul Goyal. They are making all the right moves in video games, animation and TV. Now they are basically a media company. ”

Sony’s anime strategy has evolved over a short period of time. At the time of the outbreak, Japanese anime was widely distributed to audiences outside of Japan, according to figures compiled by the Japan Animation Association.

The most recent figures for 2021 show that the global market for Japanese anime will grow to a whopping ¥2.7tn ($20bn). Estimates produced by SkyQuest Technology Consulting and used by many Sony analysts to inform their forecasts suggest that the global anime market is now growing 10 percent annually and could reach $47.14 billion by 2028.

More importantly, the market outside of Japan will represent a total of ¥1.3tn by 2021. In the coming months, analysts say, the balance will tip to the global market, and for the first time, anime will make more money overseas than domestically.

But of Our lastMacquarie analyst Damian Thong said the move marks the next step in Sony’s move to better leverage its various media businesses from its intellectual property.

the last of us It first debuted as a 2013 PlayStation game in one of the company’s in-house studios, when Sony embarked on a reinvention campaign.

The title became a sprawling gaming franchise that sold 37mn copies – ensuring a significant global audience for the show, even before it was made. The TV show, which is currently airing on HBO in the US, was described by Tong in a note to customers as “perhaps the best video game ever adapted for television or cinema”. Others said, “Sony Game of ThronesHe said.

According to Tong, the result of the success will increase the expectations for future television events from many other blockbuster game titles produced by Sony’s own studios. These include: Horizon Zero DawnBeing produced for Netflix and god of war Amazon Prime Video.

“Now, Sony probably takes my expenses every time I listen to or watch a Clash song The boys on Amazon,” said longtime Sony watcher Pelham Smirks. “If it was me Spider-Man Fan, maybe they’d take me a little fortune this year, with all that Spider-Man The universe is produced in movies and games.

But Smithers sees several areas of danger for Sony. Although the shares While they are more than 10 times higher than they were at the start of the turnaround in 2013, the stock is now down 21.5 percent from the end of December 2021, when it hit a 21-year high. The decline follows concerns that chip shortages are delaying the launch of the original PlayStation 5 console and that consumer spending on games will generally fall after the pandemic.

It is against this backdrop that Totoki will be promoted to President and Chief Operating Officer from April. Among investors, the 58-year-old finance chief was seen as a natural successor to CEO Kenichiro Yoshida, the duo who played a key role in reversing a decade of losses at the group’s consumer electronics businesses.

Totoki, known for his role in establishing Sony’s online banking business, has already indicated that he will implement Yoshida’s overall strategy. But with the group forecasting record revenue for the current financial year, Totoki will be responsible for managing the global economic slowdown, geopolitical risks and climate challenges.

“With the rapid development of technology, I feel that we are on the verge of being exploited. . . To drive further growth or face disruption,” Totoki said at a news conference this month.

Goldman Sachs analyst Minami Munakata said the turnaround will continue under Totoki, with profits from integrated entertainment businesses accounting for 61 percent of the total in the 2026 financial year.

“We believe that investors will recognize that change, so one of the main arguments is how to value the company,” she said.

Although there is scope for more the last of us-Combination between units in the future, Sony was still slow to release that. MST Financial’s Gibson said the company was at risk of being left behind because of its legacy businesses.

“CEOs of the past spent billions on small R&D projects and ideas looking for the next big thing or the next Walkman,” he said. “It’s very difficult to create a material company for $120 billion.”

[ad_2]

Source link