[ad_1]

Tech stocks have seen some relief this year, but it’s unclear whether the tide will turn again. The latest inflation number seems to have changed investor sentiment, and further rate hikes seem necessary to keep inflation at bay, albeit with a slightly softer landing rate.

Regardless, Wall Street analysts continue to favor the tech stocks listed below. They are not immune to future headwinds, but after more than a year of turmoil, each name appears to be trading at historically attractive multiples.

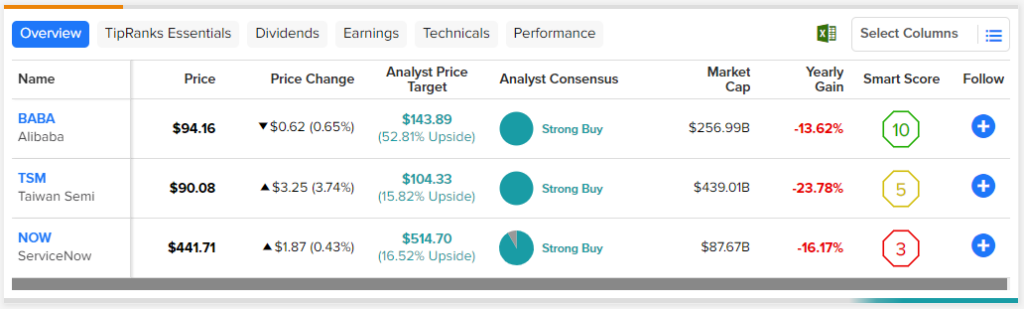

Therefore, the following strong-buy-rated tech names — TSM, BABA and NOW — may still be buys as the tech lineup takes a breather.

Taiwan Semiconductor (NYSE:TSM)

Warren Buffett’s Berkshire HathawayNYSE:BRK.B) started with a large stake in the semiconductor giant last year, only to divest 86 percent of the stake a few months later. For a financial behemoth known for its long-term investment, the move was a bit puzzling.

Given the buying and selling timing, the recent stock sell-off is unlikely to be a move to lock in profits. TSM’s shares fell sharply in the fall, only partially recovering by the end of the year. Berkshire jewel though, I’m a bully.

It is not known who made the buying and selling decisions in Berkshire. Regardless, it looks like demand may not be as strong as we learn more about the coming recession. Regardless, TSM stock still looks incredibly cheap at 14.8 times trailing earnings, which is lower than the semiconductor industry’s average P/E of 41.6 times.

Taiwan Semi’s capital spending plan is now skewed, with a budget of $32 billion-$36 billion, down from last year’s $36.3 billion. Despite budget cuts, Taiwan Semi continues to be a leader in the space, with expansion plans still in full swing.

As the economic downturn fed into chip demand, TSM’s However, long-term, I think Taiwan Semiconductor’s stock still looks undervalued, even if Berkshire has reasons to trim.

What is the price target for TSM stock?

Wall Street likes Taiwan Semiconductor, with a “strong buy” rating based on four joint acquisitions. The average TSM stock price target of $104.33 implies a potential upside of 15.8%.

Alibaba is a Chinese tech titan that has returned to retreat after enjoying a major rally to its October 2022 lows. Shares rose more than 100 percent from the trough before sliding north of 22 percent. Indeed, China’s tech giants are known to be dynamic movers. With BABA stock on the decline again, I think there’s reason for optimism as the stock looks to drain weak-handed investors. I’m a bully.

In the fourth quarter, Big Short Michael Barry took a stake in ailing e-commerce giant Alibaba. While it’s not clear what Bury has done with his investment so far, I think the move shows a lot of faith in the inevitability of Chinese stocks.

Yes, there are additional risks to betting on Chinese stocks. But, given its importance to growth, rivals like Alibaba are hard to top, especially as China’s economy reopens from the locks. Add a decent AliCloud offering into the equation, and I think Alibaba is a Chinese name, as negative momentum is rekindled.

At the time of writing, BABA shares trade for 11.5 times earnings. For a firm that can sustain double-digit growth over time, I find the multiple to be extremely low.

What is the price target for BABA stock?

Analysts have a “strong buy” rating on Alibaba based on 10 total buys assigned over the past three months. The $143.89 average price target on BABA stock indicates a potential upside of 52.8% from current levels.

ServiceNow is an edge-to-pool SaaS organization cut in half. Even though shares were hit by strong fourth-quarter earnings results ($2.28 EPS vs. $2.02 estimates) on the back of $1.9 billion in revenue, ServiceNow still stands out as a growth stock. I have been cruel.

At 12.2 times sales, it is now significantly more expensive than the software industry average of 9.2 times. It’s worth noting that 20% of the top-line growth was higher than expected in service capital.

For now, guidance is a very strong 22% – 22.5% call for year-over-year growth. ServiceNow is also relatively stable, while other big tech companies are experiencing mass layoffs. Only time will tell if the tailwinds of cloud transformation will help offset the headwinds of ServiceNow’s recession. If the company can deliver, the premium to its peer group could widen even further, and it could avoid higher cost cuts.

What is the current price target for the stock?

Wall Street outperformed ServinceNow with a consensus rating of “Strong Buy,” including 22 buys and two holds. NOW’s average stock price target of $514.70 indicates a potential upside of 16.5% from this.

which should be taken

Tech is feeling the pressure again, but the following three names look more than capable of solid gains throughout the year. Of the three, analysts expect big returns from Alibaba.

Disclosure

[ad_2]

Source link