[ad_1]

of Invesco QQQ Trust will follow Nasdaq-100The biggest stocks in the technology – hard Nasdaq Composite The index is up more than 30% this year, after a rough 2022. It caught many investors by surprise, leaving some feeling lost. But not all tech stocks are in the Nasdaq. Some of the ones that aren’t selling are trading at surprisingly cheap prices compared to their history.

Paycom software (PAYC 0.83%) And Veeva Systems (VEEV 1.61%) They are great examples. Both generate a lot of cash and a lot of revenue, and are growing at a respectable rate. They also have loyal customers and hover near all-time low prices. This is why I think stocks are a bargain now.

1. Paycom software

Paycom operates in the busy Human Capital Management (HCM) sector. Simply put, the products help companies hire, manage and pay employees. In doing so, it streamlines dozens of processes related to tracking time, managing benefits, and complying with regulations. It competes with industry giants. Automatic data processing And small challengers like Place of payment.

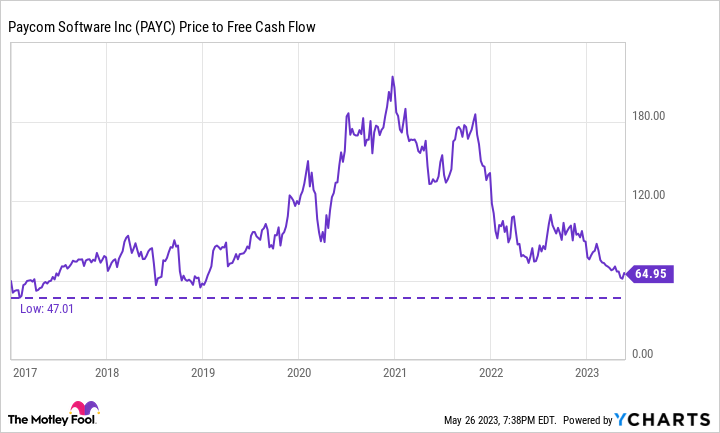

Despite intense competition, it is an unvarying success story. In the year The stock has risen 1,650% since going public in 2014. And customers and revenues increased 9% and 25%, respectively, from 2019 to 2022. But investing is about waiting. And Wall Street’s fears of a recession have driven stocks down with more free cash flow not seen since before the pandemic.

PAYC rate to free cash flow data by YCharts

Even though most of their revenue is tied up in subscriptions, HCM providers can still be hurt by price cuts. Customers usually pay based on how many employees use the system and how often they use it. When there is a recession, the number of workers decreases. But Paycom has proven resilient. At the depth of the pandemic, income growth has slowed to 7 percent. Additionally, even if the staff count changes, it will not lose many customers.

Paycom already accounts for 93% of customer revenue year over year. And Betty’s sacrifice is getting harder to let go. BET — which stands for Better Employee Marketing Interface — launched in 2021. It streamlines the payroll process, putting it in the hands of employees. That’s the same with changes to vacation, time cards, and benefits. At Betty, many of the cumbersome, error-ridden HR processes are simplified or skipped outright. Customers who use Betsy stay at 99% rate. Paycom is the latest move proving to be the most innovative company in the HCM industry. From the beginning, management has focused on simplifying complex HR processes. Delivery will continue. I believe it will continue to deliver to shareholders.

2. Veva Systems

Veva calls itself the industrial cloud for life sciences. The name fits. The company offers a variety of software solutions to customers trying to solve two different problems. The first is for companies trying to sell their products in the life sciences industry. The second is for the companies that create those products. Of course, some customers do both. Its platform integrates applications to help clients navigate everything from managing clinical trials and optimizing business processes to planning client communications and events. It has attracted amazing customers including comprehensive service Horizon Therapeutics, Bristol Myers Squibb, NovartisAnd Modern.

It is an underrated business with outstanding financial aspects. CEO Peter Gassner is quick to point out that the company is always focused on profitable growth. It’s not just a rumor. Since 2016, free cash flow per share has grown 12-fold and has never gone a year without positive free cash flow. Although management has not provided free cash flow guidance, it is projecting it. Non-GAAP (edited) Operating income will decline slightly this year. Wall Street has a tepid forecast. Prior to last year, annual revenue growth had never fallen below 25 percent. Even last year’s 16% is nothing to scoff at. But management is guiding for just 9% in the current year, through fiscal 2024.

VEEV price to free cash flow data by YCharts

Perhaps anticipating a negative response, the administration released projections for fiscal year 2025. This represents about 19% revenue growth and 25% non-GAAP operating income growth. Such a back-loaded prediction should be met with skepticism. But Gassner and Co. have gotten the benefit of the doubt in Veeva’s decades as a public company. I’m willing to take a chance considering the low valuation compared to the story.

Jason Hawthorne has held positions at Paycom Software and Veeva Systems. The Motley Fool owns and recommends positions in Bristol-Myers Squibb, Paycom Software and Veva Systems. The Motley Fool recommends Moderian. The Motley Fool has a disclosure policy.

[ad_2]

Source link