[ad_1]

giga71/iStock via Getty Images

Raytheon Technologies CorporationNYSE:RTX) is a company with a strong competitive advantage in the defense and aerospace industry, supported by its technical expertise, significant scale and sustainable switching costs. When it is expected to be used Because of geopolitical tensions and the rebound in air travel and defense spending, I believe those benefits are priced into the stock price. In this article, I discuss RTX’s competitive advantage, air travel recovery, defense spending, and the stock’s valuation.

Overview and business units

RTX emerged from the merger of United Technologies Corporation and RTX Company in April 2020. The four main components of RTX include:

- Collins Aerospace Systems, which provides avionics, cabin interiors, mechanical systems and power controls to commercial and military customers;

- Pratt & Whitney specializes in the design, manufacture and service of aircraft engines and auxiliary power. rooms;

- RTX Intelligence & Space (RIS), which provides advanced intelligence, surveillance, reconnaissance, electronic warfare and cyber security systems; And

- RTX Missiles and Defense (RMD) is responsible for developing advanced missiles, precision-guided munitions, missile defense systems and weapon systems such as the Patriot Air and Missile Defense System and the Standard Missile family.

Sustainable competitive advantages

RTX’s competitive advantage stems from its technical expertise, significant scalability, and sustainable switching costs. The complexity of the company’s defense products creates a high barrier to entry for potential competitors. Building advanced missiles and missile defense systems requires specialized technology and significant expertise, which is less likely to be acquired by non-defense contractors, who may be unwilling to invest in such technology.

Due to its technical efficiency and scale, RTX has a strong advantage in the defense and aerospace industry, and its products have sustainable switching costs. Once customers choose their products, the technical complexity of these products makes it challenging to switch to other suppliers.

Moreover, the integration of these missile systems with different military aircraft and platforms creates permanent switching costs. Modern missiles are integrated with advanced targeting technology and the mission-critical nature of these systems means that customers are unlikely to switch to alternative suppliers without justification.

Recovery of the air traffic industry

I expect that the global airline industry will continue to struggle until 2024. But there is hope for profitability in North America in 2023. Globally, the industry’s losses will decrease to -$9.7 billion, which is a net loss margin of -1.2. In 2022, this represents a significant improvement from the $137.7 billion loss (-36.0% net margin) in 2020 and the $42.1 billion loss (-8.3% net margin) in 2021.

The expected improvement in the North American airline industry is due to a number of factors, including strong demand, the lifting of travel restrictions in most markets, low unemployment in most countries and expanded personal savings. These factors are fueling a revival in demand, with passenger numbers expected to reach 83% of pre-pandemic levels.

Despite inflation, the leisure travel industry continues to recover strongly as people prioritize their experiences and take advantage of the summer travel season. However, these inflationary pressures will dampen leisure travel to some extent.

Despite rising labor and fuel costs, airlines are reducing losses by improving efficiency and productivity. The price of fuel has increased by + 40%, contributing to the increase in fuel costs, and this year the gap is widening. However, airlines are being trained and regulated to operate better.

I expect RTX’s commercial aerospace business to benefit from this recovery. RTX’s exposure to the enduring tight body market, particularly through the Pratt & Whitney segment, should position it well for a quick recovery.

Geopolitical tensions to support defense trade

RTX’s leading position in the defense industry, along with its competitive advantage, should support continued growth in this segment. The defense business is expected to remain strong, driven by ever-increasing global geopolitical tensions and the need for advanced defense systems.

Widening geopolitical rifts between countries pose a serious threat to global diversity. The growing rivalry between the US and China, with China’s growing military strength shifting the balance of power in the Western Pacific and the US strengthening alliances in response, is one example of this rift. Other countries, including Russia and Turkey, are also generating foreign energy. Geopolitical tensions are also entering the economic arena, with some countries implementing protectionist policies and challenges for Western companies doing business in China and Russia.

In addition to exacerbating geopolitical tensions, the changing nature of warfare is increasing the need for countermeasures. Increasing adversary reach requires a truly regional and global perspective on effective command and control (C2). War is becoming faster because of the need to make quick decisions in times of competition and crisis.

The Advanced Missile Defense System market is expected to grow at a CAGR of 2.2% over the next nine years. The threat of intermediate-range missile launches and asymmetric warfare are the main reasons for increasing the defense budget. RTX has been able to secure several contracts recently. For example, RTX just won a $1.2 billion contract to supply Switzerland’s Patriot anti-missile defense system, as well as a $650 million contract to manufacture and deliver next-generation jammer mid-band systems.

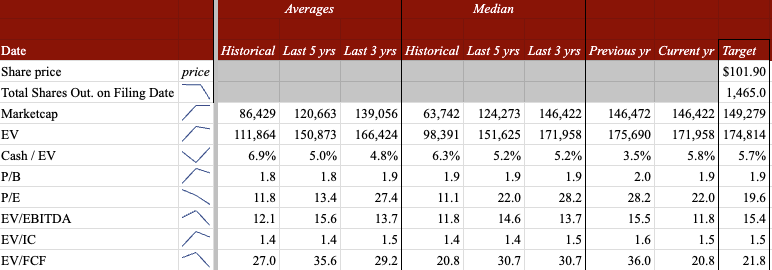

Price

Based on discounted cash flow (“DCF”) value, I value RTX shares at $102. I estimate the cost of capital for the aerospace/defense industry at 8.2% based on a capital-free beta of 1.23. I expect earnings to remain in the high single digits, supported by a recovery in air travel and strong defense spending, which is consistent with RTX guidance.

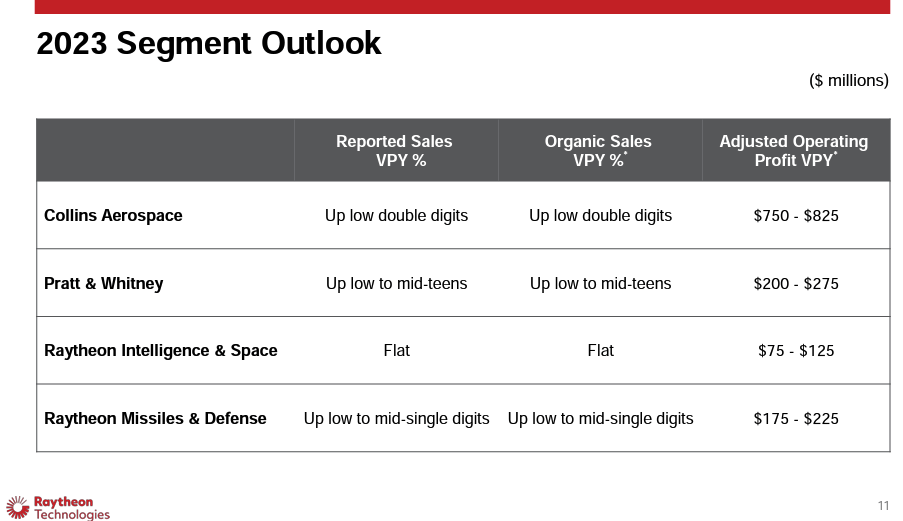

Company presentation

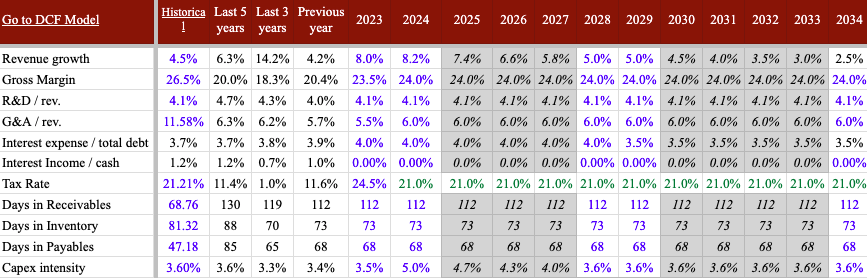

I expect marginal improvement to historical levels. Below are my guesses.

Author estimates and company documents

At a target price of $102 per share, the shares were trading at historic levels.

Author estimates, company documents and alpha search

Summary

Raytheon Technologies Corporation’s strong competitive advantage, technical expertise, significant scale and sustainable switching costs make it ideal in the defense and aerospace industries. However, despite the expected benefit from the recovery due to geopolitical tensions in aviation and defense spending, these things have already been paid for in the stock price. While Raytheon Technology Corp.’s exposure to an emerging narrower market and rising global geopolitical tensions should support continued growth, I recommend staying away from the stock at this time as it trades at historic lows.

[ad_2]

Source link