[ad_1]

Alastair Berg

The global lockdown of 2020 has resulted in the acceleration of the adoption of digital technologies, especially in the online education market. According to UNESCO, more than 1.5 billion students worldwide have been severely affected by school closures. Lockdown 2020. This massive shutdown highlighted online education as not just an optional extra, but a necessity. Even before the outbreak, there were a number of students taking at least one e-learning college course. added In consecutive years since 2002.

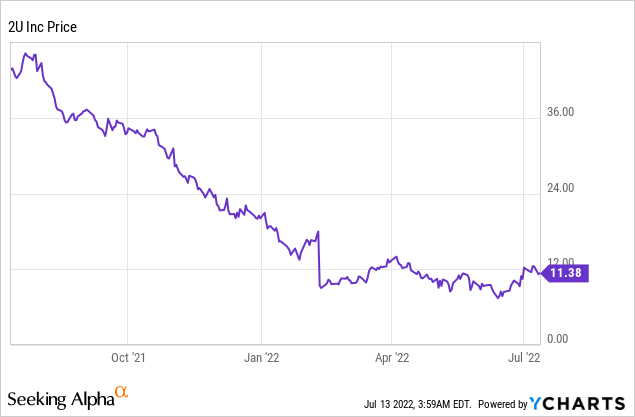

2U (Nasdaq: Two) is one of the “Big Two” online courses in the US, along with Coursera ( COUR ). The platform has partnerships with major universities that include MIT, Harvard and Berkeley, which I believe is a unique selling point. The stock is down 79% from its February 2021 high, mainly due to higher inflation, a rising interest rate environment and single-digit growth in the first quarter.

I previously covered 2U stock in February 2022, when it was trading at $9/share. I then priced the company at a conservative $13/share. Since then, the stock has gained 20% to ~$11/share. A $1 billion buyout offer was recently reported, which served as a catalyst to move the stock toward its intrinsic value. However, the stock is still undervalued and offers at least 30% upside potential. Let’s go back to school for the juicy details as we dive into market opportunities, acquisitions, finance and pricing.

The $1 trillion e-learning TAM

With colleges and universities now requiring a two-pronged approach to education (classroom and online), are old-fashioned classes really necessary? According to a recent survey, more than 75% of academic leaders believe that online learning is equal to or superior to classroom learning. 70% of these academic leaders believe that online courses will be a “critical” part of future education strategies. But of course, this is not only about teachers and universities, they use online education to make better use of their time and generate more income.

One in four students believe they learn better in online classes. Now though I don’t believe online education will replace every physical part of it because of the important social benefits of college. There are many benefits to taking online classes, including lower costs to greater inclusion and autonomy. Professionals who live far away from physical universities and those with family responsibilities will find online education more compatible with their lifestyles. After all, we live in an age of “on-demand” so why don’t we binge-watch graduate lectures like you do on Netflix?

So it’s no surprise that according to GM Insights research, the e-learning market is predicted to exceed $315 billion by 2021 and grow at a whopping 20% CAGR through 2028. 1 trillion dollars At the end of the period.

A $1 billion buyout?

A recent Bloomberg report suggests that 2U may acquire an Indian-based ed-tech company of Baiju. According to a person familiar with the matter, Byju’s has offered to acquire 2U for $1 billion in an all-cash deal, which equates to a value of $15/share. The stock is up ~20% on the news, but has a potential 30% upside from its $11.30/share valuation ($877M) at the time of writing.

Although this offer has not yet been officially confirmed and still requires 2U board approval, it makes a lot of sense. I did some digging Byju’s and this company are backed by Legendary Hedge Fund Tiger Global, Chinese Tech Titan Tencent and the Zuckerberg-Chan Foundation. In addition, the company has been very active in acquisitions in 2021. According to Global Information, Baiju has acquired 10 ed-tech companies by 2021, with a total value of $2.5 billion. Almost 10% of the web traffic to the edX website (owned by 2U) comes from India, so this provides a huge synergy.

Business strategy

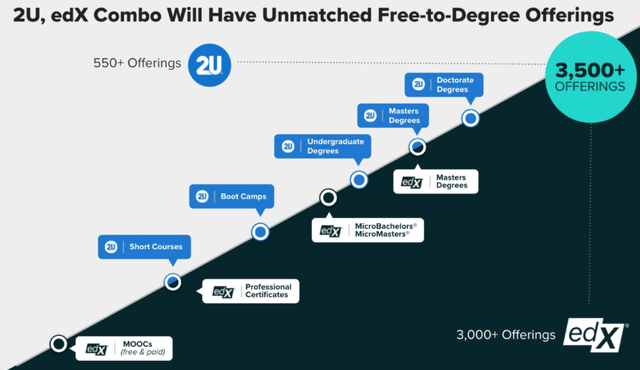

I previously covered the 2U business model in a previous post, but here’s a brief overview. 2U merged with edX in 2021 and now has more than 44 million students enrolled worldwide. It has important partnerships with 38 of the top 40 universities, 1,200 enterprises and more than 230 university and corporate partners.

The companies have more than 4000 courses and use a “free to degree” strategy that offers short free courses first before selling students on to premium degree programs. 2U conducts sales through a controversial strategy of having salespeople call students, which I discuss further in the Concerns section.

2U free degree (2U Investor Relations)

The administration plans to convert only 0.03 percent of EdX’s 39 million students into its premium degree offerings. The goal is to reduce student acquisition costs from $3900 to $3500.

2U vs Coursera Comparison

Best courses?

I compared 2U to its biggest rival, Coursera (COUR). In terms of courses, 2U (and edX) offers a better selection of premium universities like Harvard, MIT, Berkeley, Cambridge and Oxford. The best university is Stanford with Coursera (the company was founded by a Stanford professor). However, Coursera has a much better selection of courses than both Google ( GOOG ) ( GOOGL ) and Meta ( Meta ), which are very popular with digital professionals (like myself) who want to learn.

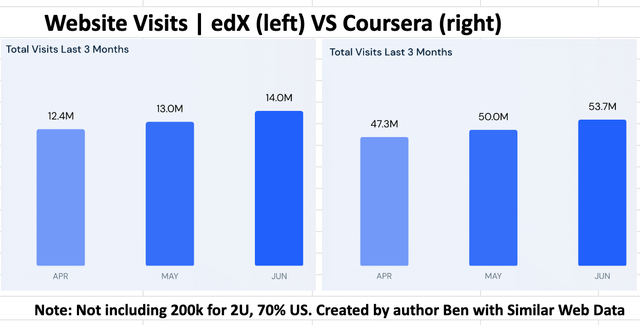

Website traffic and demographics

Coursera has the largest amount of website traffic with 53.7 million website visits in June 2022. edX, on the other hand, had 14 million site visits during the same period. 2U’s official website has very little web traffic with 200,000 visitors. However, it’s worth noting that 2U has a network of unbranded websites and landing pages that bring in an unknown number of leads. It is worth noting that traffic has increased in the last three months for both websites and could be the first sign of a good earnings report for the second quarter of 2022.

Website Visits Coursera Vs 2U (Created by the author from the same website)

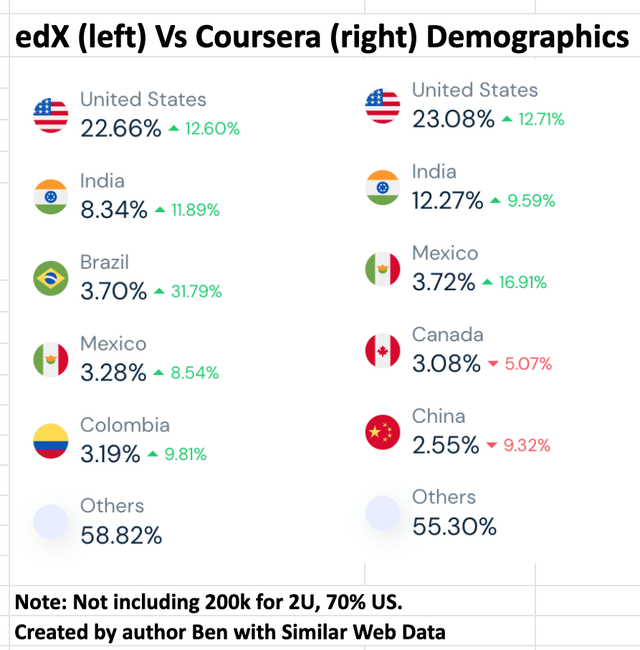

I’ve read some common misconceptions online that edX’s primary web traffic is from India and therefore may not be able to afford 2U’s premium courses at income levels. However, the website traffic data I compiled in the chart below shows EdX (owned by 2U) and Coursera have very similar demographics. Approximately 23% of website visitors are from the US, followed by India (8% vs 12%) and then Latin American countries such as Mexico (3%), Colombia (3%) and Brazil (4%).

2U vs Coursera website demographics (Created by author Ben with similar web information)

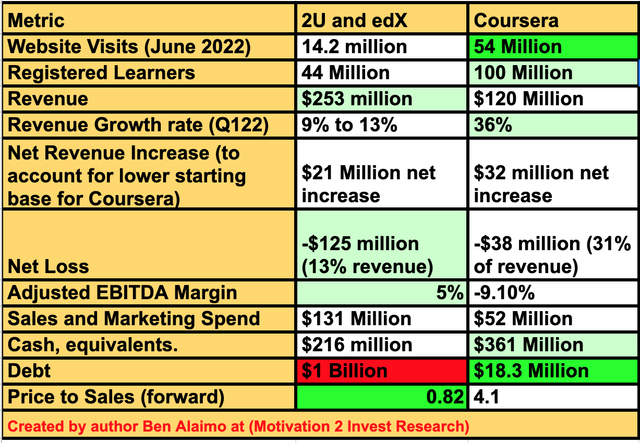

Financial comparison

In the table below, I’ve compared 2U (including EdX) and Coursera on various metrics, going through each one line by line. As mentioned earlier, Coursera has 3.7 times the amount of web traffic compared to 2U (including EdX). In addition, Coursera has more than double the number of enrolled students at 100 million, compared to 2U’s 44 million. However, financials show that 2U generates significantly more revenue. 2U generated $253 million in the first quarter of 2022, $132 million more than Coursera’s $120 million. At first glance, one may say, “Coursera is growing very fast.” This is partly true, but when we dig deeper, we see that the difference is not so serious. Coursera posted 36% year-over-year revenue growth, compared to 9% for 2U over the same period. However, Coursera has a smaller revenue base to begin with so the increase in net revenue was only $32 million for Coursera, compared to $21 million for 2U, a difference of $11 million.

Coursera vs 2U (Created by author Ben at Motivation 2 Invest)

Next, we compare net losses (yes, both companies operate at a loss). 2U reported a net loss of $125 million, or 13 percent of revenue, in the first quarter. Coursera generated $38 million, or 31 percent of revenue, although Coursera’s loss as a net figure was lower, but higher as a percentage of revenue.

2U also has a positive Adjusted EBITDA margin of 5%, which is better than Coursera’s at -9.1%, although the company may be underestimating these. 2U spent a staggering $131 million on sales and marketing in the first quarter of 2021, so without this expense the company could be “profitable” in traditional terms. It’s clear that Coursera is seeing more efficiencies in its sales and marketing spend as it “only” spends $52 million, but has generated more revenue. Coursera has a strong balance sheet with $361 million in cash and only $18.3 million in debt. That’s an eye-watering 2U with $1 billion in debt, better than $216 million in cash.

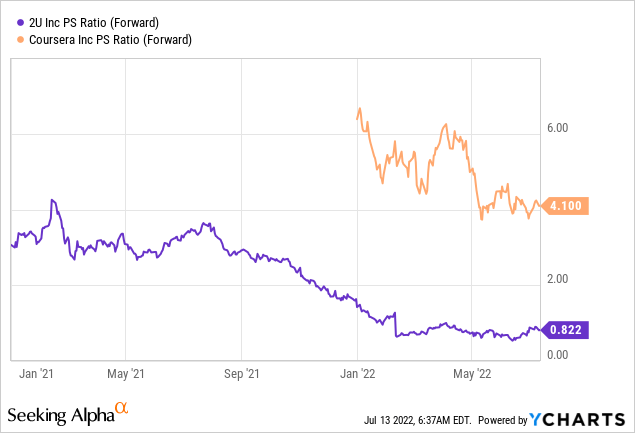

Price

The evaluation is where we see a real difference between 2U and Coursera. 2U is much cheaper than Coursera and trades at a price to sales ratio (forward) = 0.82, which is much cheaper for Coursera than a price to sales ratio (forward) = 4.1. In terms of market cap, Coursera has $2.23 billion versus $877 million for 2U.

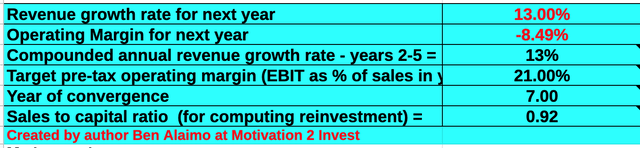

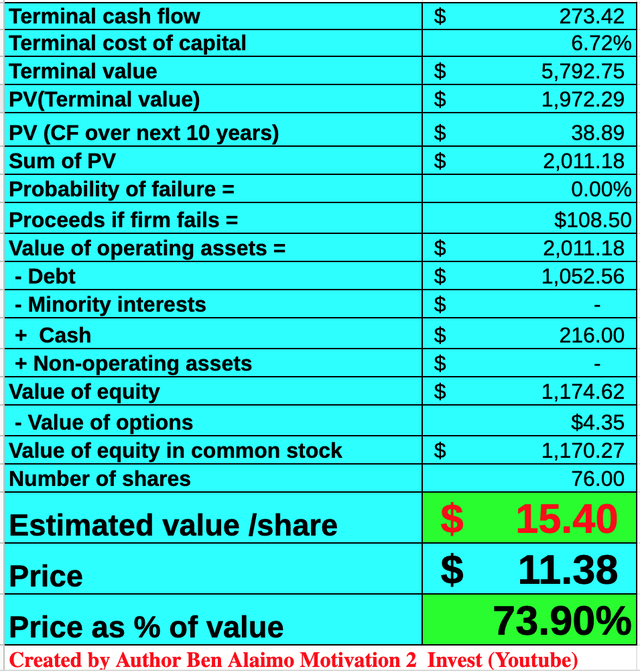

To internally value 2U, I plugged the latest financials into my advanced valuation model, which uses the discounted cash flow valuation method. I forecast 13% revenue growth for next year (based on the company’s own estimates). In addition, I predict a very conservative 13% revenue growth over the next 2 to 5 years, while some analyst reports predict 20% annual growth.

2U share price (Created by author Ben at Motivation 2 Invest)

I also forecast that the company will grow its gross margin to 21% in the next 7 years and will need to spend less on sales and marketing.

2U share price (Created by author Ben at Motivation 2 Invest)

Given these factors, I find a fair value of $15/share, while the stock is currently trading at ~$11.38/share, which is 26% undervalued at the time of writing. $15/share is also the proposed purchase amount that gives me confidence in my valuation model.

As a comparison, a potential buyer Baiju is worth $22 billion and has more than 115 million enrolled students, compared to 2U’s 44 million students, worth $700 million.

Accidents

High debt

As mentioned earlier, 2U has a whopping $1 billion in debt, which is surprising and risky for a growth company operating at a loss. Competitor Coursera (which I also believe is a great company), has a more conservative approach and therefore a higher valuation.

Controversial sales methods

2U has been accused in a Wall Street Journal report of controversial sales tactics that could get students to pay off $115,000 in debt and get a degree. As with any news report, I believe this algorithm is inflated. I believe that all college education is overpriced and somewhat exploitative of students (whether in the classroom or online). However, online education is often much cheaper and thus more inclusive. But I hope 2U takes these reports seriously and gets the sales people to communicate better as consultants.

Final thoughts

Overall, 2U is a leading ed-tech provider, and the company’s elite university partnerships with Harvard, MIT, Oxford and others are its competitive advantage in my eyes. The industry is competitive; However, with the ed-tech market predicted to be worth $1 trillion by 2028, I believe it’s big enough for 2U, Coursera and others. The company has a high level of debt and is operating at a loss while investing in growth. However, the stock is intrinsically undervalued, and recent buyout talks have served as a catalyst to move the stock.

[ad_2]

Source link