[ad_1]

Technology stocks are rarely associated with retirement plans. Pension stocks are considered to be businesses with stable, predictable profits and returns to shareholders in cash for dividends. In contrast, tech stocks are often viewed as unpredictable money-burning gambles.

As a young investor, I was tempted to simply focus on playing it safe — or at least what I thought was safe. Until I discovered one simple principle that changed my entire perspective.

Playing it safe can pay off.

I share the principle for now. But first, for retirement accounts, I would point out that many investors prioritize making money over beating the average return of the stock market. However, this focus can lead to questionable investment decisions.

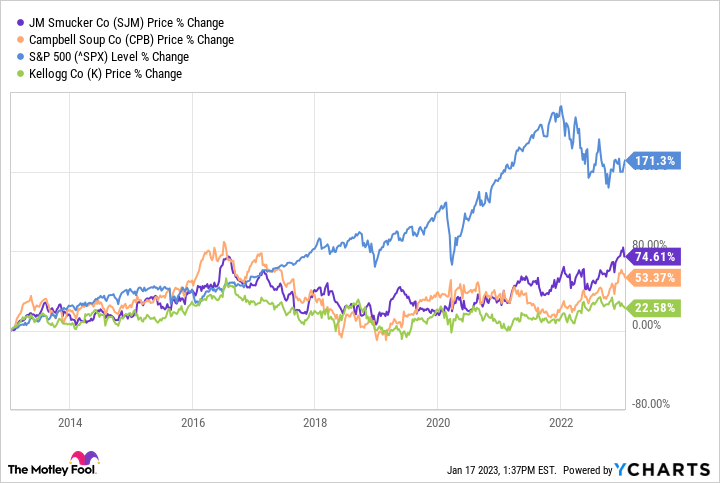

Three companies are often considered large pension stocks. J.M Smucker Company, KelloggAnd Campbell’s soup. All three have been in business for more than a hundred years, pay better-than-average dividends (dividend yields), and are down more than 10% at any time these stocks were bought 10 years ago. , as the table shows.

SJM data by YCharts

The problem is, the chart shows that they are giving investors below average. Therefore, by picking up safe stocks, investors always travel higher, which is good. But they paid dearly.

Investors who only want positive returns and good dividend payouts could choose to invest in something like it. Invesco S&P 500 Equal Weight Consumer Staples ETF. This product pays quarterly distributions to fund holders at many stable companies (including JM Smucker, Kellogg and Campbell) and has also maintained positive results for over a decade.

The benefit of the Invesco S&P 500 Equal Weight Consumer Staples ETF — and many exchange traded funds (ETFs) for that matter — is that returns are very close to average. S&P 500.

^ SPX data by YCharts

So, if your goal is to inch your way toward retirement without going back, investing in ETFs is probably the smartest choice. Some ETFs can provide the security you need without paying a premium.

A principle to challenge investment assumptions

Investing in ETFs may seem smart. And indeed, for many investors, it can be an important part of their overall investment strategy. But in this article, I want you to understand how important the Pareto principle is.

The Pareto principle basically states that 20% of inputs control 80% of outputs. And it’s a principle. Berkshire Hathaway Vice Chairman Charlie Munger agrees, at least loosely. Berkshire has produced astronomical returns for shareholders. But as Munger once said, “If you took our top 15 decisions, we’d have a mediocre record.”

In other words, a small 15 inputs account for the majority of Berkshire’s performance — the Pareto Principle at work.

The younger you are, the more thoughtful you may be as you approach your retirement journey with this principle in mind.

Let’s take three tech companies as examples: Microsoft, AppleAnd Nivea (NVDA -1.84%). 10 years ago, a 30-year-old investor invested $10,000 in each company. It was a wonderful decision, fast-tracking the path to early retirement.

AAPL data via YCharts

That $30,000 total investment would be worth about $743,000 today. And by age 40, they’ll be well on their way to retirement.

Maybe accuse me of cherry picking these tech stock examples. Well, I’m guilty as charged, because that’s the point. There are few companies that have come back in the last 10 years like cherry-picked Microsoft, Apple and Nvidia. It was three of the smaller Preeto Principle inputs that made most of the returns.

Once understood, this principle can change one’s entire investment philosophy. However, there are inherent drawbacks to investing this way.

For starters, you pick a lot of bad stocks. Additionally, your portfolio may underperform the market for a period of time.

The approach has inherent problems. But that’s why the Motley Fool’s investment philosophy takes this into account and includes this tenant: invest new money regularly.

Did you pick a bad stock? it’s okay. Try again next time with new money. This increases your chances of finding the next Nvidia.

The Motley Fool also recommends holding onto winning investments for the long term — not selling quickly to “lock in a profit.” Imagine failing repeatedly in stock picks, finally stumbling on Nvidia in 2012, and then selling after a 100% rally. Locking in profits used to lock you in. went out A life-changing retirement nest egg.

If you’re young and looking to retire early, you’ll probably need to score a few points:beat Investments. In fact, it’s clear that market-beating stocks will get you to the bottom line faster than average or below-average returns. Those market-beating stocks may come from the technology sector. But they can also come from other sectors.

However, for the strategy to work, you must adapt to a different investment mindset that accepts being wrong more often and is determined to be an investor for the long term.

Jon Quast has no position in the stocks mentioned. He has a spot in the Motley Fool and recommends Apple, Berkshire Hathaway, JM Smucker, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2023 $200 calls on Berkshire Hathaway, long March 2023 $120 calls on Apple, short January 2023 $200 calls on Berkshire Hathaway, short January 2023 $265 calls on Berkshire Hathaway and short March 2023 $11 calls on Apple. The Motley Fool has a disclosure policy.

[ad_2]

Source link