[ad_1]

Tech investors are forever looking for the next best thing. However, a prudent investment may be in companies that are already successful and have established themselves in their respective industries.

Savvy investors have the opportunity to buy two great stocks to hold for 2022 and beyond. Alphabet (GOOG -2.27%) (GOOGL -2.46%) And Shopify (Shop -7.22%) They are the dominant forces in digital advertising and e-commerce, respectively. These are two industries with strong secular tailwinds that could boost growth over the long term.

Alphabet is approaching $100 billion in annual profits.

Alphabet is arguably the largest advertising company in the world. Google Search and YouTube are home to some of the most widely used ad-supported products. According to Statista, Google Search holds a staggering 83% market share in search engines worldwide. Similarly, YouTube boasts 2.6 billion monthly active users. Of course, advertisers follow consumers, which means the popularity of these services has attracted marketers looking to influence purchasing decisions.

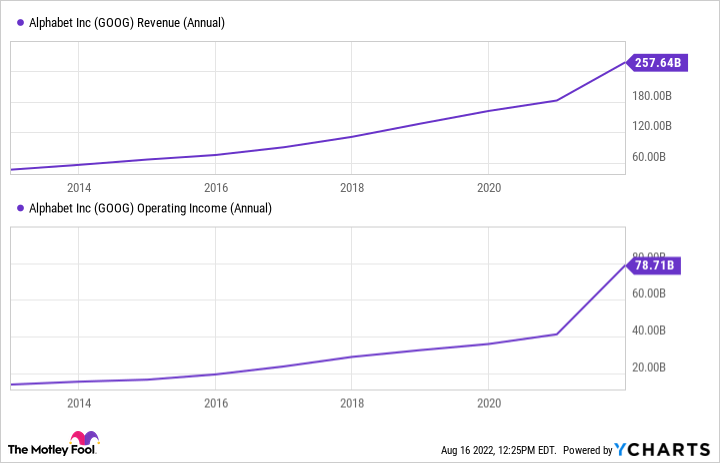

GOOG revenue (annual) data by YCharts

As a result, Alphabet’s revenue grew from $55.5 billion in 2013 to $257.6 billion in 2021. Operating income also increased from $15.4 billion to $78.7 billion over the same period. Alphabet’s popularity has turned into tangible profits that can be extended over the long term. Marketers They will spend $763 billion globally in 2021, an increase of 22.5% compared to last year. Interestingly, the share of spending on digital channels has increased from 52.1% in 2019 to 64.4% in 2021.

Shopify’s revenue increased.

Similarly, Shopify is operating in an industry ripe for growth. The company helps merchants set up and optimize their online sales channel, a business that has expanded due to the pandemic. However, Shopify’s growth has recently slowed as consumers prefer to leave home and shop in person, at least temporarily. In the long run, a more significant share of spending is shifting online. According to Statista, 14% of spending in the US will be online by 2020. This figure is predicted to grow to 22 percent by 2025.

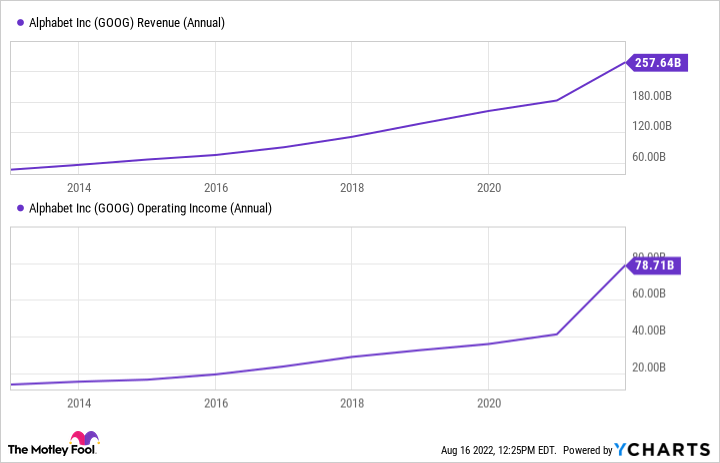

SHOP revenue (annual) data by YCharts

Shopify earns a monthly premium from merchants on its platform and takes a percentage of their revenue. So, when people spend more money online, Shopify has an advantage. Already, Shopify’s business has bucked the trend in recent years. That’s up from $24 million in 2012 to $4.6 billion, helping the company to post a $269 million profit in 2021 after reporting a $2 million loss in 2012.

Shares of Shopify and Alphabet are relatively cheap.

SHOP PS Ratio data by YCharts

Fortunately for savvy investors, Shopify and Alphabet shares aren’t expensive. On the contrary, they are relative bargains. With a price-to-sales ratio of 10, Shopify has never been cheaper by this measure. Font’s price-to-sales ratio of 6 is at the lower end of the historical average. Investors looking for smart buys might feel better adding shares of Shopify and Alphabet.

Alphabet CEO Susan Frey is a member of The Motley Fool’s board of directors. Parkev Tatevosian has positions in Alphabet (C shares) and Shopify. The Motley Fool has positions and recommends Alphabet (A shares), Alphabet (C shares) and Shopify. The Motley Fool recommends the following options: long January 2023 $1,140 calls on Shopify and short January 2023 $1,160 calls on Shopify. The Motley Fool has a disclosure policy.

[ad_2]

Source link