[ad_1]

“Cheap” and “tech” don’t often appear together in the same sentence. “Technology” is often associated with “excess”. While this was the case a few months ago, with the recent market selloff, some stocks are starting to look attractively priced.

However, some stocks should be cheaper due to declining business or bad executions. From a business perspective, they are two stocks that are cheap and still in good shape. Alphabet (GOOG -5.81%) (GOOGL -5.63%) And Autodesk (ADSK -1.58%). Let’s dive into these two stocks and see what makes them attractive buys in the market today.

1. Alphabet

Alphabet’s business units have some of the most lucrative advertising space. With the market dominance of Google, YouTube and the Android operating system, advertisers flock to those platforms to deliver their ads to a diverse audience.

This advertising focus is also the biggest problem of Alphabet. In the first quarter, Alphabet got 80 percent of its revenue from advertising. With the way the economy is going, a recession seems inevitable. Advertising spending is typically cut during recessions, so investors expect Alphabet’s revenue (and earnings) to drop.

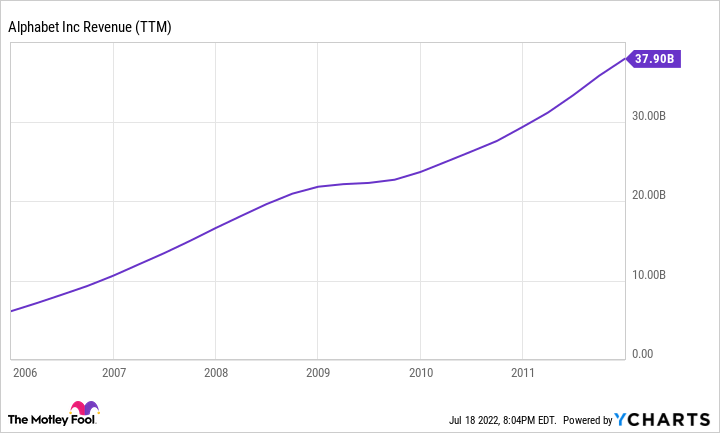

The disappointment pushed Alphabet’s price-to-earnings (P/E) ratio down to 20, its lowest since 2012. However, I believe how well Alphabet did during the last extended recession of 2008-2009.

GOOG revenue (TTM) data by YCharts

I think Alphabet has the brand power to maintain its leadership position in the ad space, and despite slowing growth (revenues were still up 23% year over year) in the first quarter, Alphabet is doing well.

Even if Alphabet sees a short-term headwind, it will emerge stronger than when it entered the recession. It also has a growing Google Cloud division, up 44% year over year in Q1. The cloud computing industry is expected to be $1.6 trillion by 2030, and if Alphabet can maintain its current market share of 10%, this could be a $160 billion future opportunity for Alphabet. For reference, Alphabet’s current annual revenue was $270 billion.

Investors will get an update on Alphabet’s outlook for the economy when the company reports earnings on Tuesday, July 26th. However, with so much pessimism baked into the stock, now may be a good time to buy one of the world’s leading companies.

2. Autodesk

Since many software companies operate on a subscription model, the impact of economic downturn on these companies is reduced. For example, Autodesk customers could decide whether to buy the next version of their modeling software every year. When times were tough, they didn’t grow up. Now, customers don’t have that choice as they have to pay an annual fee to continue using the product.

Autodesk software is used by engineers and architects around the world and is essential for them to do their jobs. This importance makes Autodesk a relatively recession-proof business. However, businesses are reluctant to add more licenses, so it may still struggle to increase sales.

Still, another advantage Autodesk has is geographic diversity. Here’s what the revenue breakdown looks like for Q1 of fiscal year 2023 (ending April 30).

| Area | Percentage of total income | Q1 Revenue Growth (YOY) |

|---|---|---|

| America | 41.4% | 24% |

| Ema | 38.4% | 17% |

| APAC | 20.2% | 10% |

Source: Autodesk EMEA-Europe, Middle East and Africa. APAC-Asia-Pacific. Yoi = over a year.

If the US goes into recession, Autodesk’s growth will slow, but not disappear. Despite a potential recession on the horizon, management is still guiding for fiscal 2023 billings growth of 18% to 21% and earnings per share (EPS) at a midpoint of $3.93.

After switching to a subscription model, Autodesk’s earnings are skewed, and it’s not useful to compare the valuation to the pre-subscription model. However, looking at a more formal number, Autodesk’s price-to-free cash flow (P/FCF) ratio is 25, close to Alphabet’s 23.

Regardless of the economy, Autodesk is doing well. So now the production represents a good time to enter an important company in architecture and engineering.

Susan Frey, an executive at Alphabet, is a member of the Motley Fool’s board of directors. Keithen Drury has positions in Alphabet (C shares) and Autodesk. The Motley Fool has positions and recommends Alphabet (A shares), Alphabet (C shares) and Autodesk. The Motley Fool has a disclosure policy.

[ad_2]

Source link