[ad_1]

Seoul-based equity management platform QuotaBook has raised $11 million in funding led by Elefund, with participation from Access Ventures, Hana Securities and South Korean fintech company Viva Republica. Some of its previous backers, including Draper Associates and Capstone Partners, also joined the round.

The Korean startup, which graduated from Y Combinator’s (YC) Winter 21 batch, was founded in 2019 by former venture capitalists Andy Choi, Dan Hong and Pilson Jun. In their investor capacity, the trio noticed that startups in Korea and many other Asian countries still rely on Excel to manage their cap spreadsheets, stock options, stakeholders and other related information.

That means the startup’s backers are forced to make sense of these spreadsheets as well. “VCs were stuck with Excel sheets or very old enterprise resource planning (ERP) tools, which were not web-based and could only be installed on Windows machines,” Choi said. “It created a frustrating and error-prone process where startups and investors exchanged critical equity information and corporate information via document attachments or text messages.”

Everyone was typing the information by hand because investors and startups had different formats and had to re-run the checks twice on each side, Choi told TechCrunch.

“I had a case where the startup didn’t provide the most up-to-date cap table Excel sheet for more than two months, which made it difficult for us LPs to update investment valuations and returns needed to report,” Choi said.

QuotaBook will use its recent funding – totaling nearly $20 million – to digitize the equity/fund management process, provide a common standard for access to security-related information, and securely host online stock and board meetings. The startup also plans to expand its product team into Southeast Asia and launch services for investors in the Middle East, Choi pointed out. ” of [Asian] Market is still very young, so we want to establish local offices or teams in regions like Vietnam, Indonesia, Singapore and Taiwan.

The outfit currently employs 45 people, Choi added.

Image Credits: Kotabook

QuotaBook claims to have more than 3,500 startups and investors users in South Korea, where the company started. According to Cho, about 40% of startups in Korea use Quotabook’s service for cap table management. It launched its Restricted Stock Units (RSU) management service in June.

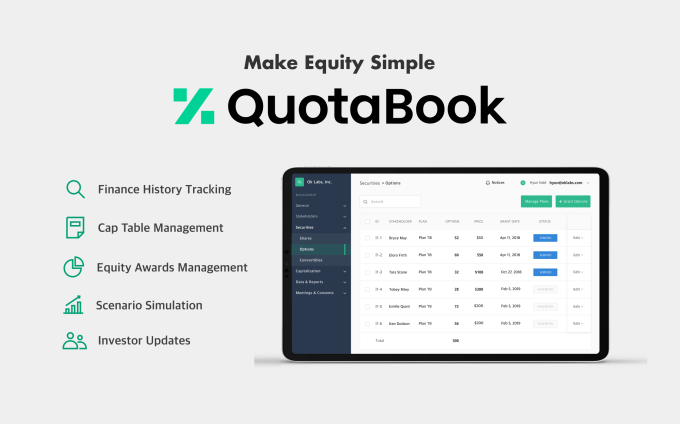

Its SaaS-based platform offers two services: an equity management service for startups, which provides cap table management, stock option management, investor reporting, investor approval, shareholder and board meetings, and a fund management platform for investors, providing financial information. Investment and returns management, portfolio management, LP commitment and returns management, LP reporting and fund activity analysis.

Its novice users start with a freemium plan. If you upgrade to a plan with more features, such as guarantees and stock options, you’ll be charged a higher number of stakeholders, Choi said. Investors are also charged based on their fund’s AUM and number of portfolios.

QuotaBook recently launched QuotaSpace, a communications platform that focuses on communication and networking between investors and their portfolio companies. Choi said more features are also coming.

“After our core business is stabilized, we plan to expand into new business opportunities with the network and information we cover. Assisting in secondary sales and providing information services are a few examples,” he said.

QuotaBook did not provide the review when requested. The startup raised its first round of funding in June 2021 from Draper Associates, Carta Ventures, Elefund, Goodwater Capital and Scale Asia Ventures.

[ad_2]

Source link