[ad_1]

After a brutal start to the year, with the Nasdaq down more than 30% from its November peak, the tech-heavy index has bounced back to life, hitting a 20% low since June. It remains to be seen whether that low marks an official bottom and whether this is simply a bear market rally or the start of a new bull market. But one thing is certain – technology and development have reached a peak in the last month and a half. Let’s examine a few reasons why this is the case and why tech will continue to be effective as long as the rally lasts.

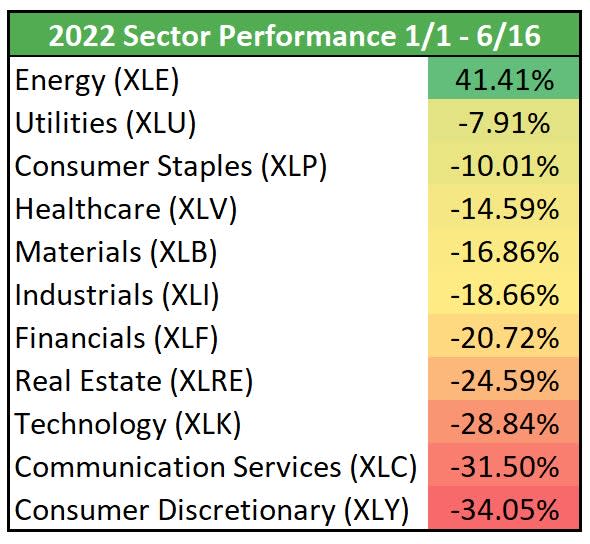

This bearish rally was fueled by countertrends from battered and oversold stocks. Made from the beginning of the year until June 16ThGrowth areas such as technology XLK and consumer discretionary XLY led the downside as the energy sector (defined by the XLE ETF) rose.

Image source: Zacks Investment Research

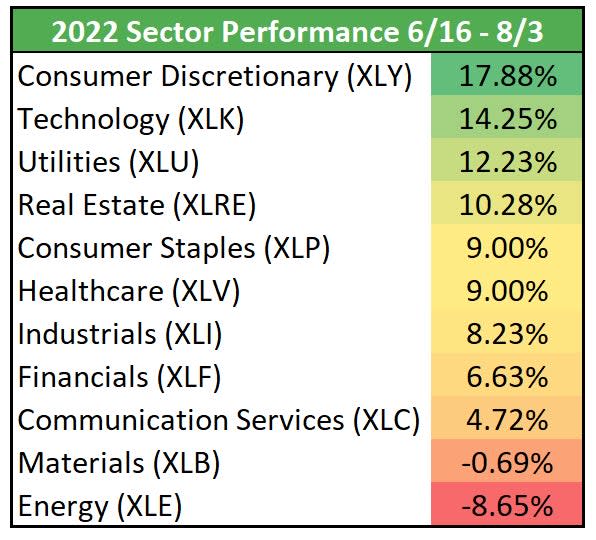

And since mid-June, it’s been leading the opposite in energy (XLE) lag and consumer discretionary (XLY) and technology (XLK).

Image source: Zacks Investment Research

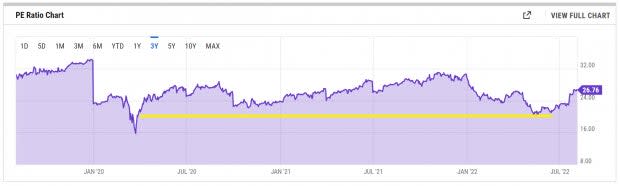

Additionally, the Nasdaq’s P/E ratio hovered around 20 in May and June this year, a level not seen since it collapsed in early 2020 due to the coronavirus. Progress and technology were oversold, and the correction of that situation began.

Image source: YCharts

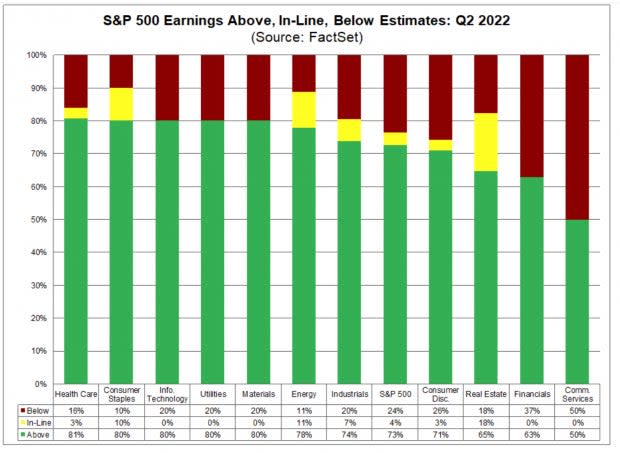

Earnings in the second quarter were not as bad as expected. Eighty percent of information technology companies beat earnings estimates, while revenues grew nearly 8 percent year-over-year. It’s a testament to their strength and resilience that many of the biggest tech companies have held their own in these uncertain and volatile times.

Image source: FactSet

Finally, inflation expectations have declined over the past few months. Some inflation is OK, but when concerns about high inflation fade, tech stocks tend to rally. This can be seen in many areas, including energy prices and bond yields. XLE is now in a bear market over 20% off its highs.

Image source: StockCharts

Bond yields fell to record highs in June, as evidenced by yields on the 10-year note.

Image source: StockCharts

Technology tends to outperform during bullish cycles, and underperform during bear markets. And that’s what we’ve seen in the back-and-forth dynamic that’s happened this year.

Looking for the latest recommendations from Zacks Investment Research? Today, you can download 7 best stocks for the next 30 days. Click here to get this free report.

Energy Select Sector SPDR ETF (XLE): ETF Research Reports

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Select Consumer Discretionary Sector SPDR ETF (XLY): EFL Research Reports

Click here to read this article on Zacks.com.

Zacks Investment Research

[ad_2]

Source link