[ad_1]

National Express (GB: NEX) recently announced its half-year results for 2022. Group revenue was £1.32 billion, up 33% year-on-year. Revenue rose 54.3 per cent to £197.8 million from the same quarter last year.

NEX posted an operating profit of £42.3 million last year against a loss of £26.1 million. The damage has led to the disruption of many services due to nationwide travel restrictions.

Meanwhile, revenue is moving at a faster pace from the company’s coach business, particularly airport transfers in the UK and Spain.

National Express’ Spanish subsidiary, ALSA, has shown good progress in terms of revenue and profit in HY 2022. ALSA operates buses in Spain, Morocco, Switzerland, Portugal and France. Revenue rose to £444 million from £287.3 million in HY 2021. Operating profit rose to £50 million from £17 million a year earlier.

Overall, the stock has fallen by 33% in the past year.

A hopeful attitude

The outlook for the company looks promising as public transport is back in business due to high travel demand. In the medium term, the company expects the bus business to gain more momentum due to high inflation and the cost of living.

National Express has a massive £2.1bn tender pipeline and has won around 16 contracts, expecting £150m in revenue. These contracts are distributed across the services under ALSA and its North American shipping business.

The shipping business in North America showed a 28 percent revenue growth in the kit and nine out of 16 contracts. However, the lack of drivers in the region causes some headwinds and can affect profits. Hiring more drivers in the region is a priority for the company. With an average salary increase of 12%, it is hoped to overcome this problem and serve the contracts in full force.

The group’s CEO, Ignacio Gerat, said: “The road ahead will not be without challenges. But we believe, we are well in an inflationary environment; Resistance to slowing economic growth; And we’re taking every step we can to address the school bus driver shortage in the industry. Keeping these challenges in mind, we maintain our full-year guidance and look forward to 2018. Regarding 2022, we continue to expect to restore full-year dividends.

View from the city

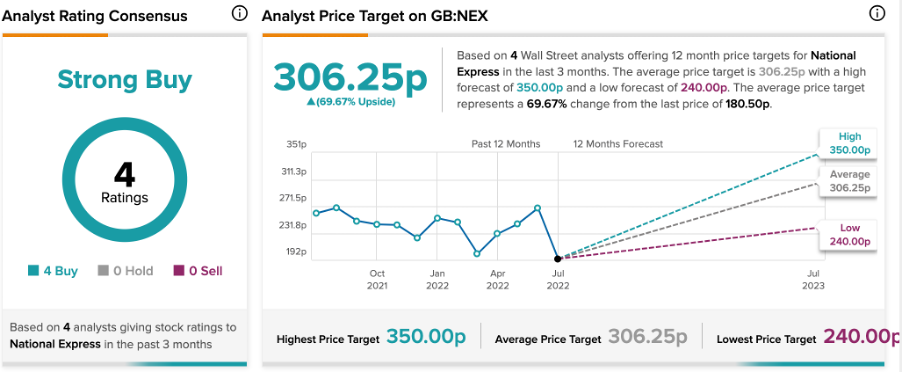

According to Tipranks, National Express stock has a consensus rating of Strong Buy based on four Buys.

NEX’s average price forecast of 306.3p represents a 69.6% change from current levels. The price target is a low and high forecast of 240p and 350p, respectively.

Owen Shirley at Bernberg Bank, who has a buy rating on the stock, recently cut his price target to 240p from 300p.

Concluding thoughts

Rising fuel prices, coupled with ever-inflation, are forcing travelers to use more buses and trains. This creates an attractive scenario for the company’s future earnings growth. Meanwhile, the bidding process and winning the contract will give more confidence to the company’s stakeholders.

Read full description

[ad_2]

Source link