[ad_1]

In 2021, it was a pretty short period of time for a few months when robot investments could be protected from broader market forces. We all fundamentally and implicitly understood that this was not the case, but it was a good time.

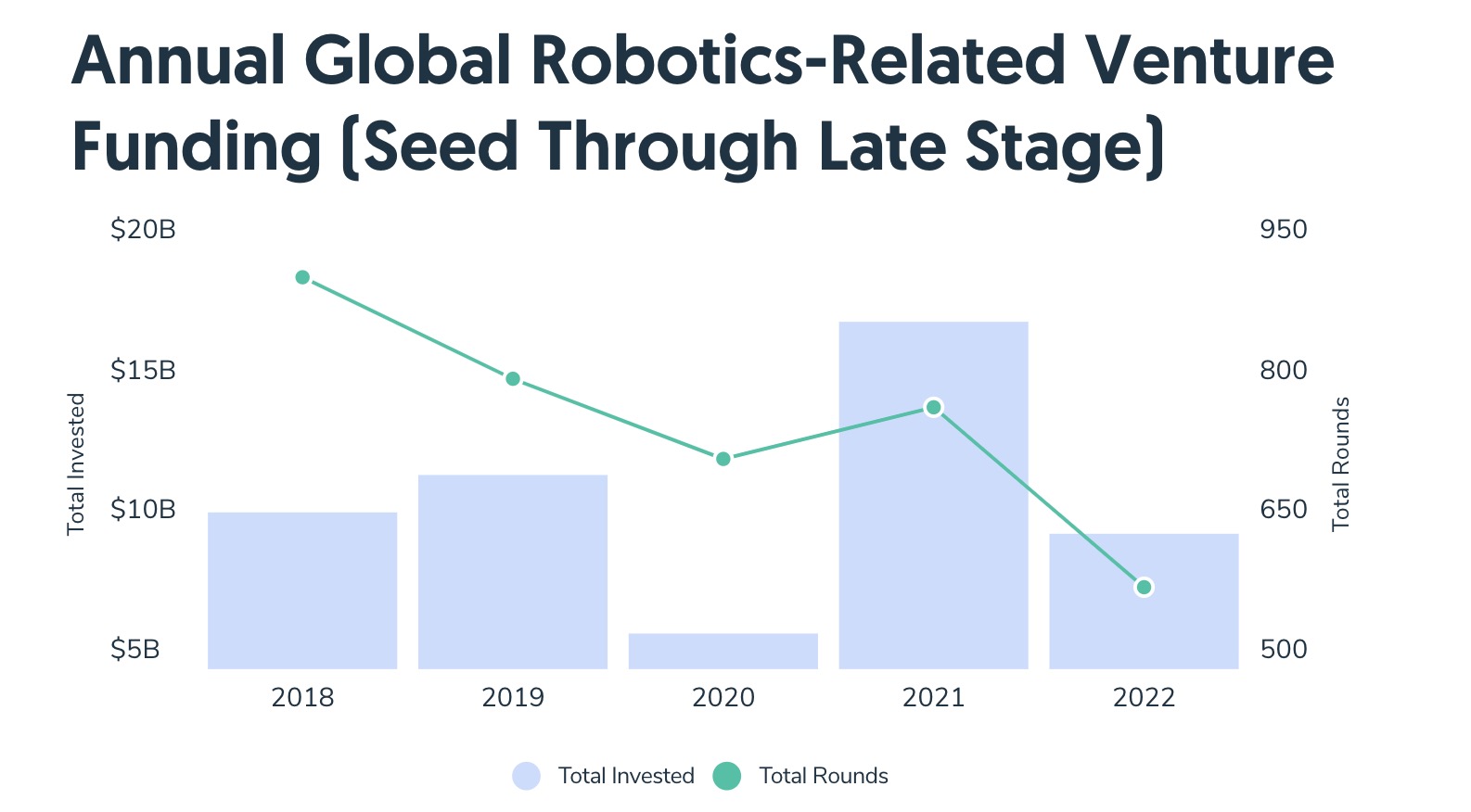

In fact, there was little protection in there. Although the headwind was increasing there was still enough forward to keep going for a bit. But everything comes down to earth in the end. Now that we’re about a month into 2023, we can assess the damage. Looking at these graphs put together by Crunchbase, things look really wrong.

Image Credits: Crunchbase

Two main points:

- In the year 2022 was the second worst year for robotics investments in the last five years.

- The figure has been steadily declining for the past five quarters.

At the first point, 2020 was the lowest. Also, what an unusual event it was with a global pandemic. Uncertainty does not breed investment confidence. Even more surprising are the full-year figures given how investor confidence has held up to the start of last year. Things really started to slow down in Q2. A cursory look at the bar graph may indicate that 2021 is unusual. Yes and no. Yes, as far as acceleration. No, until the long view. The question is not if those bars will start growing year over year, but when.

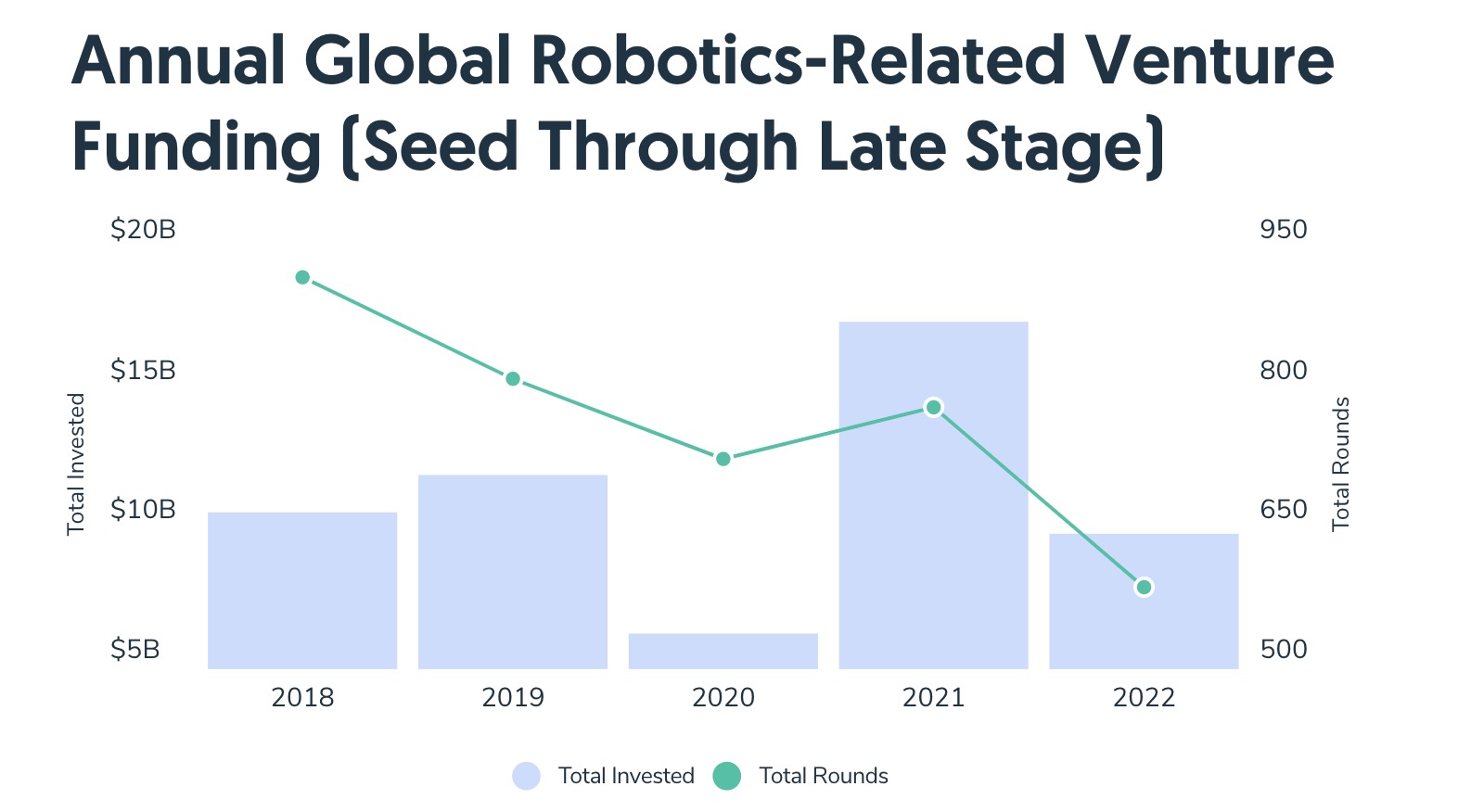

Image Credits: Crunchbase

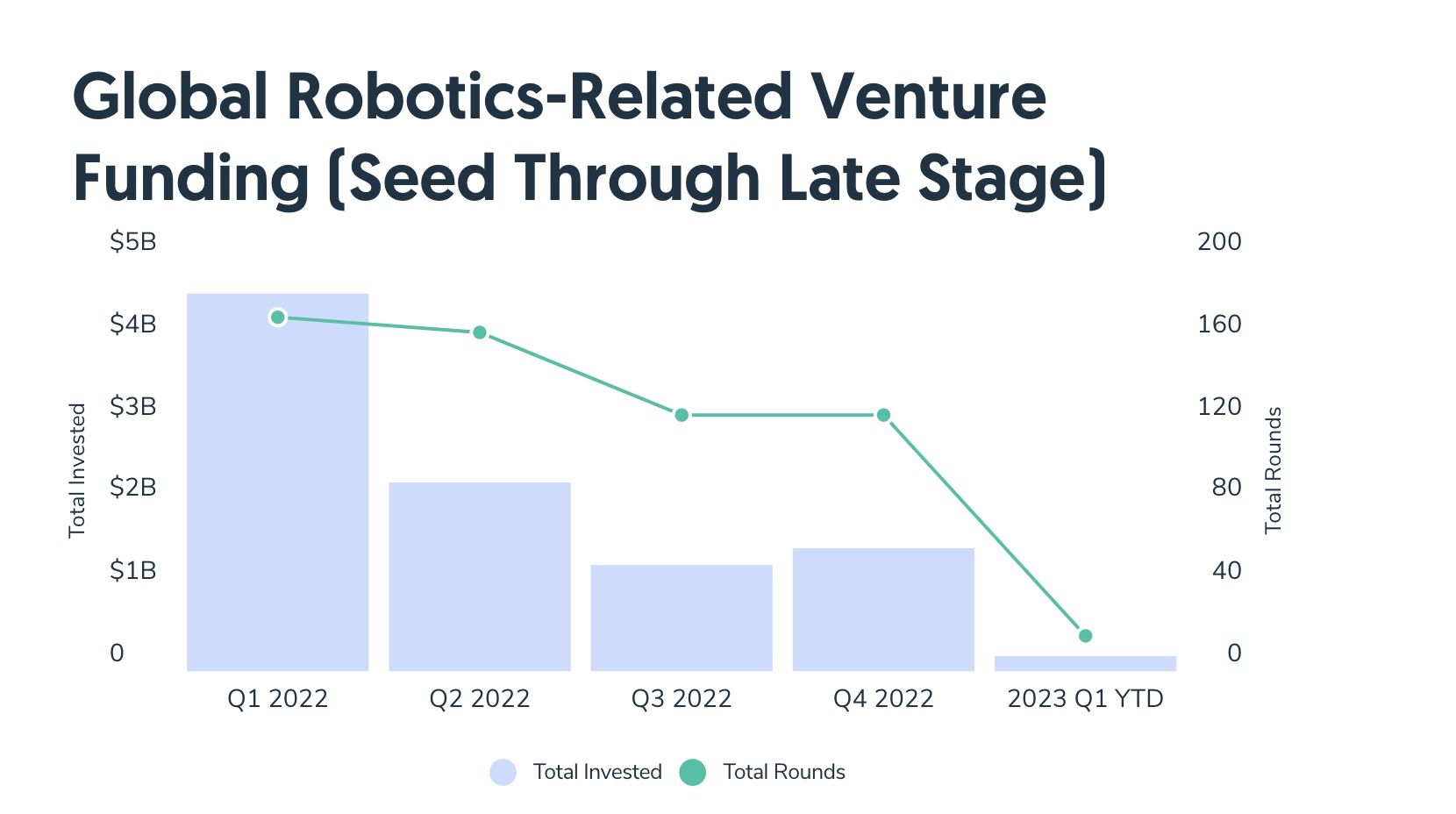

The same thing that stopped investments in 2020 accelerated them next year. Even when things reopened, jobs were hard to fill and companies across the board were under intense pressure to automate. As good as it is, we’re not ready to label automation and robotics as “recession-proof.” But I suspect that those who control the purse strings understand that these downward trends are more the result of the macro environment than anything related to robotics.

But for some first-timers, that’s cold comfort. This year, many runways were dramatically shortened. Comfort may come somewhere along the way, but in many cases decisive action is needed for those unable to close the loop on what may have felt like a foregone conclusion 12 months ago.

Given the choice between acquiring and closing some of them, M&A activity appears to be high. There’s certainly less money floating around, but few can turn down a good fire sale. In some cases, that leads to ways to consolidate products and portfolios.

Incidentally, I’m seeing investments pick up for the year, but that seems to be part of the natural cycle of companies waiting until after the holidays. On the other hand, actual recovery seems inevitable, but only those with high-powered crystal balls can tell exactly when.

[ad_2]

Source link