[ad_1]

Posted August 14, 2022, 6:10 am.

James Morton Turner

Wellesley College/The Conversation

The U.S. Senate passed the sweeping Climate, Energy and Health Care Act on Aug. 7, 2022, which would pour an unprecedented $370 billion into energy and climate programs over the next 10 years — including incentives to expand renewable energy and electric vehicles.

Rapid and widespread adoption of electric vehicles is essential for the United States to meet its climate goals. And the new bill, which includes other health and tax-related provisions, is intended to encourage people to trade in their gasoline-powered cars for electric vehicles, and provides tax credits of up to $7,500 for new electric vehicles and up to $4,000 for electric vehicles through 2032.

But there’s a catch, and it makes it difficult for most EVs to qualify for the new incentive.

The bill, which needs House approval, would require new electric vehicles to meet stricter consumption standards for critical materials, battery components and final assembly to qualify for tax credits. While some automakers, such as Tesla and GM, have well-developed domestic supply chains, no electric vehicle manufacturer currently meets all the billing requirements.

Building a domestic EV supply chain

At first glance, the revised EV tax credit seems like a smart move.

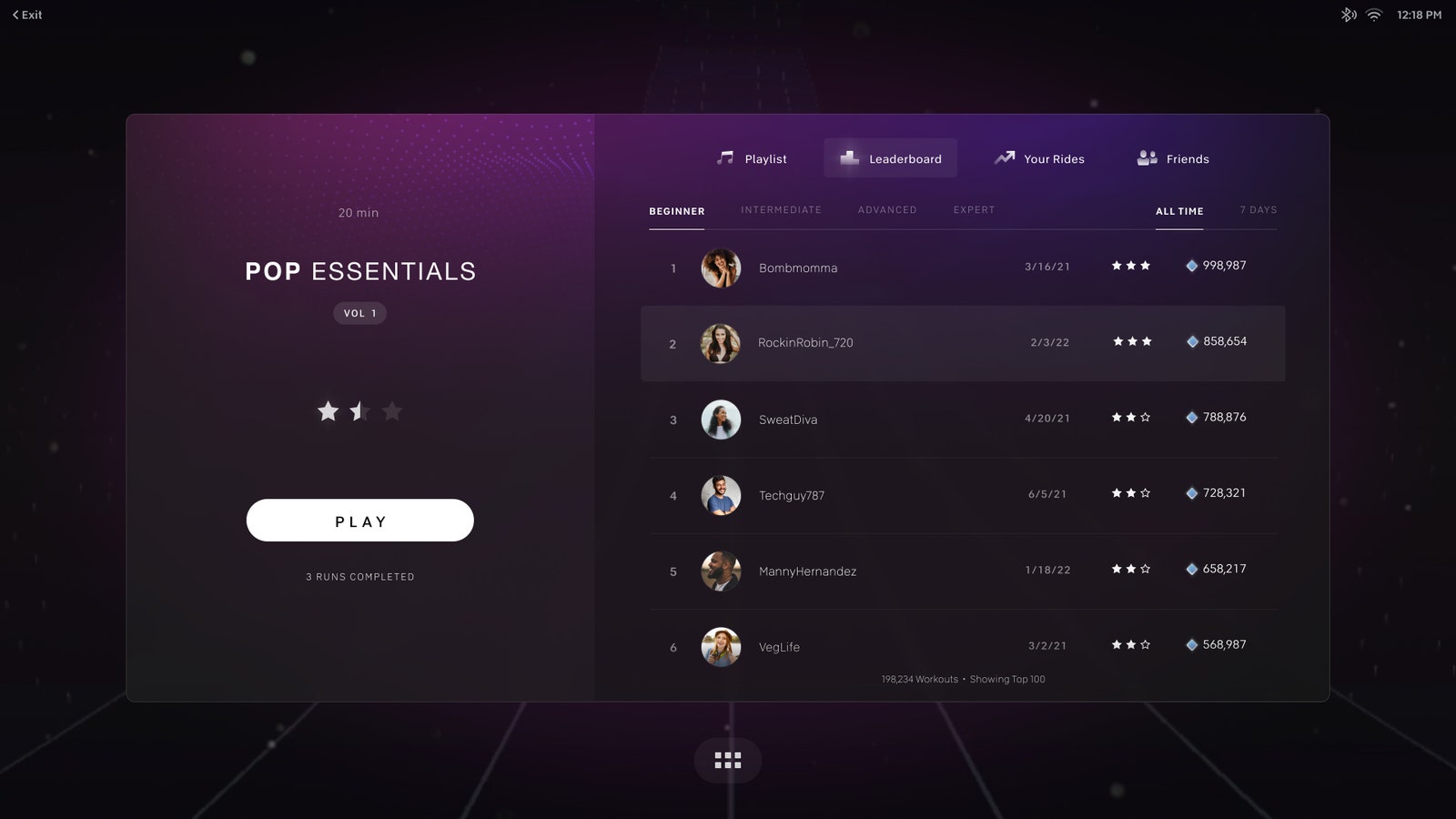

Existing US policy allows a credit for the first 200,000 electric vehicles a manufacturer sells. Those credits helped jumpstart demand for EVs. But industry leaders including Tesla and GM have reached that point, with most foreign automakers’ vehicles still eligible. The bill would eliminate the cap on individual automobiles and extend tax credits until 2032 — for any vehicle that meets production requirements.

China currently dominates the global supply chain for materials and lithium-ion batteries used in electric vehicles. This is no accident. Since the early 2000s, Chinese policymakers have adopted aggressive policies to support advanced battery technologies, including investments in mining, materials processing, and manufacturing. In my new book, Charged: Batteries and Lessons for a Clean Energy Future, I discuss how China started the race to a clean energy future.

Senator Joe Manchin, Democrat of West Virginia, who previously stalled efforts to push the measures through the deeply divided Senate, said he hoped the requirements would help boost America’s domestic supply chain for critical minerals.

EV incentives complement other U.S. policies aimed at spurring domestic EV manufacturing capacity. In the year Included in the 2021 Infrastructure Investment and Jobs Act are $7 billion in support to accelerate battery supply chain development and a $3 billion Advanced Vehicle Manufacturing Loan program included in the current bill, known as the Inflation Reduction Act. .

The problem is that the Inflationary Reduction Act’s source requirements come online starting in 2023 and ramp up quickly, making the plan likely to backfire. Instead of promoting electric vehicle adoption, the policy could make all electric vehicles ineligible for tax incentives.

Even Tesla’s Gigafactory will be based in China.

The bill does not include incentives for any new vehicle that includes battery materials or components, designed, manufactured or assembled by a “foreign entity of concern” – including China.

According to Benchmark Intelligence, a market research firm that tracks the battery industry, China currently controls 81 percent of the world’s cathode production capacity, 91 percent of the world’s anode capacity, and 79 percent of the world’s lithium-ion battery production capacity. By comparison, the United States has 0.16% of cathode manufacturing capacity, 0.27% of anode manufacturing capacity, and 5.5% of lithium-ion battery manufacturing capacity.

Even the US’s most advanced battery factories, such as Tesla’s Nevada Gigafactory, currently rely on materials manufactured in China. While Ford plans to expand its domestic supply chain, its latest deal is to produce batteries from Chinese manufacturer CATL.

In the year In addition to excluding materials and components originating from China starting in 2023, it requires at least a percentage of materials and components in batteries to be domestic or in line with the US’s fair trade agreements with Australia and Chile. The limit starts at 40% of the value of critical minerals in 2023 and will rise to 80% in 2027, with similar requirements for battery components.

If a manufacturer does not meet these requirements, the vehicle will not be eligible for the tax credit. Whether the Treasury Department will come up with exemptions remains to be seen.

Although EV manufacturers are pursuing plans to develop supply chains that meet these initial requirements, proposals for mining and processing facilities often face challenges. Indigenous and environmental concerns have delayed a proposed lithium mine in Nevada. In some cases, key materials such as cobalt and graphite are not readily available from local or fair trade partners.

Projects aimed at recycling can help meet demand. Redwood Materials is building a recycling facility in Nevada that will supply cathode and anode materials to support one million electric vehicles per year by 2025. Despite favorable forecasts, experts estimate that recycling will play only a small role in offsetting demand. Raw materials needed to boost electric vehicle adoption over the next decade.

How much could the bill do to reduce emissions?

Clean energy advocates called the bill historic. In addition to significant investment in renewable energy and electric vehicles, it provides support for technologies such as carbon capture and storage and zero-carbon fuels, and includes payments to curb methane emissions, as well as some trade changes that increase the use of fossil fuels. .

Forecasters predict that the climate package could help put the U.S. as a whole on a path to reduce greenhouse gas emissions by about 40% from 2005 levels by 2030 — still short of the Biden administration’s 50% reduction goal, but more.

But for the U.S. to hit those goals, electric vehicles must replace fossil-fueled vehicles by the millions. A proper EV tax credit will be critical, allowing manufacturers time to diversify their supply chains and making these vehicles more affordable for all Americans. The proposed policy risks short-circuiting EV tax credits when they are most needed.

Professor of Environmental Studies, Wellesley College

– 30 –

[ad_2]

Source link