[ad_1]

welcome to Exchange! If you received this in your inbox, thank you for your subscription and vote of confidence. If you are reading this as a post on our site, please register over here So you can receive it directly in the future. Every week, I look at the hottest fintech news from the previous week. This includes everything from funding rounds to trends to niche analysis to hot takes on a specific company or event. There’s a lot of fintech news out there and it’s my job to stay on top of it – and understand it – so you can stay informed. – Mary Ann

Although there was an economic crisis last year, I think it is possible to say that many of us did not see it Sudden full-on implosion The arrival of Silicon Valley Bank. While we could imagine that the financial institution was struggling, we didn’t expect it to close so soon after announcing the struggle. The impact of this event could be severe, widespread and – fearing it might not be dramatic – dangerous for many. Already, businesses are worried about making payroll, which can lead to unexpected closings and layoffs. As one VC put it: “It’s bad.” Our hearts go out to all those affected.

Natasha Massarenhas and I have spoken to several competitors in the space and are seeing a surprising amount of interest. You can read all about that here. We also spoke to several founders who have banked there to get their perspective on working with other TC employees.

Aside from TC’s multiple (and wonderfully reported, may I add) stories on the topic, there’s another newsworthy chatter I overheard, which you can find summarized here.

- A fintech investor told me he knew a single company had moved. More than 80 million dollars from Silicon Valley Bank on Thursday.

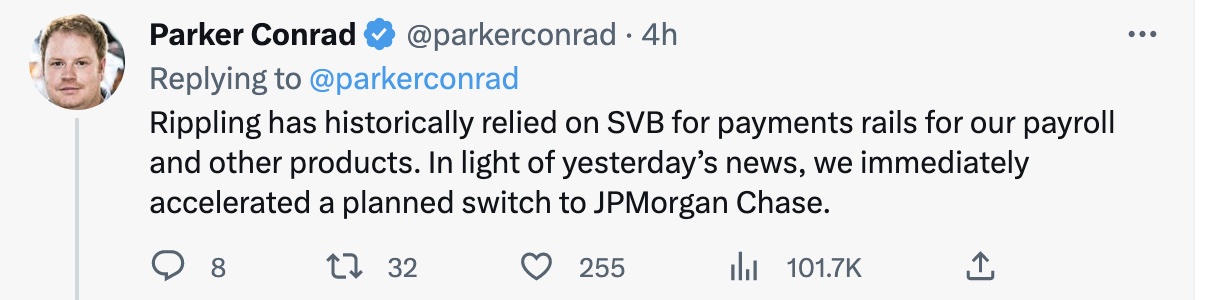

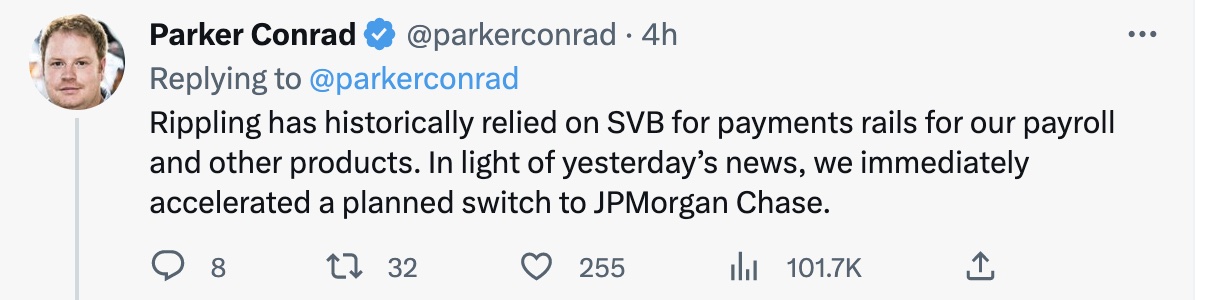

- Ripple founder and CEO Parker Conrad on March 10 He tweeted. He said his company has historically relied on SVB for payroll and other product payments, but according to the news, it “immediately accelerated the planned transition to JPMorgan Chase.” On that day, his company failed to pay salaries to some of the company’s employees and They apologized.Noting that future payroll processes will be handled by JPMorgan Chase, he said any payroll funds that work for the day’s check were “cut off from customers earlier in the week” and the company is “currently stuck with SVB at the FDIC.” Receiver”

- Unlike other VCs that encourage companies to move their money from SVB, fintech-focused Restive Ventures’ Ran Falvey urges people to do so. “calm down.”

- Some people think “”Bank run” ultimately led to the demise of SVB.

- Following the news, Brazilian fintech Trace Finance launched a new checking account for startups. Via email, a spokesperson told me on Friday that balances were withdrawn in full. 200 million dollars Since the news broke on Thursday, $100 million has already been moved from SVB to Trace Finance and deposited into a new checking account at Trace Finance. Clients of the new checking account include Rocket.chat, Mercado Bitcoin, Rentbrella, The Coffee and Gringo.

Note: I had a completely different entry planned for today based on a very interesting conversation I had with the founder of Neobank, but I have to jump into the impact of the Silicon Valley Bank shutdown, so I’ll save that for another day. The world of startups and ventures.

Image Credits: Twitter

Weekly news

I surveyed 7 fintech investors: Charles Birnbaum, partner; Bessemer Venture Partners; Aunkur Arya, Partner, Menlo Ventures; Ansaf Karim, Venture Partner, Lightspeed Venture Partners; Emmaline Shaw, Managing Partner; Prosperous Ventures; Michael Sidgomore, Partner and Founder; Broadhaven Ventures; Ruth Fox Blader, Partner; Song; Miguel Armaza, Co-Founder and General Partner; Gilgamesh Ventures. Not just because I did the survey, but because I was. Really They were impressed with how detailed and thoughtful their responses were. Spoiler alert: B2B payments and infrastructure are on fire and most investors expect to see more flat and lower rounds this year. Additionally, they were kind enough to share some of the advice they are giving their portfolio companies.

While the public market correction was widespread, technology and fintech stocks showed the biggest declines, according to a recent report. In particular, the FinTech Index – which tracks the performance of publicly traded financial technology companies – has fallen a staggering 72 percent in 2022. F-Prime CapitalThe State of FinTech 2022 Report. In the year After peaking at $1.3 trillion at the end of 2021, the F-Prime FinTech Index has fallen to $397 billion at the end of 2022. Insurance and proptech. I dug deep into the topic.

As Christine Hall reports: “The people who brought you credit monitoring services have now arrived. Credit Karma Net Worth, a new product that helps people discover, grow and protect their wealth. The new feature makes the 16-year-old company an end-to-end personal finance management platform that also offers debt, credit building and checking and savings products, Credit Karma founder and CEO Kenneth Lin said in an interview. As Credit Karma members go through their credit journey of establishing credit and getting their credit score, they’re now thinking about the next phase of their lives: “financial goals and outcomes,” he said.

Our monitoring Better.com Last week’s news (collaboration with the awesome Alex Wilhelm): Better.com’s SPAC merger closes, but the transaction is only approached from a cash perspective. From the company’s subsequent SEC filing: “About 92.6% of the Company’s Class A common stock is outstanding and approximately 7.4% of the Class A common stock is outstanding.” After satisfaction of such redemptions, the balance in Aurora’s Trust Account will be approximately $20,931,627. Although the filing date for the public filing through the SPAC is Sept. 30, it will be clear over the summer whether Better.com can move forward with the transaction. A source familiar with the company’s internal affairs told TechCrunch that it might be “time for the death spiral to begin.” Without earnings equity funding and confidence from creditors, the company may have to consider filing for bankruptcy in late 2023 or early 2024, the source added. It may be in the future of the company. Meanwhile, multiple sources familiar with Better.com’s “deal” with Amazon told TechCrunch that the deal does not actually represent a partnership between the two companies. Better yet, it announced its new Equity Unlocking tool last week and said it would initially only be available to Amazon employees. The news was framed to suggest some sort of partnership between the two, supposedly to boost Better.com’s credibility.

according to KPMGAccording to the latest FinTech Report, the US continued to expand fintech investments last year, with 2,222 deals totaling $61.6 billion in 2022, including $25.2 billion in the second half. Seed-stage fintech deals saw record investment as valuations of late-stage VC-backed companies showed significant downward pressure, attracting a record $4.5 billion, up from $3.4 billion in 2021. KPMG said in an email: “We are also looking at continued focus on BNPL, AI offerings/equipment and M&A activity in the first half of 2023.

Meanwhile, according to Pitchbook, enterprise fintech startups are capturing the wider fintech VC pool. The company’s latest New technology research Global VC investment in the broader fintech space totaled $57.6 billion across 2,747 deals in 2022, down 40.7 percent year-over-year and 18.1 percent year-over-year. Within the vertical, enterprise fintech startups raised 60.9% more capital from investors compared to their retail counterparts. In 2020, this number was 48.2% of capital.

Ingrid Lunden reports: “Startups are undervalued in the current economic climate, and one of the most promising players in the fintech world today has fallen under pressure. RailsrA UK-incorporated financial start-up formerly known as RailsBank, once valued at nearly $1 billion, has been acquired by a joint venture. And as part of the deal, it is going into administration to keep it going. [operating] . . . When reset. The consortium, which trades as Embedded Finance Limited, includes former realtor investors D Square Capital, Moneta VC and Venture Capital. The company is not disclosing the value of the deal. In the year In October 2022 It was valued at around $250 million when it was still liquid, so that’s one starting point.

By TC Tage Kene-Okafor: African Fintech Moniepoint (formerly known as TeamApt Inc) has appointed Pawel Swietech as Chief Operating Officer. Powell joins the business from Capital One, where he served as vice president for more than four years. At Capital One, he was head of the bank’s financial inclusion program. He was also a member of the management team of the world’s largest hedge fund, Bridgewater. At MoniPoint, SWIATECH’s financial inclusion experience is applied in building performance operating systems, driving strategy and building performance policies and tools. Moniepoint provides payment, banking, credit and business management tools to more than 600,000 businesses and processes more than $10 billion in monthly TPV. FinTech is backed by Lightrock, Novastar and QED, with global fintech investor Nigel Morris, managing partner, who founded Capital One.

Payments are huge Scratch Looks like he’s still trying (hard) to raise venture capital. Eric Neumer reported last week that the company is now raising $6 billion, instead of the $2 to $3 billion it was trying to raise in previous reports. According to Eric, Thrive Capital, General Catalyst, Andreessen Horowitz and Founders Fund will participate in the round, along with Goldman Sachs’ private wealth clients. In the meantime, there was a noise On Twitter About the company’s decision not to refund the $15 litigation fee for successfully litigated disputes. Meanwhile, there seems to be some talk of how the FedNow real-time payment system, which the Federal Reserve is rolling out over the next couple of months, will negatively impact Stripe. Oh, and for one fintech watcher’s opinion on why the company is “unbeatable” despite its challenges, go here.

The beginning of construction technology Kojo It’s expanding into fintech. The materials management company has launched a new invoice matching product designed to help contractors manage their costs, eliminate billing errors and streamline payments. Kojo, led by 31-year-old founder and CEO Maria Davidson, says 11,000 construction professionals use it across the country. The company has raised more than $84 million. TechCrunch covered the latest addition here.

Funding and M&A

Featured on TechCrunch.

Indian fintech unicorn Slice acquired a stake in the bank

Why Unicorn Socure chose to take the $95M credit facility

Fynn raised $36 million to finance students’ vocational education

Synthera has raised $15 million to help companies launch incorporated banking products in Canada

Elin will slightly delay online payments so you can try before you pay

Open banking startup Abound raises $601M to boost AI-based consumer lending platform

New U.S. policies seriously raise student debt relief.

And elsewhere

FilmHedge Closes $5M Series A Funding $100m credit facility

French fintech Aria bags €50m debt facility

Brazilian B2B payments platform Barte has raised $3M.

SaaS FinTech Grofin 7.5M

Tiger Global Leads Monay Deal for $6.5M

Guaranteed to find Compare.com

Okay, well, with that, I’m out of here now. Next week is spring break for my family, so I’ll be out and about and the wonderful Christine Hall will be taking over the newsletter for me. But I’ll be back for the March 26 edition! Until then, take care!! xoxo, Mary Ann

[ad_2]

Source link