[ad_1]

April 24 (Reuters) – Wall Street is set to close on Monday ahead of a busy week for earnings, with investors awaiting key data that could shed light on the U.S. economy and shape the Federal Reserve’s monetary policy.

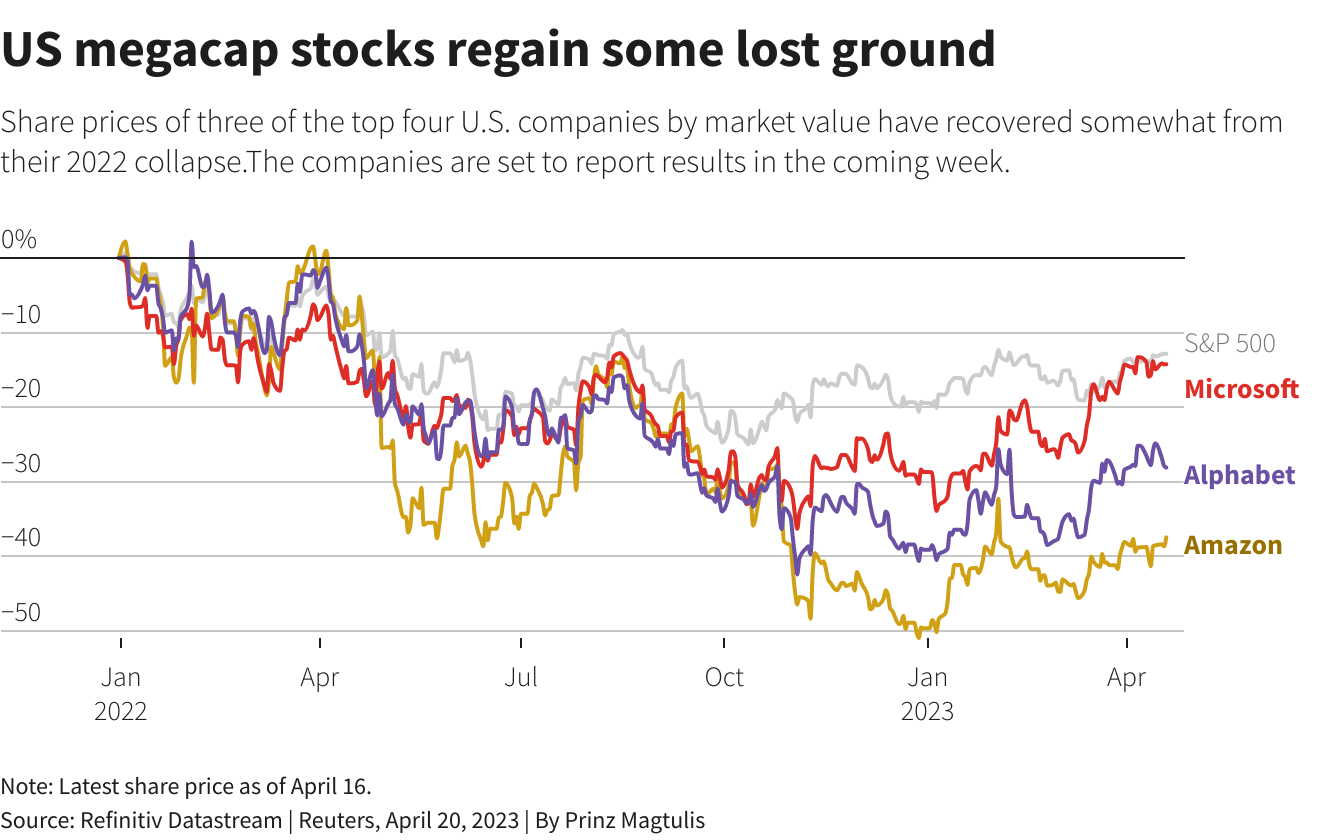

Major technology and growth companies Alphabet Inc ( GOOGL.O ), Microsoft Corp ( MSFT.O ), Amazon.com Inc ( AMZN.O ) and Meta Platforms Inc ( META.O ), which are worth more than 14% of the benchmark S&P 500 (. SPX) is scheduled to report results this week.

The rally in these stocks has supported Wall Street this year, and investors are waiting to see if the gains can continue amid a bleak economic outlook.

“These companies should not only be hit, but should lead to a re-acceleration of EPS growth in the second quarter and beyond … That’s what the path is looking for,” said Nicholas Collas, founder of DataTrek Research.

U.S. stocks were mostly flat at the start of the earnings season as results from big banks came in stronger than expected, easing fears from a banking crisis in March.

Investors will also be watching for signs of higher inflation and slower economic pressure from consumer firms.

Boosting sentiment, Coca-Cola Co ( KO.N ) gained 2% in premarket trading.

Of the 90 S&P 500 companies that have reported first-quarter results so far, nearly 77% topped analysts’ profit estimates, according to Refinitiv IBES data. The long-term average strike rate is 66 percent.

Earnings forecasts have been revised up slightly, with analysts expecting a 4.7% drop in quarterly profit, down from a 5.1% decline predicted in early April.

The first reading of first-quarter US GDP, the Personal Consumer Expenditure Index (PCE) for March, and consumer confidence numbers for April are among the data scheduled for release this week.

Mixed economic numbers last week bolstered bets on another 25-basis-point hike by the Fed in May, with money market traders pricing in an 85% chance of such a move, according to CME Group’s FedWatch tool.

On the other hand, the Speaker of the US House of Representatives, Kevin McCarthy, said that the House will vote on the spending and debt bill this week, fearing that the US government may hit the debt ceiling more than expected.

“Based largely on history, it looks like we’re going to solve this before we have a real crisis,” said Hugh Johnson, chief economist at Hugh Johnson Economics. But it is not clear that the Speaker of the House has a good plan and it will be accepted.

At 8:46 a.m. ET, Dow e-minis were down 41 points, or 0.12%, S&P 500 e-minis were down 2.75 points, or 0.07%, and Nasdaq 100 e-minis were down 1.25 points, or 0.01%.

Bed Bath & Beyond Inc’s ( BBBY.O ) shares fell 25.3 percent after the home furnishings retailer filed for Chapter 11 bankruptcy protection.

First Republic Bank (FRC.N) gained 1.5%. The regional bank, whose shares have plunged 88 percent in the wake of the US banking crisis, is expected to announce results after the market closes on Monday.

Reporting by Sruthi Shankar, Bengaluru Editing by Vinay Dwivedi

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link