[ad_1]

Piranha

Data Center REITs and Digital Infrastructure ETFs (NASDAQ: VPN) is a pretty flawless exposure. Unlike bonds, there is the prospect of earnings growth led by Equinix (EQIX), so the earnings will outperform Bond products are highly appreciated. In terms of risk, real estate’s heavy exposure and REITs’ relevance in a late-cycle environment puts VPN high on the list of solid ETFs for equity market investors to consider. It offers recession resistance and inflation resistance, and there isn’t much that can take the lion’s share of ETF elements.

A note on vulnerability

The exposures in this ETF represent important and irreplaceable infrastructure connected to rapidly and gracefully growing markets. We will talk about it in detail in our previous article, but the main thing to pay attention to is the IX market represented by EQIX. We’ve previously looked at infrastructure ETFs and found them to be relatively attractive to bonds. Regulated utilities have built-in resistance to inflation and interest rates, and are not subject to market forces, but they do not have pricing power. In fact, many infrastructures can be a bit lacking in pricing power in cooperation with regulatory authorities. Therefore, returns on such ETFs will be slightly lower relative to bonds, where coupons will definitely adjust, especially considering that infrastructure stocks are still riskier than bonds. What sets EQIX VPN apart is its ability to grow revenue quickly. The amount of investment in IX facilities will drive the value of those facilities, and this demand-side economic business will see revenues grow with little to no downside. Thus, today’s 5% income yield is thanks to such exposures, while the typical 4% YTM corporate bond is underperforming and therefore exposed to duration risks.

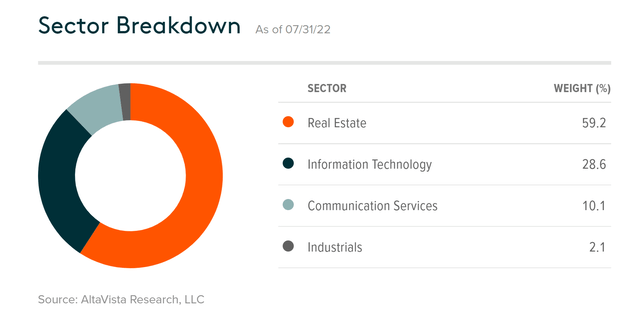

In a worst-case scenario, it’s still real estate exposure, and those leases will be a strong source of resistance. This real estate issue is important for VPNs.

Sectoring (globalxetfs.com)

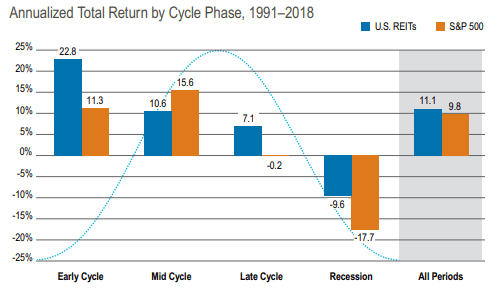

In such markets, REITs are an excellent source of recovery. They are better not only in falling, but also in reverse, so you can sit on them without timing the reverse. EQIX is a REIT, like the VPN portfolio’s other major telco exposures, again very safe with minimal income growth in lease agreements with virtually no risk.

REIT Returns (Cohen & Steers)

Conclusions

Income products are less than 5%. Currently, the typical corporate bond YTM has a YTM of about 4% compared to a reference target expected by the markets at about 2%. The risk premium here is 3% for risk-free instruments and 1% for corporate bonds, which may be relatively free from credit risk, but not free from duration risk. A corporate bond can be expensive in our opinion, something like a VPN really isn’t. After fees the yields are not as high as about 1.65%, but many insider companies are charged a premium as some don’t even pay dividends. Still, it’s ultimately the earnings result for shareholders because you have the right to build equity. With both persistence and value, VPN looks like a solid choice for the ETF investor.

While we don’t often make macroeconomic comments, occasionally drop by our Marketplace service here; Value lab. We focus on long-term only value propositions to find global misfit stocks and target a portfolio yield of around 4%. We have done well for ourselves over the past 5 years but have had to get our hands dirty in international markets. If you are a value investor and are serious about protecting your wealth, we at Value Lab can be your inspiration. Give our no-strings free trial a try to see if it’s for you.

[ad_2]

Source link