[ad_1]

In a couple of recent conversations I’ve had with VCs, one topic keeps coming up: defense technology. And while the war in Ukraine has created interest for some VCs in the sector, which focuses largely on building technologies for national defense, other long-term investors say there are few big tailwinds to invest now.

In the year When Russia invaded Ukraine in early 2022, “I think it woke people up,” Lux Capital founder and managing partner Josh Wolff said last month, “watching off-the-shelf commercial technologies being used to defend democracy.” Nation was an inspiration to many. Lux has become a major investor in defense technologies on land, sea, air and space, Wolff notes, with investments in start-ups such as military technology company Anduril and independent precision parts builder Hadrian. A new $1.15 billion fund is a key investment area for the company.

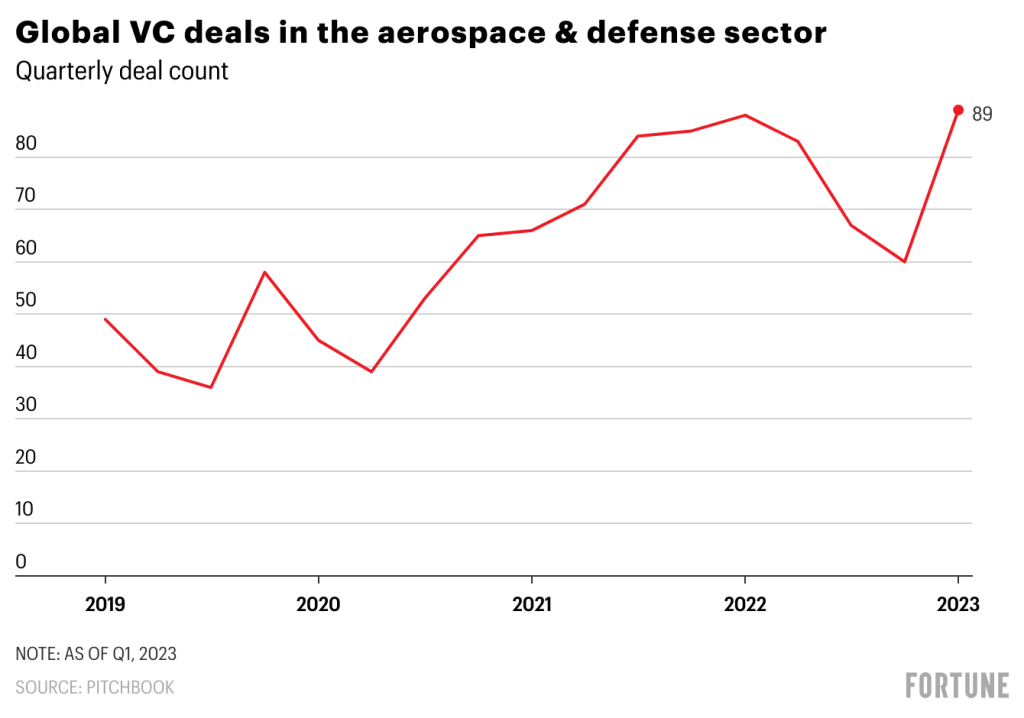

Defense technology may be a very broad term, but VCs are looking into areas like drones, satellites, cyber security, AI, space and communications. According to a new Pitchbook report released this week, defense technology has seen significant growth in recent years: From 2016 to 2022, investors poured $135.3 billion into the sector through 4,744 deals. Prices increased in Q1 this year, with 89 deals compared to 60 in Q4, although deals are still tracking low for Q2. According to PitchBook information Chance. There is interest from some big players: Andreessen Horowitz announced that the firm is setting aside $500 million to invest in companies that support American interests, including defense.

In the past year, “high defense technology units were renewable energy [and] Generation ($3.9 billion), perception, communication [and] security ($3.4 billion) and biotechnology ($3.2 billion), indicating that “military priorities are moving beyond aerospace and weapons to include technologies that provide a broader definition of ‘national security,'” the pitchbook authors note.

VCs argue that defense tech’s growing popularity is due to a few variables: Historically, the process of winning government contracts is longer than the frequency with which venture-backed startups raise funding, which is around 18 to 24 months, making it difficult. According to Bob Ackerman, founder and managing director of cybersecurity firm AllegisCyber, young startups selling to the government. But he told me, “There is a growing awareness that something needs to change and that the government is looking for ways to fix their processes.” (Ackerman still believes that aligning startup cycles with government procurement remains a problem.)

Another encouraging feature is that startups that use technologies for business and government use can achieve more venture-eligible growth. The Defense Department in recent years has created programs like Defense Innovation Unit Testing, or DIUx, and hired other transaction authorities (OTAs) to allow the government to write checks faster, giving venture investors confidence that these companies can scale quickly. Chandrasekhar, managing partner of Point72 Private Investments, the hedge fund’s private investment arm, told me. I think that’s why you’re seeing all these people jump in. They’re seeing all the traditional SaaS businesses… where growth is slow and instead we’re seeing a market where companies are growing fast.

VCs today Elon Musk points to SpaceX, founded in 2002 and valued at more than $100 billion, as a good example of a defense technology success story: “Between Palantir and SpaceX, we’re seeing very expensive business deals. Most of the revenue comes from the government. Venture investors see that, and [they’re like]’Huh, that’s interesting,’ says Chandrasekhar. We’re also currently seeing more former Palantir and former SpaceX founders building startups, he added.

But it’s not just America; Investors in Europe are also taking an interest in defense technology. “Defence startups can’t go anywhere for two years,” Pawel Chudzinski, a partner at Berlin-based Point Nine Capital, told me recently when I was in Europe. “This all looks like an opportunity for European tech entrepreneurs,” Chudzinci said, adding that Europe is expected to increase its defense spending.

Where are VCs looking to invest? Alegis Ackerman suggests using artificial intelligence to address issues such as preventing malicious applications. Point Nine, meanwhile, focuses primarily on software companies, and Chudzinski says they’re really looking at applications that are “software heavy—automation, simulation, computer vision, etc.” As elsewhere in venture capital, multiples for defense- and cyber-related startups have come down due to macro factors, Ackerman says.

To be sure, defense has been a controversial area for VCs to invest in, and Ackerman says they don’t invest in offensive technologies — like those used to exploit cyberattacks. But Luke Wolff, a longtime defense technology evangelist, has argued that “do-gooders around the world have a moral obligation to invent technology to benefit, not harm.”

And despite the up-and-right nature of defense technology deals in recent years, make no mistake: “This is not a 2023 event,” Ackerman says. “This is a trend line that has been growing for 20-plus years. [and] It continues to grow,” he said.

Goodbye,

Ann Sraders

Twitter: @AnneSraders

Email: anne.sraders@fortune.com

Submit contract for Term Sheet newspaper over here.

Jackson Fordyce He hosts the deals section of today’s newsletter.

Venture offers

– ElevateBioWaltham, Mass. , a cell and gene therapy biotech company that has raised $401 million in Series D funding. AyurMaya Capital Management Fund He led the round and joined. Wood line, Lee Family Office, Novo Nordisk, Softbank Vision Fund 2, F2 VenturesAnd so on.

– FigSunnyvale, Calif. The AI robotics company has raised $70 million in Series A funding. Parkway Venture Capital He led the round and joined. Alia capital city, Bright capital, Tamarack Global, I dare VC., FJ LabsAnd so on.

– ArchyThe New York-based buy-and-run SaaS subscription platform has raised $32 million in Series B funding. Endeit Capital He led the round and joined. Simon Capital, HV Capital, FirstMark CapitalAnd TriplePoint Capital.

– Setting up labsSanta Clara, Calif. , Inc.-based silicon photonics developer for chip-to-chip communications has raised an additional $25 million in C1 funding. Capital TEN He led the round and joined. VentureTech Alliance, Boardman Bay Capital Management, IAG Capital Partners, NVIDIAAnd Tyche partners.

– do you knowMontreal-based ESG data management software company has raised $20 million in Series B funding. Innovia Capital He led the round and joined. Portage Ventures, SCOR Ventures, White Star CapitalAnd diagram venture.

– Infinite timePune, India-based provider of predictive maintenance solutions for industrial machinery, has raised $18.85 million in Series B3 funding. Tiger Global He led the round and joined. GSR Ventures, VentureEast, MayfieldAnd THK.

– ValidatorA Los Angeles-based automated savings platform for online shopping has raised $15 million in Series A funding. G.V He led the round and joined. Mantis V.C, Common metal, Biduk Capital, Black Angels team, Wischoff Ventures, Oil capital, Blackbird Ventures, F7 Venture, Night capitalAnd Scribble Ventures.

– Kira’s educationSan Francisco-based computer science teaching and learning platform raises $15 million in Series A funding NEA And AI fund.

– PackedLondon-based online sneaker marketplace has raised $12 million in Series A funding. Such capital He led the round and joined. H&M Group Venture.

– PestoA San Francisco-based asset-backed credit card company has raised $11 million in Series A funding. Active capital And a lot.

– SpellingA Toronto-based legal technology startup has raised $10.9 million in funding. Thomson Reuters, Moxibustion Venturesand others invested in the round.

– MemsicoRamat Gan, an Israel-based website encryption and defense solution, has raised $10 million in seed funding. Capri Ventures And Venture guidelines.

– Six timesNew York-based insurer’s generative AI tool raises $6.5 million in seed funding Bessemer Venture Partners.

– WireMockSan Francisco-based API platform for developer productivity has raised $6.5 million in seed funding. Ridge Ventures He led the round and joined. First Reis Venture Partners And Scribble Ventures.

– InProTherA Copenhagen-based early-stage biotech company developing human endogenous retrovirus immunotherapy has raised €6 million ($6.46 million) in seed funding. Europeans Innovation Council fund And so on.

– BebopbyA Seattle-based mobile game development studio has raised $4 million in funding. BITKRAFT VENTURE, Court venture, And above, GOAL VenturesAnd other angels invested in the round.

– BBA New York-based breast milk storage and management company has raised $3 million in seed funding. Pioneer Fund He led the round and joined. Y Combinator, 7G BioVenture, Cathexis Venturesand other angels.

Personal equity

– Exclusive protectionsupported Knowledge capitalobtained XOR security, Falls Church, Va. Based on cyber security operations and engineering providers. Financial terms were not disclosed.

– Baird Capital got a minority share in Freemarket, a Dublin and London-based fintech platform for regulated B2B cross-border payments and remittances. Financial terms were not disclosed.

– British Columbia Investment Management Corporation got a minority share in ZEDRAPlanning, management and operations services provider based in Geneva, Switzerland. Financial terms were not disclosed.

– A group of partners got a minority share in Sterling Pharma SolutionsDudley, UK based contract development and manufacturing company and GHO Capital Partners portfolio company. GHO It holds the majority share. The investment is managed by a consortium of investors led by the funds. AlpInvest And Pantheon.

other

– Pyxis Oncology Agreed to get it. Apoxygen, a San Carlos, California-based biopharmaceutical company. The deal is worth approximately 16 million dollars.

– Vertex Labs obtained Digital studioA digital art studio in London for $12 million.

People

– Cambridge AssociatesHe was hired by a Boston-based investment firm Samantha Davidson As president and head of international investment. She was with him before. Mercer.

– Kleiner PerkinsMenlo Park, Calif. Based on a venture capital firm, he was hired Leigh Marie Braswell As a partner and Nadia Cochinwala And Lucas Oliveira As investors. Braswell was already with him. Founders FundCochinwala was with him. TPGAnd Oliveira was with him Thomas Bravo.

– Side investment managementSan Mateo, Calif. based private investment firm, employed Jeff Benjamin As an operating partner. He was together before Eli M.

– VerdaneAn Oslo-based growth equity investor, hired Dominic Black As a partner. He was together before EMH partners.

[ad_2]

Source link