[ad_1]

Netflix lost nearly a million subscribers last quarter, and the streaming giant expects to shed hundreds of thousands more this year.

Does that mean consumers are suffering from “subscription fatigue”?

Or are there just more options to choose from as studios develop new platforms (pulling their content from the big red N)?

Full TechCrunch+ articles are available to members only.

Use discount code TCP PLUS ROUNDUP Save 20% on a one- or two-year subscription.

“Subscriptions are not dying; They’re evolving now,” says Chargebee CMO Sanjay Manchanda, who notes that more than half of SaaS companies plan to roll out usage-based billing in the next year.

To help founders capitalize on this trend, he identifies some of the ways companies are evolving as they strive to emulate the success of companies like Twilio, Snowflake, and Frog.

“Subscriptions are not going anywhere,” says Manchanda. “They’ve been around since at least the 17th century for good reason – people love them.”

Thank you very much for reading

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

How to take BS from your TAM

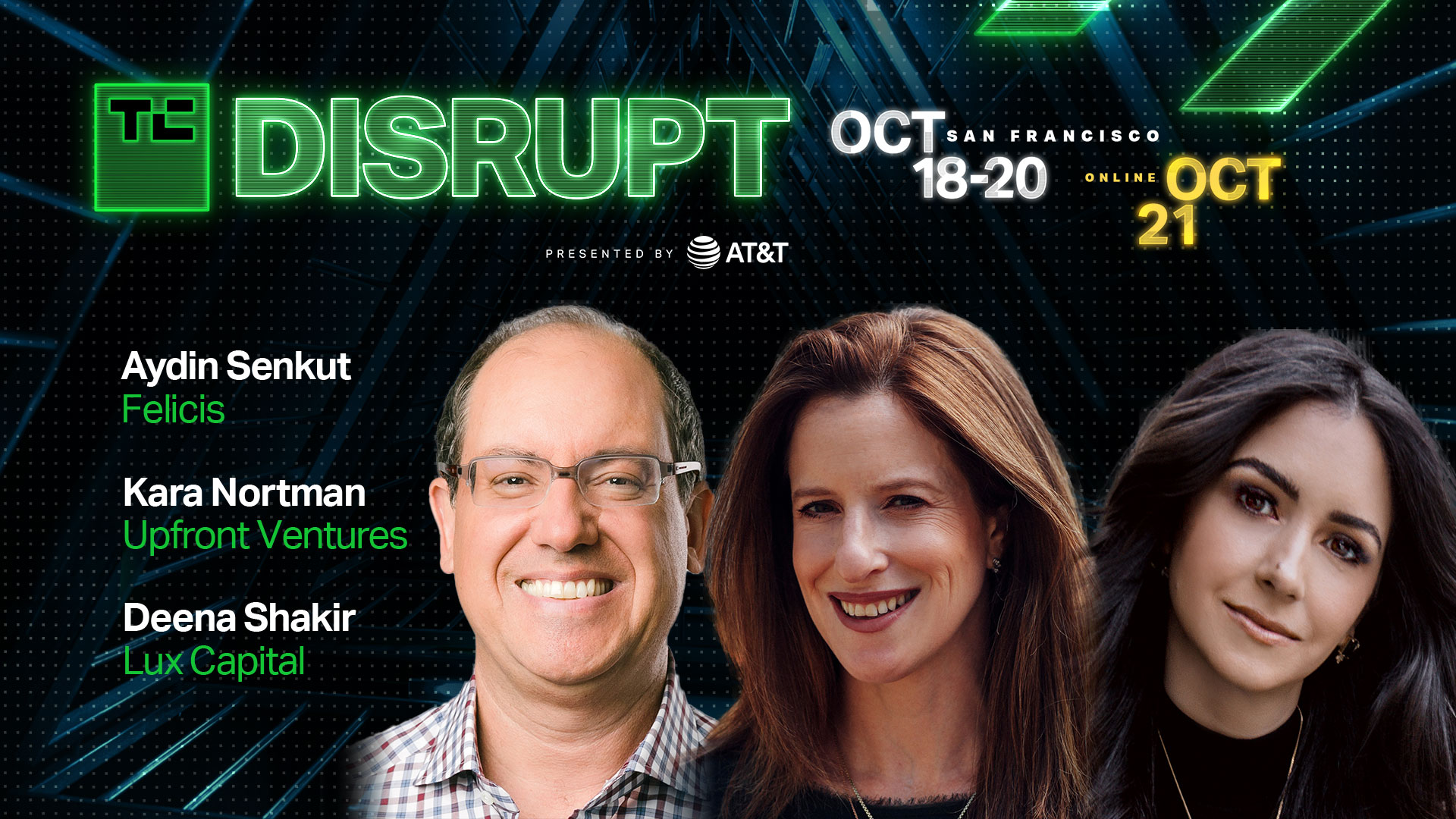

On Wednesday, October 19th, I moderated the panel “How to Take the BS Out of Your TAM” at TechCrunch Disruption in San Francisco.

Calculating a company’s future market share is difficult for inexperienced entrepreneurs, and getting it wrong is a red flag for investors. I talk to three VCs to help founders overcome this hurdle, so learn more about how to measure TAM in an era when tailwinds are turning into headwinds:

- Cara Norman, Managing Partner, Upfront Ventures

- Aydin Senkut, Founder and Managing Partner, Felicis Ventures

- Deena Shakir, Partner Lux Capital

Some clear advice for open source startups looking for a product market fit

Image Credits: Sutad Wattanakul/Aim (Opens in a new window) / Getty Images

Open source startups need to find product-market fit like other companies, but their path to market is a little different: they need to attract more users, but they also need to cultivate a community of developers who support their product.

“In this sense, an open-source company’s go-to-market journey is often less about acquiring new customers and less about converting sales — more to the dismay of additional paid features for existing free users,” says Y investor Arnav Sahu. Continuity of coupling.

“The playbook to build in the early days is to identify who is a good customer and who might not be.”

How Should Web3 Companies Approach Fundraising During Downsizing?

Image Credits: Stephen Swintek (Opens in a new window) / Getty Images

Most Web3 startups are in the same liquid boat: the product market hasn’t matured, hiring technical talent is difficult at best, and many investors who were eager to take their call a year ago are now getting excited.

Thirsty hikers who know where to look can still find water, but Galaxy E.Io CEO Jenny Kee Ta.

In a TechCrunch+ guest post, she offers ideas for approaching angels, startups, and traditional VCs along with some tips that can help level 3 entrepreneurs.

“Don’t let stress call you the shot. This too shall pass, but do not waste time.

VCs have set their sights on African countries beyond the ‘Big Four’

Image Credits: Brice Durbin

Together, Kenya, South Africa, Egypt and Nigeria account for more than 70% of Africa’s venture capital. Known as the “Big Four,” these countries collected about $5 billion last year.

However, in recent months, TechCrunch reporter Annie Njanja in Nairobi confirmed that investors have been hunting for deals elsewhere.

“Excluding the Big Four, investments rose to $1.4 billion, up 382% year-on-year.

Serena Williams’ next move in venture capital is important at this time.

Image Credits: ADAM DAVY / Contributor / Getty Images

Serena Ventures was founded in 2011.

According to Dominique-Madori Davis, she has invested in nearly 80 companies, including 16 unicorns. And she will retire from tennis in a few weeks.

“She knows the balancing act and has mastered the art of winning and losing — essential skills for running an early stage venture fund.”

[ad_2]

Source link