[ad_1]

Introduction: Sainsbury’s CEO warns cost of living squeeze will intensify

Good morning, and welcome to our rolling coverage of business, the world economy, the financial markets, and the cost of living crisis.

The squeeze facing UK households will only intensify in the coming months, as inflation hits incomes.

That’s the warning from Sainsbury’s boss Simon Roberts this morning, as the supermarket chain reports a drop in underlying sales for the last quarter.

Roberts, chief executive of the supermarket group, says “We really understand how hard it is for millions of households right now”, with inflation hitting a 40-year high of 9.1% in May.

Customers are “watching every penny and every pound”, Roberts says, and he fears the pressures on budgets will get worse, as Sainsbury’s “invests £500 million” to keep prices down.

Roberts says:

The pressure on household budgets will only intensify over the remainder of the year and I am very clear that doing the right thing for our customers and colleagues will remain at the very top of our agenda.

Sainsbury’s underlying sales fell by 4% in the 16 weeks to 25 June (excluding fuel sales), led by weakness in general merchandise as cash-strapped consumers held back on discretionary spending.

Grocery sales down 2.4% compared with last year (when pandemic restrictions boosted spending at supermarkets), while sales at its Argos division fell 10.5% in the quarter.

On Thursday, Sainsbury’s shareholders will vote on whether it should pay the independently set living wage for all staff and contracted workers.

My colleague Sarah Butler explained last week:

Sainsbury’s has raised pay for its 171,000 direct employees across more than 1,400 stores in the UK to the living wage, which is independently calculated for the Living Wage Foundation charity, of at least £9.90 an hour outside London or £11.05 in the capital.

However, it has not made the same commitment to contractors.

Today, Roberts says:

We are proud to be the first major supermarket to pay the Living Wage to all colleagues, regardless of where they live – and to have increased Sainsbury’s colleague pay by 25% and Argos by 39% over the past five years.

Also coming up today

The latest UK car sales data are expected to show that registrations tumbled by nearly a quarter year-on-year in June, as the sector continues to struggle with supply disruption (more on that shortly).

The Bank of England releases its latest Financial Stability Report this morning, which will analyse the stability of the UK financial system and what it is doing to remove or reduce any risks to it.

In parliament, MPs on the Business, Energy and Industrial Strategy Committee will examine the strengths and weaknesses of the semiconductor industry and its supply chain in the UK, at a hearing.

We also get the latest healthcheck on UK and eurozone services companies.

In the City, the FTSE 100 index is set to open a little higher as European stocks rally. But copper is languishing ner a 17-month low, on concerns of a possible recession.

The agenda

- 9am BST: UK new car sales for June

- 9am BST: Eurozone service sector PMI survey for June

- 9.30am BST: UK service sector PMI survey for June

- 10.15am BST: BEIS committee holds hearing into UK semiconductor industry

- 10.30am BST: Bank of England’s financial stability report

- 11am BST: Bank of England holds press conference

- 3pm BST: US factory orders for May

In the travel sector, British Airways is reportedly planning to axe flights for up to 105,000 holidaymakers this month, the Daily Telegraph says today.

They say:

Britain’s biggest airline has told airport slot authorities that it is cancelling more than 650 flights from Heathrow and Gatwick in order to avoid a repeat of last month’s travel chaos.

More than 76,000 seats are being axed from Heathrow and 29,400 from Gatwick on flights to more than 70 destinations including Malaga, Ibiza, Palma, Faro and Athens.

A Government “amnesty” on the rules on airport slots is in place until Friday, which allows airlines to change schedules without facing a potential penalty. That could mean other airlines also make cancellations to summer flights this week, in an attempt to avoid further disruption at airports.

UK firms are planning price hikes as they battle their own rising costs, the struggle to build operating capacity and a shortage of raw materials caused by war and continuing supply chain disruption.

So says Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply:

Another deterioration in the UK marketplace meant new order growth dropped for a fourth month in a row to its weakest since February 2021, indicating the direction of travel for service activity in the coming months.

This is unlikely to change any time soon as consumer reluctance to spend will increase with cost-of-living pressures dominating priorities, and purchases perceived as non-essential going on the back burner for now.

UK services firms plan further price rises this year

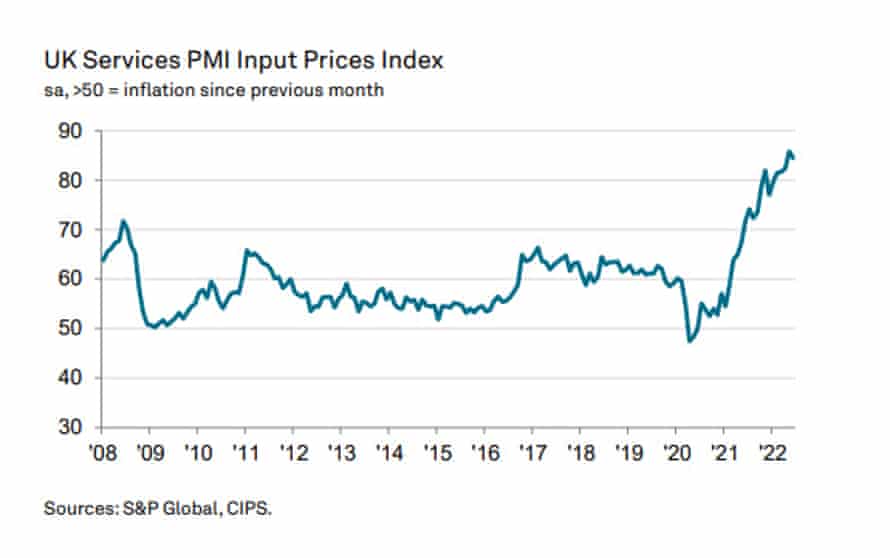

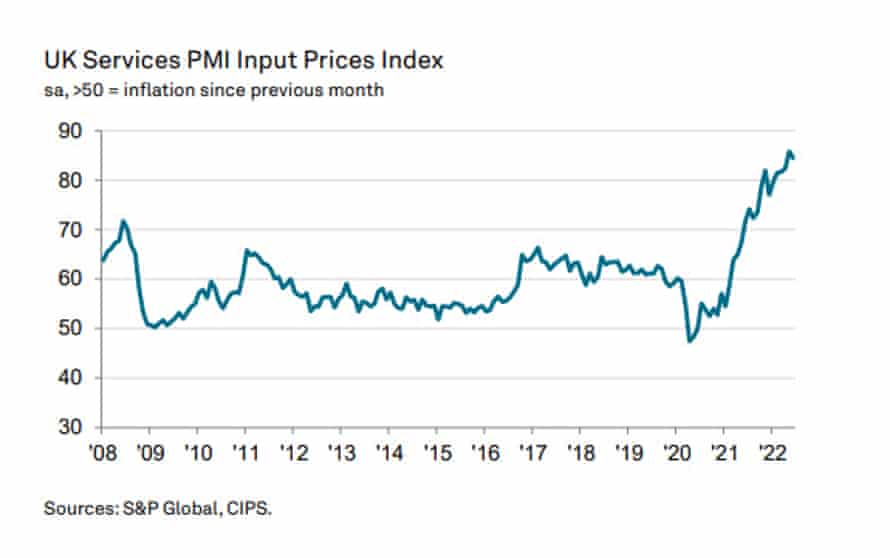

UK services firms are planning to keep hiking prices as they pass on higher input costs to their customers.

Service sector companies raised their prices at a rapid pace again in June, with the rate of price inflation only fractionally lower than May’s record high, according to the latest snapshot of the economy, from S&P Global.

Some 37% of services firms surveyed said they raised prices in June, while only 2% cut them — and many said they were aiming for further price rises this year.

That is a sign that consumers face more inflationary pressures, backing up Sainsbury’s warning today that the squeeze will intensify.

Two-thirds of firms reported a rise in their average cost burdens in June — such as energy, fuel and staff wages.

Tim Moore, economics director at S&P Global Market Intelligence, explains:

“June data highlighted the second-fastest rise in input prices since the survey began 26 years ago, driven by intense wage pressures and rapid increases in fuel costs.

Staff shortages added to demand and supply imbalances, with subsequent constraints on business capacity acting as a further incentive to defend margins from escalating operating expenses.

Around 37% of the survey panel reported an increase in their charges since May and many commented on plans to push through further price rises in the second half of 2022.

The survey of UK purchasing managers also found that new orders growth fell to the lowest since February 2021, during the national lockdown. Firms blamed the cost of living crisis and pessimism about the economic outlook.

Stubbornly high inflationary pressures and signs of weaker customer demand pushed business optimism to the lowest since May 2020.

The overall service sector PMI, which measures activity, rose to 54.3 from 53.4 in May, and also above the “flash” reading of 53.4 taken during June.

After a positive start, shares have dropped in London while European stocks are now flat.

The FTSE 100 index of blue-chip shares is down 46 points, or 0.64%. Financial stocks, mining companies and oil producers are in the fallers, suggesting recession fears are rising.

Sainsbury’s are up 1.7% after its first-quarter results.

Supply shortages push UK June car sales to lowest since 1996

It’s official: UK car sales last month were the worst for the month since June 1996 (when many were more focused on football than automobiles).

Trade body SMMT has reported that:

- June new car registrations fall -24.3% to 140,958 units – weakest performance for the month since 1996.

- Ongoing challenges in component supply, exacerbated by restrictions in China, hamper industry’s ability to fulfil demand.

- Year to date registrations reach 802,079 units – a fall of -11.9% on last year, and second weakest first half for 30 years.

Battery electric vehicles sales grew 14.6% year-on-year, while drivers continued to shun diesel (down over 46%).

The semiconductor shortage is stifling the new car market even more than last year’s lockdown, says Mike Hawes, SMMT chief executive:

Electric vehicle demand continues to be the one bright spot, as more electric cars than ever take to the road, but while this growth is welcome it is not yet enough to offset weak overall volumes, which has huge implications for fleet renewal and our ability to meet overall carbon reduction targets.

With motorists facing rising fuel costs, however, the switch to an electric car makes ever more sense and the industry is working hard to improve supply and prioritise deliveries of these new technologies given the savings they can afford drivers.”

Eurozone downturn looms as growth slows in June

Business growth across the euro zone has slowed to a 16-month low, according to a new poll of companies that suggests Europe’s economy could shrink this quarter.

Manufacturing production fell in June, for the first time in two years, while the services sector grew more slowly.

Worryingly, inflows of new work stalled in June, ending a 15-month sequence of growth, while factory order book volumes declined at the steepest rate since the depths of the initial COVID-19 lockdown in May 2020.

That’s according to S&P Global’s final composite Purchasing Managers’ Index (PMI), seen as a good guide to economic health. It fell to 52.0 in June from May’s 54.8, slightly better than the preliminary 51.9 estimate, but nearer to the 50 point mark showing stagnation.

This sharp slowdown raises the risk of the region slipping into economic decline in the third quarter, said Chris Williamson, chief business economist at S&P Global Market Intelligence:

The manufacturing sector is already in decline, for the first time in two years, and the service sector has suffered a marked loss of growth momentum amid the cost of living crisis.

Household spending on non-essential goods and services has come under particular pressure due to soaring prices but business spending and investment is also waning in response to the gloomier outlook and tightening financial conditions.

Shoppers are switching to Sainsbury’s economy own-brand products due to the squeeze on budgets, CEO Simon Roberts tells reporters.

But premium range items are still in demand for special occasions.

“We are seeing some switching into economy own-label, clearly as we expected, and that’s the reason why Sainsbury’s quality Aldi-price match is playing such an important role.

“We are also seeing at the same time premium sales remaining resilient.”

Union: Train drivers’ strike could bring “massive” disruption this summer

The head of the UK train drivers’ union has warned of “massive” disruption this summer as his members vote on their first national strike since 1995.

Walkouts over pay would further inflame Britain’s travel chaos, with the union Aslef balloting drivers at 10 train companies over industrial action.

Mick Whelan, general secretary of drivers’ union Aslef, has told the Financial Times that:

“It will be far more disruptive than it has been in the past. We do not go on strike very often.”

“We believe [strikes] will have a massive effect….There will be a summer of disruption.”

This could come on top of industrial ation by RMT union members, who have already held one walkout last month

The Transport Salaried Staffs’ Association (TSSA) union, whose members manage control rooms, signalling and power for train operators and Network Rail, is also holding a strike ballot.

Our transport correspondent Gwyn Topham wrote about the situation here:

and here:

Full story: Sainsbury’s boss warns UK living costs squeeze will ‘only intensify’

Sarah Butler

The pressure on households will “only intensify” through the rest of this year, the boss of Sainsbury’s has warned as he said the supermarket would invest £500m in attempting to keep prices low.

The pledge came as the UK’s second biggest supermarket, which also owns the Argos and Habitat chains, revealed that sales at established stores fell 4% in the 16 weeks to 25 June compared with the same period a year before and excluding fuel.

The slide was led by an 11% fall in sales of general merchandise and a 10% drop in sales of clothing. Grocery sales fell 2.4% year-on-year but were up nearly 9% on pre-pandemic levels.

The figures emerged as shoppers switch to cheaper products, such as frozen and tinned foods and supermarket own label items, and set themselves tight budgets amid hefty grocery inflation and a squeeze on the cost of living from higher energy, petrol and housing costs. More here:

Sainsbury’s results: what the experts say

Richard Hunter, Head of Markets at interactive investor, says Sainsbury is struggling to maintain momentum as customers cut back, based on today’s results.

Set against ever tightening competitive screws, Sainsbury had its work cut out on any number of fronts going into the statement. And the ferocity of competition in the sector is plain to see.

Against strong comparatives from a partial lockdown last year, each of the main categories have fallen, with Grocery sales down 2.4%, Argos 10.5%, General Merchandise 14.6% and Clothing 10.1%. The picture is marginally better against pre-pandemic sales, although still mixed, with Grocery up 8.7% and Clothing up 3.9%, but Argos down 4.5% and General Merchandise down 13.8%.

Here’s Steve Dresser of Grocery Insight:

I think the biggest reservation I have over Sainsbury’s is that they’re doing a good job (far better now, with the elevation) of Aldi Price Match.

But it doesn’t say anywhere near enough about Sainsbury’s quality at the same time.

— Steve Dresser (@dresserman) July 5, 2022

In JS – Big ticket technology sales are falling, with economy (value) label sales rising. Premium remains resilient.

— Steve Dresser (@dresserman) July 5, 2022

Matt Britzman, equity analyst at Hargreaves Lansdown, adds:

“Jubilee celebrations might have provided a temporary distraction for consumers who indulged in Pimms, Prosecco and strawberries, but we’re very much back to reality now.

It doesn’t come as much of a surprise that management are warning of a consumer that’s watching every penny as the cost-of-living crisis takes its toll, and the group’s expecting that pain to only get.

It’s positive then to see guidance remain intact, though it’s worth remembering it’s been raised and lowered already this year.

Cost of living dampening demand for new cars

Rising energy costs are deterring drivers from buying new cars, knocking sales by around a quarter year-on-year last month.

Lisa Watson, director of sales at Close Brothers Motor Finance, explains:

“The soaring cost of living remains at the top of the agenda for consumers, with the price of electricity, petrol, and diesel all on the rise.

This means prospective car buyers are having to think not just about the upfront cost, but also the ongoing maintenance and running expenses of a vehicle. It’s clear from June’s registration data that this is dampening demand for new cars.

Alongside this contraction in demand, supply issues continue to cause huge delays, Watson adds:

Stellantis is pulling the handbrake on production in several Citroen and Peugeot factories in France, and Ford has recently closed its order book for the new Fiesta due to production difficulties.

This follows recent difficulties for Toyota, Mini, and VW Group, worsened by the ongoing chip shortage. In reality, even customers keen to buy might be waiting until next summer for a car to land on their driveway.”

SAS files for bankruptcy protection in the United States as it fights for survival

Scandinavian airline SAS has filed for bankruptcy protection in the United States, as it tries to push through a financial restructuring as pilots start strike action.

SAS AB said this morning it had filed for chapter 11 bankruptcy protection, to accelerate a restructuring plan announced in February.

Wage talks between SAS and around 1,000 cockpit crew, who are pushing for an improved pay deal, collapsed on Monday, triggering a strike that adds to travel chaos across Europe this summer.

The company said in a statement on Tuesday it would continue to serve its customers throughout the bankruptcy process, although the pilot strike is impacting its flight schedule.

Carsten Dilling, chairman of the Board of SAS, explained:

The Board has concluded that legal tools are required to make progress in our ongoing negotiations with key stakeholders, and ultimately to succeed in making SAS a competitive and financially strong business.

The process we have commenced will enable SAS to continue our more than 75-year legacy of being integral to Scandinavian infrastructure and societies.

Sainsbury’s says it is “investing over £500m” in the two years to March 2023 in keeping its prices low.

This is being funded by cost savings, the company tells shareholders, adding it is “continuing to inflate behind competitors”. [ie, raising prices less quickly].

A new term for the City jargon book….

Today’s Sainsbury results @sainsburys contain one of the funniest (and dumbest) sentences ever in an RNS “we continue to inflate behind competitors.” I think I know what they mean …

— Dominic O’Connell (@dominicoc) April 28, 2022

On June’s slump in UK car sales, Bloomberg says:

First-half sales fell 12% to around 800,000 vehicles — the second-weakest showing in 30 years.

The SMMT has repeatedly called for government support to help soften the blow of surging energy costs as carmakers try to transition to producing zero-emissions vehicles.

The UK has seen auto production steadily decline over decades, with uncertainty over the future of its trading relationship with the European Union adding to the industry’s woes.

‘It’s hard getting money to stretch’: single mothers say they need support

Jessica Murray

Lone parents are suffering particular hardship in the cost of living squeeze, as a Guardian special report this week shows.

Kelly Ross, a single mother to her three-year-old son Charlie, has just found out her energy bills are tripling in price, from £94 a month to £292.

With summer holidays on the horizon, there’s not much left in the pot for anything other than essentials, and she finds it hard to escape the constant burden of money worries.

“I think I’m glad that my son is this young at the minute because he doesn’t really know that we’re missing out on things,” the 39-year-old says. “It’s hard getting the money to stretch and still trying to give your child a life for him to look back at with fond memories.”

As she speaks, her son Charlie zooms around Littlethorpe village hall on a trike while other parents and children play and chat. This is her one weekly respite, a free group for struggling parents in the area run by the Leicestershire-based charity Home-Start Horizons.

She says:

“Nobody judges. If one day you want to come in crying, they’ll just make you a tea and give you a hug,” she says.

Here’s the full story:

Mothers like Ross are facing a bleak winter.

Research by the Institute for Fiscal Studies revealed this week how a decade of austerity, during which vital benefits have been frozen or cut, has resulted in child poverty in single-parent households rising by almost 10% – compared with only 2% for two-parent families.

Half of all children being raised by one parent are now in relative poverty.

Jim Holder, editorial director of magazine and website What Car?, said car buyers are being hit by a combination of issues, including rising energy bills which push up manufacturing costs, and thus forecourt prices.

Holder warned:

“The result is longer waiting times on cars which will cost more to buy.”

UK car sales slide in June

The UK automotive industry has suffered its worst June for new car sales since 1996, amid the cost of living crisis and supply chain woes.

Registrations of new cars fell by around 24% last month compared with June 2021, according to preliminary figures from the Society of Motor Manufacturers and Traders (SMMT).

The UK car industry has suffered its worst June since ‘96 with a drop in sales last month of 24% compared to June ‘21.

Full figures out soon…#SMMT— Ginny Buckley 🇺🇦 (@GinnyBuckley) July 5, 2022

Rising inflation hit consumer confidence – deterring people from buying big ticket items such as a new car. And even if you wanted to take the plunge, manufacturers continued to struggle to obtain components.

As well as the well-publicised shortage of semiconductors, carmakers face a shortage of wiring harnesses due to the conflict in Ukraine. Those harnesses are used to bundle together electric cabling that controls different systems in a car.

Registrations so far this year are thought to have fallen by 12% to about 800,000 units, due to those challenges. We’ll find out when the data is released at 9am…

Introduction: Sainsbury’s CEO warns cost of living squeeze will intensify

Good morning, and welcome to our rolling coverage of business, the world economy, the financial markets, and the cost of living crisis.

The squeeze facing UK households will only intensify in the coming months, as inflation hits incomes.

That’s the warning from Sainsbury’s boss Simon Roberts this morning, as the supermarket chain reports a drop in underlying sales for the last quarter.

Roberts, chief executive of the supermarket group, says “We really understand how hard it is for millions of households right now”, with inflation hitting a 40-year high of 9.1% in May.

Customers are “watching every penny and every pound”, Roberts says, and he fears the pressures on budgets will get worse, as Sainsbury’s “invests £500 million” to keep prices down.

Roberts says:

The pressure on household budgets will only intensify over the remainder of the year and I am very clear that doing the right thing for our customers and colleagues will remain at the very top of our agenda.

Sainsbury’s underlying sales fell by 4% in the 16 weeks to 25 June (excluding fuel sales), led by weakness in general merchandise as cash-strapped consumers held back on discretionary spending.

Grocery sales down 2.4% compared with last year (when pandemic restrictions boosted spending at supermarkets), while sales at its Argos division fell 10.5% in the quarter.

On Thursday, Sainsbury’s shareholders will vote on whether it should pay the independently set living wage for all staff and contracted workers.

My colleague Sarah Butler explained last week:

Sainsbury’s has raised pay for its 171,000 direct employees across more than 1,400 stores in the UK to the living wage, which is independently calculated for the Living Wage Foundation charity, of at least £9.90 an hour outside London or £11.05 in the capital.

However, it has not made the same commitment to contractors.

Today, Roberts says:

We are proud to be the first major supermarket to pay the Living Wage to all colleagues, regardless of where they live – and to have increased Sainsbury’s colleague pay by 25% and Argos by 39% over the past five years.

Also coming up today

The latest UK car sales data are expected to show that registrations tumbled by nearly a quarter year-on-year in June, as the sector continues to struggle with supply disruption (more on that shortly).

The Bank of England releases its latest Financial Stability Report this morning, which will analyse the stability of the UK financial system and what it is doing to remove or reduce any risks to it.

In parliament, MPs on the Business, Energy and Industrial Strategy Committee will examine the strengths and weaknesses of the semiconductor industry and its supply chain in the UK, at a hearing.

We also get the latest healthcheck on UK and eurozone services companies.

In the City, the FTSE 100 index is set to open a little higher as European stocks rally. But copper is languishing ner a 17-month low, on concerns of a possible recession.

The agenda

- 9am BST: UK new car sales for June

- 9am BST: Eurozone service sector PMI survey for June

- 9.30am BST: UK service sector PMI survey for June

- 10.15am BST: BEIS committee holds hearing into UK semiconductor industry

- 10.30am BST: Bank of England’s financial stability report

- 11am BST: Bank of England holds press conference

- 3pm BST: US factory orders for May

[ad_2]

Source link