[ad_1]

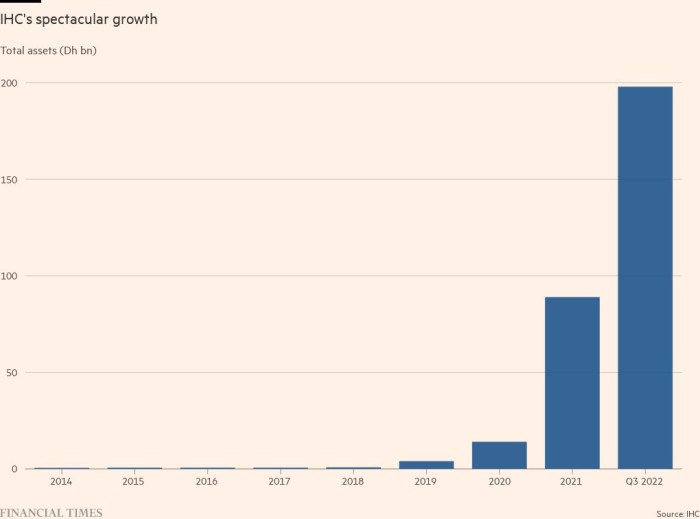

Three years ago, International Holding Company was a little-known company that ran fish farms and food and real estate businesses. It employs only 40 people. Today, the Abu Dhabi-listed group has a capitalization of $240 billion, twice the size of global giants Siemens and GE, and has a headcount of 150,000.

It is a rare change that has gone largely unnoticed and little understood outside the UAE – even by bankers in the region.

“Nobody knows,” said a Gulf international banker when asked to explain IHC’s remarkable growth. It’s a common response to questions about the conglomerate, even though the ADX Abu Dhabi Securities Exchange’s benchmark index, the FADX 15, ranks third. In the year With its share price up 42,000 percent since 2019, it has become the second largest state-owned oil company in the Middle East after Saudi Aramco.

In the year Even Syed Bashar Shub, who took over as IHC CEO in mid-2019, said it was “amazing.”

In an interview with the Financial Times, he insisted that there are simple explanations for the company’s growth – the transfer of more than 40 companies, valued at $4.7 billion to IHC, another Abu Dhabi Royal Group company. Shub said most of the businesses were transferred at a price of one dirham each.

However, that only explains part of the story: IHC’s total assets grew from $215mn at the end of 2018 to $54bn in the third quarter of 2022.

According to IHC, this depends on the growth of the businesses it currently oversees. “We will not pay any dividends, our profits in 2020, 2021 will mainly be . . . He invested back,” Shub said. “We are trying to create a giant here. . . Global giant”

But others see the IHC as an example of the blurred relationship between business and power in Abu Dhabi, the capital of the United Arab Emirates and the richest member of the federation. It also raised questions of transparency.

“That’s probably the biggest risk for the ADX because we don’t know what’s going on,” the banker said. “A lot of great things are happening at ADX, and there’s this thing that nobody knows about.”

Concerned by the dramatic growth in IHC’s market capitalization, officials in Dubai are not considering reviving talks on a future merger of the stock market with ADX, people familiar with the matter said.

Ernst & Young said the review of IHC’s latest financial statements in the third quarter of last year “falls far short of an audit by international standards” and that E&Y was unable to obtain assurance on “all material matters”.

The IHC stated: “Due to the limited amount of information required to be presented in the interim financial statements . . . External auditors typically do not perform a complete audit of these financial statements.

The company’s turnaround is likely to come in 2020 when Sheikh Tahnoon bin Zayed Al-Nahyan, one of the most powerful in Abu Dhabi, takes over as chairman. Also being the National Security Adviser of the United Arab Emirates, he is a full brother. The president, Sheikh Mohammed bin Zayed Al-Nahyan, oversees an expanding business empire.

In addition to his role at IHC, he chairs ADQ, a new and growing government investment vehicle, First Abu Dhabi Bank, the UAE’s largest lender, and Group 42, an Abu Dhabi-based artificial intelligence and cloud computing company.

It also controls the Royal Group, which owns 62 percent of IHC. About 24 percent of IHC’s shares are free-floating, with more than 90 percent owned by investors from the Gulf.

Shub said Sheikh Tahnon’s vision for IHC was “limited to creating value for shareholders”.

“How we create [value] It has been handed over to management.

He dismissed doubts as to what caused the rapid rise in stock prices, saying it was “a bit of ignorance on the part of the bankers who were not looking at it properly”.

“An investor who is willing to invest at this market value, only because they have done their homework because they see that those properties have a high value,” he said. “I believe people are expecting some of those assets to still be out there. [with Royal Group] It comes to the IHC team. . . What I deny is that they will not come.

Schubb wanted to explain the team’s goal as “one simple thing. [to] Create value for our shareholders by investing in a diverse portfolio rather than a single investment stream.

“We will do the acquisition, we will do the cooperation, we will immediately go to diversification,” he said.

For example, if IHC buys a telecom company, it will merge with IHC’s services side and expand into “solutions” and “hardware sales.” In agriculture, the plan was to provide food from “farm to table”.

The company said it has a $10 billion war chest for investments and is targeting group revenue growth from $7.7 billion in 2021 to $27 billion in 2023.

“Our five-year plan is to reach 1tn dirhams. [$272bn] At least in terms of revenue, acquisitions and our own businesses are doing very well,” Schubb said.

In the year By 2022, IHC’s deals include a $2 billion investment in three Mumbai-listed companies, part of Asian tycoon Gautam Adani’s empire, a $500 million deal to buy a 50 percent stake in a Turkish clean energy company, and a $2 billion cut of up to 31.25 percent of Colombian food group Grupo. To buy Nutresa.

Shueb said IHC’s profit of $6.5 billion in the first nine months of 2022, a 236 percent increase from the same period in 2021, was mainly due to investments, including its stake in Adani companies.

Shub said IHC’s focus is on tech, healthcare, real estate, construction, food and agribusiness, and general investment. Geographically, the focus has been on Asia and Latin America and is looking for deals in markets as diverse as Turkey and Indonesia.

“These are developing economies; they have the population; they have reasonable systems to support all this growth and at the end of the day, because we are from Abu Dhabi and the population of the UAE is only 10mn, I can’t . . . reach 100mn people but with these companies 100mn I can reach it, he said.

He also added that IHC was “looking at some deals” in the US, where it has some holdings, including a stake in Elon Musk’s SpaceX. However, he sees Europe as a “very uncertain market right now”.

“We’re getting really good deals. [in Europe]But [we] I don’t know if these good deals will continue to be good,” he added.

“It’s up to them if they want to do it or not,” Shub said when asked why no independent research has been done on the group given the breadth and dominance of the ADX.

“When I go to market for any IPO for my companies, I get enough inquiries from local investors. . . . They have enough research on our finances,” he said. “Our books are very open.”

IHC discussed ratings with credit agencies, but that process hit a snag when the agency asked what it should compare the group to, Schubb said.

“The team is still working. [on the rating and] Maybe it will be resolved,” he added.

He said that IHC has about 10 billion dirhams in debt, not including the debts of the portfolio companies, and wants to increase the loan as it expands. The group has also begun developing relationships with international banks, securing a “multi-billion dollar” loan from Standard Chartered and engaging with Goldman Sachs and UBS, he added.

Others still need convincing of the team’s strategy.

Another Gulf banker said: “I don’t understand because it’s a company with a market capitalization of $200 billion that provides less public information than the company, and the overall listed and unlisted subsidies are very active.”

But, he added, “I’m sure some banks are looking at what they can do because this is such an important source of deals.”

[ad_2]

Source link