[ad_1]

When Christy Kim She launched TomoCredit in early 2019, on a mission to help international students get credit easily.

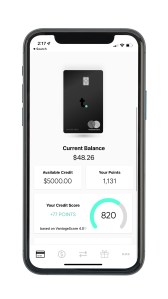

Three and a half years later, the mission has evolved. TomoCredit, which aims to help adults with good financial health but no credit score, isn’t just aimed at immigrants.

Today, Tomo is expanding his focus to a wider group of people in the United States, including local students and SMBs who want to “build credit fast.”

“As we expand, we realize that our target market is bigger than we expected. Now we know Credit goes beyond the invisible immigrantsCEO Kim He told TechCrunch in an interview.

TOMO differs from many other credit providers in that it does not rely on FICO scores. Instead, a A “proprietary” underwriting algorithm (Tomo Score) to identify “top borrowers” without a credit score. The TomoCredit card requires no credit check, no deposit, 0% APR and no fees. fintech It offers cardholders a credit limit of up to $30,000 based on cash flow. It gets its money only from interchange fees paid to merchants, not directly from consumers.

Does it sound dangerous? Well, it is.

But Kim expects the company’s default rate — at 0.11% — doesn’t reflect that risk. (For context, American Express reports a default rate of 2.5%.)

“Our customers spend thousands a month, more than any fintech customer,” she said. “We learned this from talking to other neobanks.”

“Our customers are not in financial trouble… once you get to know them and give them a card, they spend a lot and don’t make payments. Our performance was good. This gave us and our investors confidence to grow.

Image Credits: TomoCredit

To help lend more to Gen Xers, TomoCredit today announced it has raised $22 million in Series B funding at a post-money valuation of $222 million. He also received 100 million dollars in loan financing. Since its inception, TomoCredit has raised $39 million in equity.

The increase came in the same year that Kim reported 1,000% revenue growth, which he described as “primarily organic.” Tomo is on track to achieve an additional 1,000% year-over-year revenue growth, she said.

Kim declined to say how many cardholders Tomo has, but said it has received 2.5 million applications over time.

The fundraiser, Kim notes, was a “locked deal” before the market turned and the valuation was agreed upon earlier this year.

The company plans to use the new capital to improve its product offerings, such as car loans and mortgages. Yes, Loans Kim considers it an opportunity that the mortgage market is currently taking a beating.

“During the pandemic, we saw a huge increase in applications. We are seeing another high number of customers coming to us during the market downturn,” she told TechCrush. “In the absence of certainty, clients become cautious about personal finance.”

Since its inception, Tomo has been driven by lean thinking. Today it has 50 employees. Part of its new capital will also go toward hiring more engineers and product people, Kim said.

Interestingly, Morgan Stanley’s Next Level Fund and MasterCard participated in the “oversubscribed” equity portion of the financing, which also included participation from GoldHouse, Asian Hustle network and Hyphen Capital. The debt was provided by Silicon Valley Bank.

“As a first-generation South Korean immigrant, I wanted to help immigrant communities achieve their American dreams faster with TomoCredit,” said Kim. It’s been great to partner with minority-focused funds that really understand Tomo’s mission.

Alice Vilma is an associate portfolio manager at Morgan Stanley’s Next Stage Fund, which focuses primarily on early-stage technology and technology-backed companies that have women or diverse managers as part of their founding teams. As a young female immigrant, Kim said she was drawn to back TomoCredit because she was impressed by its ability to identify a problem and turn it into a new financial product.

“She understands what clients like her want and need from the financial services industry,” Vilma wrote in an email. We are delighted to be a part of TomoCredit’s journey as it works to democratize access to credit and build a more inclusive credit landscape.

My weekly fintech newsletter, The Interchange, launched on May 1st! open up over here To find it in your inbox.

[ad_2]

Source link