[ad_1]

One startup is banking, as businesses want to earn as much interest as possible on their cash.

Mayfair is a new fintech startup offering businesses up to 4.02% APY, a number it claims is the highest out there. How can a less than two-year-old start-up offer businesses such high interest rates back to its partners? Mayfair itself Not a bank, but a fintech company that offers FDIC-certified products through a bank based in Arkansas. Evolve Bank and Trust. The money is actually moved through Stripe’s technology to the Evolve account, where Stripe maintains a balance sheet.

“We tied it all together,” said Mayfair’s founder and COO Munish Chopra.

Chopra And Daniel Chan had worked in private equity hedge funds for most of his career and was frustrated that he couldn’t use his own money to do any work “for a good product.”The average savings account for businesses pays 0.3% in interest.

“AAnd we didn’t want to take any risk with our money.said Chopra Previously worked as Managing Director of Triton Partners.

The couple was paired with a series of entrepreneurs Kent Mori and Kevin Chan To set up a company in May 2021, exploring different business models before settling on Mayfair’s current offer.

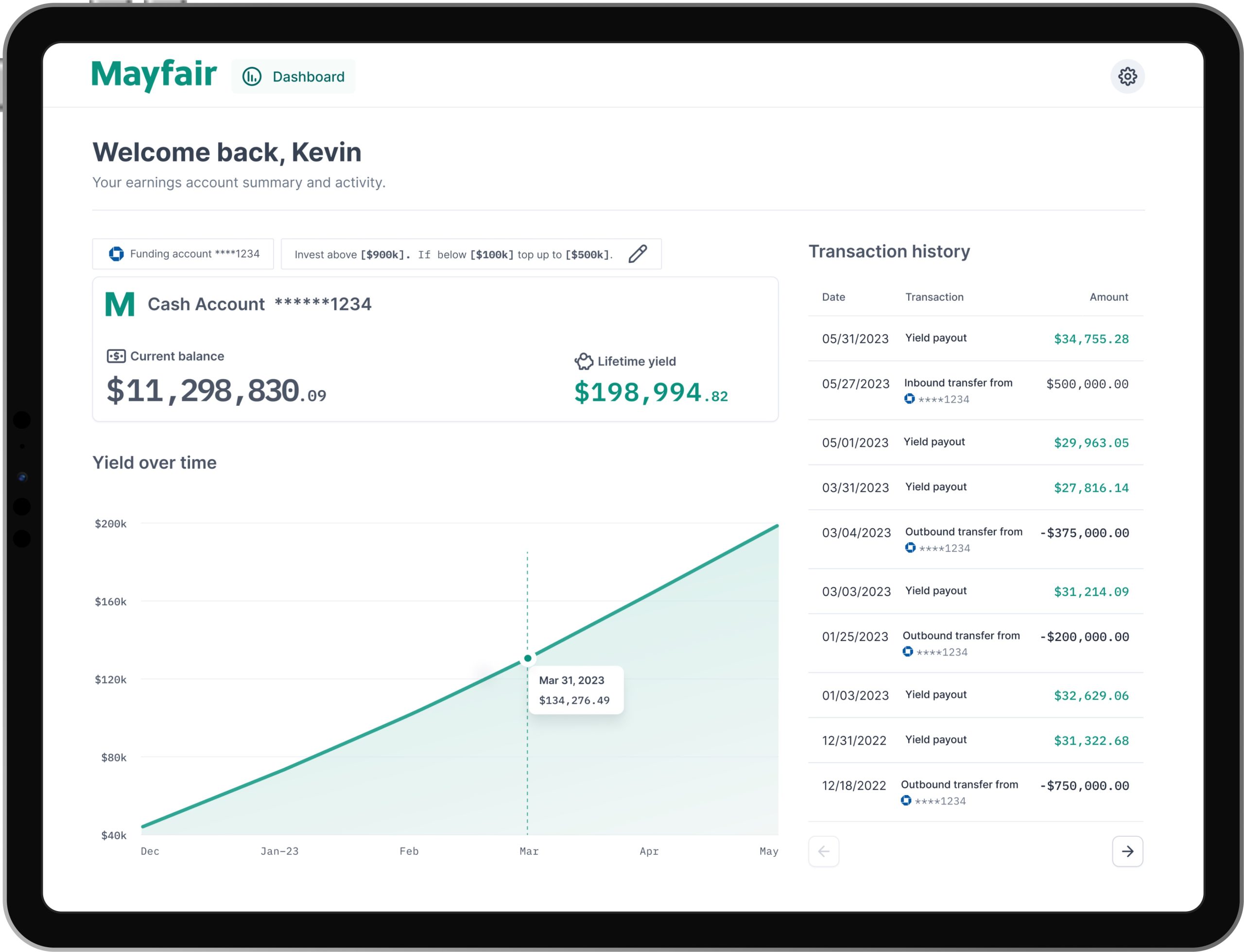

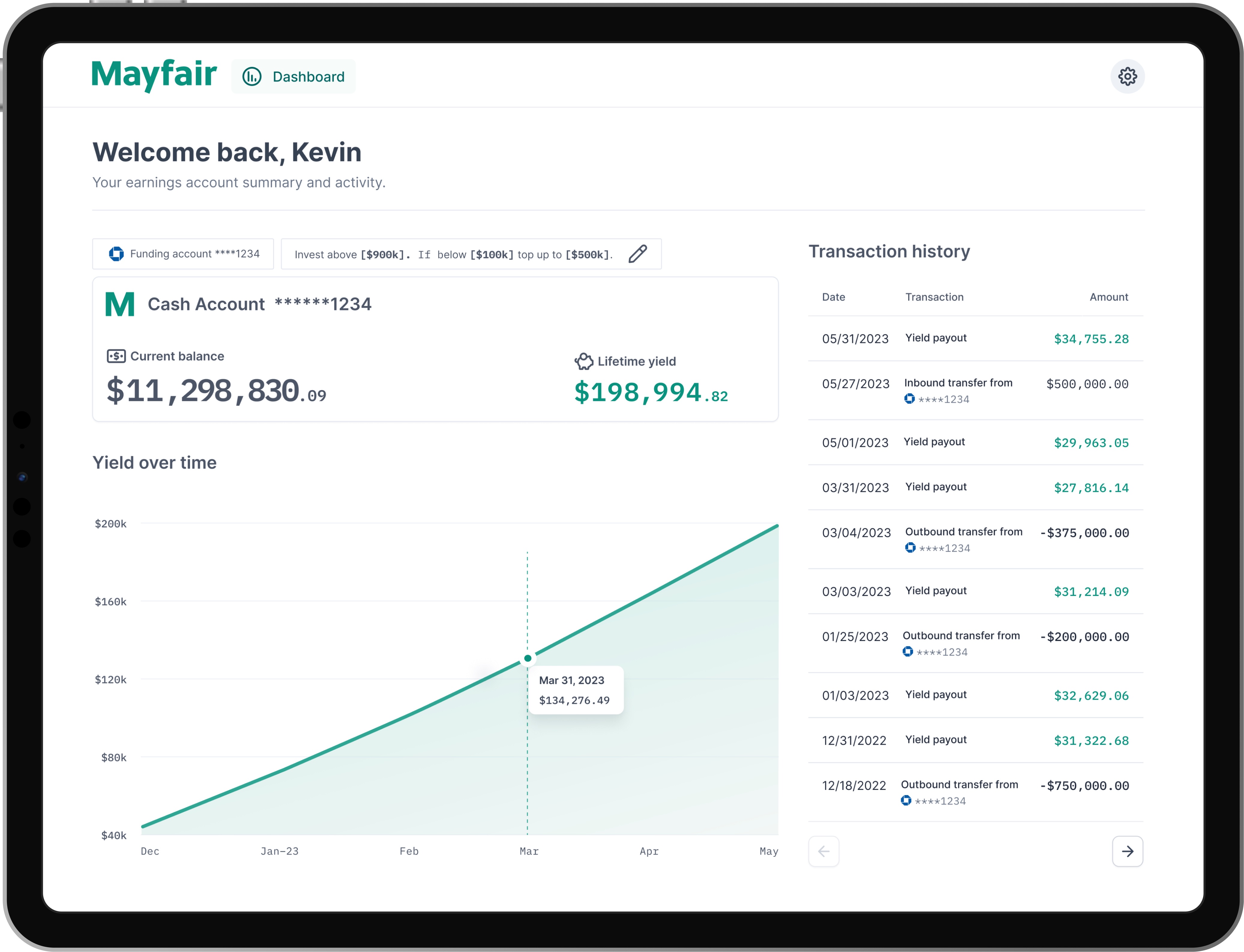

In addition to offering high interest rates, Mayfair also offers a way for businesses to choose how much they want to spend on business and get automated cash management on the rest, he said.

“Every day, if you can say more than half a million in your operating account, we adjust your accounts to make sure that we put it into the cash account for maximum yield. ” said Chopra. “And if you remember below that, we’ll top up your account so you’ll always have the half million dollars you need for your operating purposes.”

Notably, Mayfair has managed to raise $10 million in venture funding around $2 million in pre-seed and $8 million in seed, even with its current concept. The raise comes before the start-up world’s recession fully kicks in, with the seed round closing in April 2022 in conjunction with the closing of a $4 million debt facility. Amity and Box Group jointly led Mayfair’s pre-seed financing. Tiger Global, led by John Curtius (who has since left the firm), led the company’s seed development through partnerships with Amity and Box Group.

“When we were looking around and trying to figure out what our options were, it became clear that if we negotiated hard enough, we would be much better off. [interest] rates, and we can develop much better partnerships,” Chopra told TechCrunch in an interview. “So in doing that, it became clear to us that we needed to build a company that made that value accessible to others, whether they were startups or more successful companies… That’s obviously a very smart thing for people to do. Especially now with inflation and everybody having less and having to do something with cash.” Do it in cash.

Mayfair goes live in late 2022, including “dozens” of customers coming out of hiding. The start of freight logistics Fair quality, On his platform.

“Some have very small balances, like tens of thousands of dollars,” Chopra said. “Some have tens of millions of dollars. And it’s not limited to America.”

Image credit: Mayfair

In a short period of time, Mayfair is eager to line up more partner banks and build more products. The company believes it can attract banks to partner with it by promising to deliver a larger deposit than it earns on its own.

“They don’t have to have market power or pay for distribution,” says Chopra. “We’re doing that effectively, and we’re giving them a pot of money. They had to pay more than if they had to borrow overnight.

Evolve pays Stripe. Strip in turn pays Mayfair and Mayfair pays its clients, keeping what Chopra described as a small cut. In this line, the company plans to charge some functions related to financial management that have not yet been developed. Chopra says the company doesn’t see its fellow fintech Mercury as a competitor (it’s partnered with Evolve) and sees its services as “complementary.”

Mayfair currently has 12 employees. It is using the funds to hire, focusing on engineering, production and design.

Patrick Young, general partner at Amity Ventures, told TechCrunch in an email that he was attracted to the scale of Mayfair’s founding team.

For example, Kevin Chan founded Headway, which raised over $100 million from investors such as Andreessen Horowitz, Accel, GV, and Thrive. Meanwhile, he founded Dan Chan JANDI, which is named. Asian Slack.

“I had known the team for many years prior to investing and was drawn to their ability to execute and the speed with which they were able to deliver quality products that were used at scale. They have an ambitious vision of enabling the end-to-end financial platform for fast-growing companies that includes management and automation across treasury, finance, accounting and operations,” Yang told TechCrunch. “As an investor in Maps, I see the same path for Mayfair to become an essential part of every business from treasury management as Maps has done with Cap Table Management.”

Want more fintech news in your inbox? open over here.

[ad_2]

Source link