[ad_1]

Outwardly, it seems like a high-tech business for Israel. Unemployment is still insignificant compared to the United States, new unicorns continue to be born, although at low speeds, there is no shortage of new funding rounds, and restaurants at tech centers are still packed for lunch. However, the view behind the show is that not everything is perfect in Startup Nation.

Calcist examined three different signs of a significant increase in environmental ecology and stress levels in June. These signs include a significant increase in the number of secondary contracts concluded by technical staff and pre-angel investors. The company was in the final round of funding.

Other Signs The number of vacancies on the company’s website has dropped dramatically and the return of the Venture Capital Fund prior to investment has been unheard of for more than five years since the transfer of power from investors to entrepreneurs.

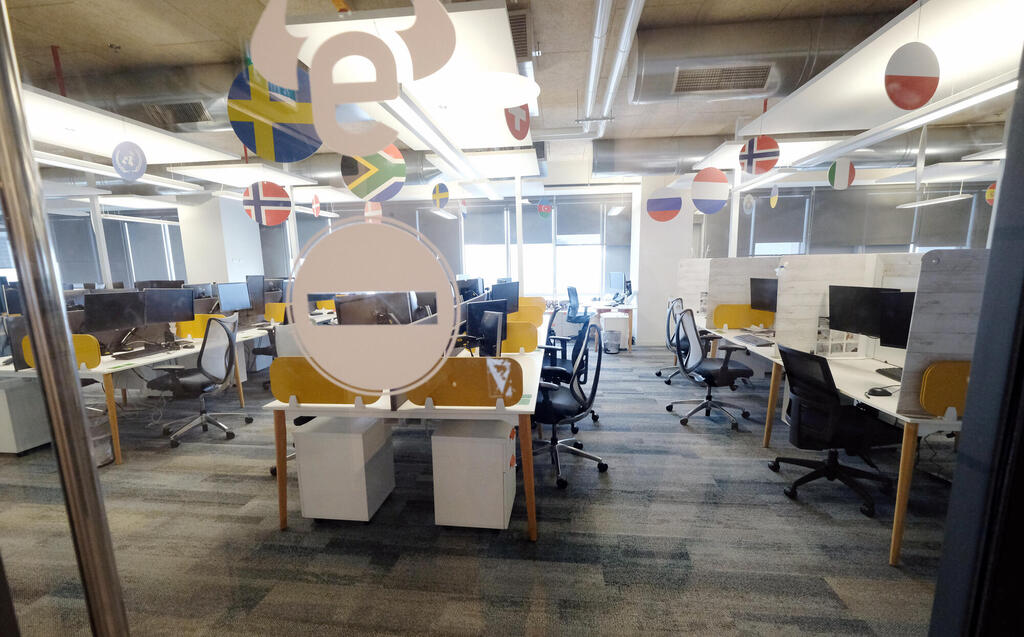

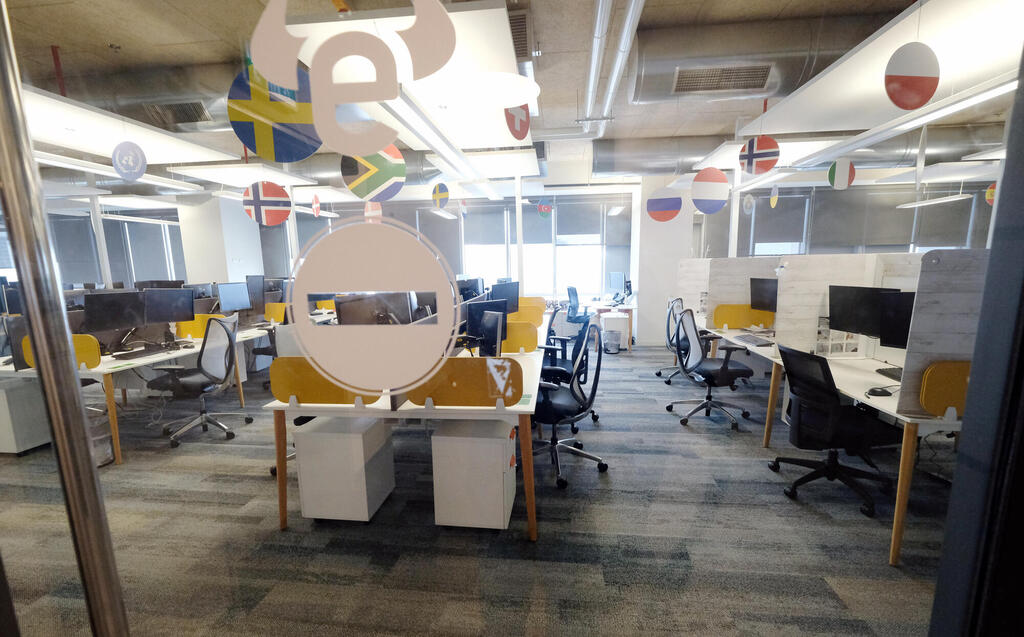

2 See gallery

Empty Etoro offices.

(Photo: Shaul Golan)

All of these changes are still happening behind the scenes and many are not even visible to those employed in the industry. This allows technology executives to say that journalists are either too frustrated with their reviews or even happy about the sector’s downfall. However, unless there is a miracle in the US economy or Wall Street in the coming months, these changes are broad-based and will hurt the sector as a whole.

The stress is now felt primarily underground and it is everyone’s interest to keep it that way. Or, as VC said last week, “Nowadays, entrepreneurs and investors want to connect because they know they need to talk about the company’s current review, so no one wants to do that.

Funds focused on secondary deals have been harassing technology workers and investors over the past two years, but that has changed in recent months. In recent years, their employees have not been in a hurry to sell their shares, hoping that the next round of funding will increase their appraisal. To reduce overall risk, executives had to persuade junior employees to understand at least some of their assets. This situation has changed. Calcist understands that after seeing the value of companies on Wall Street and considering the financial burden of labor, many employees are now pushing for secondary deals. These agreements are subject to the approval of the administration, but at a lower cost than the companies have recently received in their fundraising.

For example, shares in Fundbox, one of Israel’s new unicorns, which raised $ 100 million and $ 1 billion last November, sold 20% less than in recent rounds. Another Unicorn, valued at $ 1 billion in the last round, is selling shares at Seissens at a 10-20% discount compared to recent estimates. Eto’o’s employers, aware that the company will no longer be open to the public after SPAC merger of $ 10.3 billion, have realized that some of the company’s shares are worth between $ 3.5-5 billion.

“In recent months, staff turnover has increased by 30%, and first-time angel investors have approached us in June,” said Moran Chamsi, co-founder and managing partner of Ampfield Fields, a private equity fund. Lately, they are specialists in technology companies. After reviewing more than 100 companies in recent months, I now have 50 deals on my desk to find shares. Not everyone fell to the ground during the assessment, but the staff realized that it was better to hold a bird in their hand.

According to Chamsey, most deals with employees are 10-15% less than the company recently received. “On average, these deals are for 10,000 shares in terms of employees, but when it comes to angels, it can reach 2-5% of the company,” Chamsey said. “What stands out right now is the shock of the workers and the desire to accept whatever they can before the progress is further reduced. In most cases, we are approached by a group of employees to sell a more significant share in the company.

“Recently, we have begun to receive approaches from many senior staff and primary investors. However, most of them are still young workers in their 30s who have one or two children and are struggling to meet their financial obligations. They no longer have millions, but most of our deals cost hundreds of thousands of dollars per worker.

Like the Amplefields website, the company holds shares in several popular Unicorns, including Verbit, Via, Trax, OpenWeb, StoreDot and Cybereason.

In addition to discarding reviews, in recent months VCs have included an increasing number of safety clauses in their investment papers. This was common five years ago, but by 2015, the storm had almost completely disappeared as favorites for entrepreneurs. Now that the investors are in control and are taking advantage of the situation, sometimes the investment round, which looks amazing on its face, increases the dividend fee even in the most lucrative sales for investors. It leaves very few entrepreneurs, excluding workers. Most of the protections are invested in the latter companies, valued at hundreds of millions of dollars.

2 See gallery

Natalie Refua, general partner in viola development.

(Photo: Shlomi Ofir)

“The market is adjusting. The review has begun to decline, with the number of deals falling, and there is now a huge gap between the last round of evaluation and there are situations where investors are now willing to invest. In these cases, instead of running low-stakes, they seek innovative ways to reduce the risk that close investors will take to enter. We don’t have to make such agreements yet, but I am hearing more about them, ”Natalie Refuha, Viola’s general development partner, told Calcist.

These innovations include what is known as the Divide Article, although the name is not the same as the distribution of dividends to shareholders for public companies, but rather a method of dividing profits for investors when they leave.

For example, if a fund invests $ 100 million in a company and agrees with a 12% profit clause (this represents the real deal), the company could receive around $ 170 million in five years. , In addition to the price of the container. So the company was sold for $ 500 million, more than half of the total could go to an investor, which is before the entrepreneurs, not including the employees, receive a dollar from the sale.

There are other provisions, such as ‘Participant Preferred Shares’, in which the holder is entitled to an equal share of the dividend payable to the selected shareholders, as well as additional dividends or secured loans (for future equity agreements). ) It became relatively popular at the beginning of the CVD-19 epidemic but quickly faded.

While lending banks and lenders try to persuade beginners to take out loans, most still opt for the equity fund cycle because borrowing shows they don’t want to invest in the sector VCs. Refuah believes that it is still better to provide financial assistance to beginners than to receive credit, despite the difficult words sometimes included in the discount sheets.

“I personally do not like to be in debt in times of crisis because this means that you have to pay your bills and it is best to avoid such situations when you are unsure. In the same assessment, it is better to run another round and avoid showing debt or another round of increased prices, but in a nutshell.

In addition to money, technology is a major concern. Israel’s unique position in the technology world is a direct result of its manpower and has made the country a global R&D hub. Although more than 20,000 technology workers have been laid off in the US, fewer than 1,000 in Israel, and this is short of 10,000 trained workers in the sector.

Meanwhile, the number of Israelis employed in the technology sector reached 431,000 last April, compared to 11.7% of the total domestic workforce in 10.5% in 2020, according to the Central Bureau of Statistics of Israel. Almost all of the recently laid-off workers have had little trouble getting a new job, with some even acknowledging that they have done better than their previous job.

However, according to data collected by Data Intelligence Forum Lagon, the number of vacancies advertised by tech companies on their website has decreased significantly. Lagon, which scans company sites, work websites, LinkedIn profiles, and more, has seen a 20 percent reduction in these vacancies. This is similar to the 23% discount on US giant Salesforce and Coinbase websites.

The reality could be even worse, as many employees realize that after many employees have been notified that the position is not being filled after applying for the role listed on the company’s website. Manpower managers were told to post the vacancies on their website but were told not to try to fill them.

“The number of vacancies continued to grow in the first quarter, but the trend in the second quarter has completely changed and worsened in June,” said Lagoon co-founder and CEO Omry Steiner. A company like Riskified, which employs more than 100 employees in 2021 and has only 20 recruits in the first half of this year, can see a change in recruitment rates on LinkedIn profiles.

The data shows that the reduction in employment among government companies is greater than that of private companies. The state-owned companies slowed their pace at the beginning of the year, while the private sector followed suit only in April. The biggest reductions in vacancies are Israeli companies eToro (which left the SPAC merger), Snyk (as well as sacked employees) and the same website (which was released last year and saw a fall in stock prices). 50% from the beginning of 2022).

Elsewhere, Facebook Israel has reduced the number of vacancies by about 50%, a figure that Microsoft has reduced by 15 percent. Reducing each vacancy does not necessarily result in dismissal, most companies agree to stop recruiting and relinquish vacancies. However, Lagon’s findings show that the situation in Israel is no different than in the United States, and that the difference is only in terms of delay and intensity.

[ad_2]

Source link