[ad_1]

If you’re looking for a multipurpose bag, there are a few things to keep an eye out for. First of all, we want to identify what is growing give back ROCE on Capital Employed (ROCE) and side by side, is increasing over time. basis Employed capital. If you see this, it means a company with a good business model and many profitable reinvestment opportunities. So when we look Euro Tech Holdings (NASDAQ:CLWT) and its ROCE trend, we really like what we see.

What is Return on Capital Employed (ROCE)?

For those not sure what ROCE is, it measures the amount of pre-tax profit a company makes over the capital employed in its business. Here is the formula for calculating this ratio for Eurotech Holdings:

Return on Capital Employed = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.053 = US$784k ÷ (US$21m – US$6.4m) (Based on twelve months to December 2021).

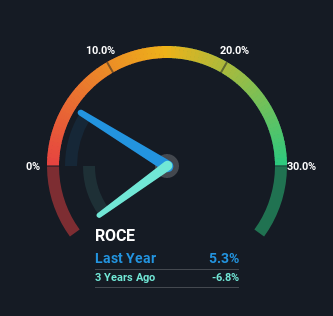

Therefore Euro Tech Holdings has a ROCE of 5.3%. After all, that’s a low return and commercial distributors have underperformed the industry average of 14 percent.

Check out our latest analysis of Euro Tech Holdings

Historical performance is a good place to start when researching a stock, so you can look at Euro Tech Holdings ROCE above as a measure of returns before returns. If you are interested in exploring the past of Eurotech Holdings, check this out free Past earnings, income and cash flow graph.

What the ROCE trend can tell us.

We are delighted to see that EuroTech Holdings is reaping the rewards from its investments and has now entered profitability. The company now earns 5.3% on capital, because five years ago it was making losses. Ironically, the capital employed by the business has remained relatively flat, so these higher returns are paying off previous investments or increasing efficiency. In the absence of an increase in capital employed, it is important to know what the company plans to reinvest and grow the business. After all, a company can only be a long-term multi-bagger if it continuously invests itself in high rates of return.

Our look at Euro Tech Holdings’ ROCE

As discussed above, Eurotech Holdings appears to be more adept at generating returns as capital employed remains flat while earnings (before interest and taxes) increase. And investors look forward to more, as they have rewarded shareholders with a 97% return over the past five years. Given that, we think it’s worth looking further into this stock.

If you want to know more about Eurotech Holdings, we have seen it 2 warning signs; And 1 is important.

While EuroTech Holdings may not currently be earning the highest earnings, we’ve compiled a list of companies currently earning a return on equity of over 25%. Look at this free List here.

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality material. Simply put, Wall St has no position in any of the listed stocks.

Join a paid user research session

They receive a. $30 Amazon gift card 1 hour of your time helping us build great investment tools for individual investors like yourself. Register here

[ad_2]

Source link